Solana has become the next major asset for treasuries after Bitcoin and Ethereum. The blockchain became a treasury favorite on the basis of its scalability, cost, redundancy, decentralized control, and popularity among crypto markets.

In this article, we explore five major reasons why Solana became the next natural choice for Digital Asset Treasuries after Bitcoin and Ethereum.

Below is a detailed list of all Solana Treasuries for your reference.

Highly Scalable Blockchain

Solana offers a highly scalable blockchain with an average real-time speed of 5,000 transactions per second and can be easily scaled to 65,000 transactions per second without any additional effort. This high scalability means that the chain can process transactions at a cost of less than 1 cent ($0.01).

Further, Solana’s scalability does not compromise its security or its decentralization. The blockchain is one of the most secure ones after Bitcoin and Ethereum. Additionally, due to its decentralization, the chain has more than 850 active validators spread globally.

What is Solana’s Alpenglow Protocol? Reducing Block FinalityTime by 99%

Highly Decentralized

Solana has one of the most decentralized ecosystems, with decentralization being ensured at Governance, Validator, and Token ownership levels.

Governance is undertaken with stakeholder voting, ensuring a lesser concentration of power.

Further, more than 850 validators ensure that the blockchain remains functional despite all threats to the blockchain, natural or otherwise. Compared to this, the BNB chain has just 21 validators.

Solana’s token ownership is more with the retail investors and not whales or treasuries. Even when all treasuries are combined, their net holdings amount to just 3.65% of the total SOL supply.

Thoroughly Tested

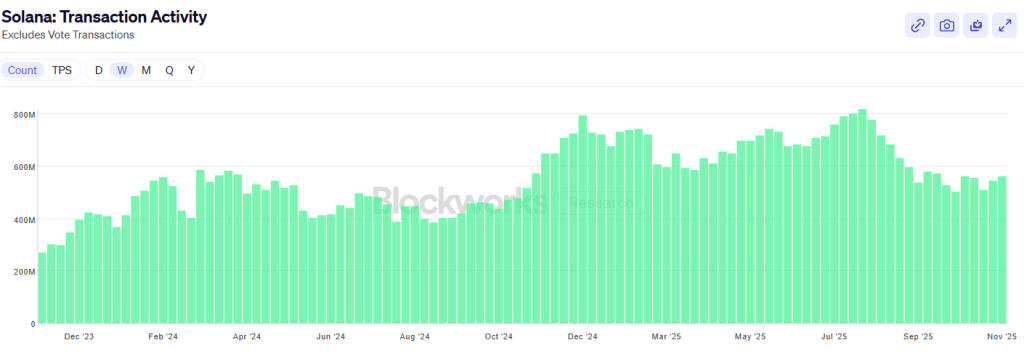

The Solana blockchain has been thoroughly tested in both ordinary and extraordinary conditions. The blockchain performs well during its due course and has also handled high traffic without any issues during the memecoin mania (late 2024 to early 2025).

The highest stress test for the blockchain was during the Trump coin launch, when it clocked roughly 750 million transactions per week.

This reduces the likelihood of blockchain failure. Typically, blockchain failures result in a token price crash.

Most Visited Blockchain

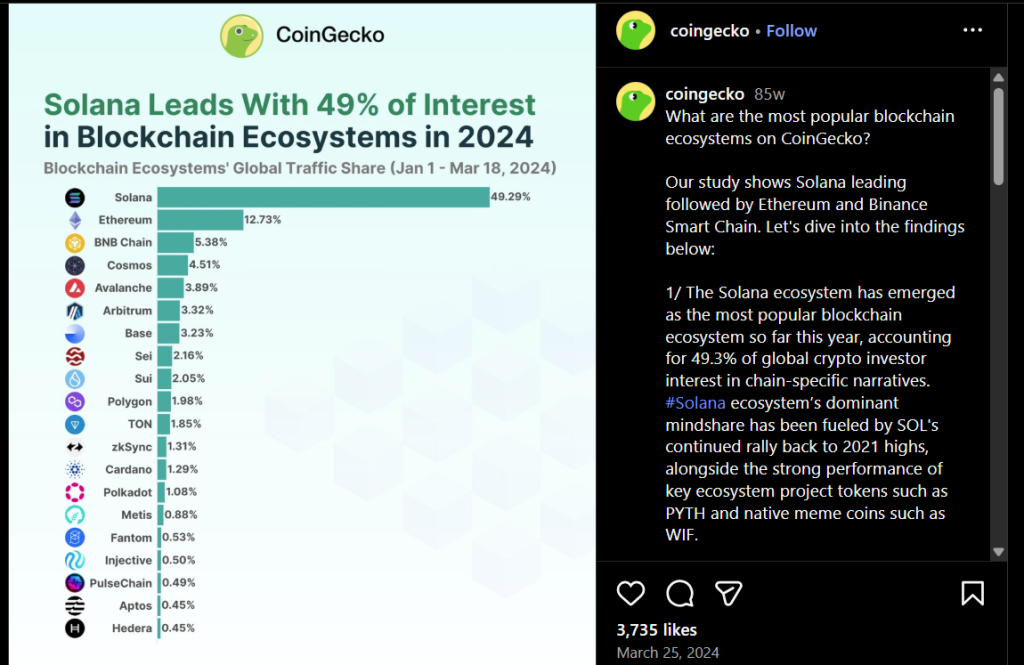

Solana has been the most visited blockchain in 2024, according to Coingecko, garnering almost half the attention as all other chains combined.

Naturally, if a treasury adds SOL to its blockchain, its publicly listed shares have a greater chance of attracting retail investors. Further, more popular investment assets might also boost the confidence of other investors.

Solana vs Ethereum: A Detailed Comparison of Two Leading Blockchains

Highly Liquid Market Pairs

Solana consistently maintains impressive liquidity in the cryptocurrency markets, exchanges, DeFi protocols, and DEXs due to its high demand. This helps in the easy purchase and sale of tokens by investors. With high liquidity, there is greater freedom on being able to easily cash in and out with SOL.

Another aspect highlighting its high liquidity is the presence of an impressive fourth-largest on-chain stablecoin reserve, marginally lower than BSC on average but significantly larger than Base, its next-largest competitor, by 3 to 4 times.

High liquidity helps treasuries easily invest and sell assets whenever required. During difficult times, such as a liquidation, there is also a lesser loss incurred during the distress sale of assets.

Don’t want to invest in treasuries? Here are the Top 5 Solana Wallets to Store Your $SOL in 2025