One of the core characteristics of Decentralized Finance (DeFi) is eliminating a third party’s control over one’s finances. It allows individuals to make digital transactions easily, faster, and cheaper than financial institutions.

Decentralized Finance, shortened as DeFi, is an emerging finance technology that’s being employed by many cryptocurrency traders today. It provides every trader full custody of their crypto assets and private encryption keys.

More than ever, the introduction of Decentralized Finance has enhanced the transparency of blockchain smart contracts. In this piece, you will discover other financial models associated with DeFi, such as Decentralized Apps (dApps) and Decentralized Exchanges (DEXs).

Overview of DeFi

DeFi encourages peer-to-peer (P2P) transactions without incurring a middle-man fee. Since this financial model is rapidly growing in the economic space, here is an overview of what it entails.

Definition and Principles of DeFi

In simple words, DeFi stands for self-custody finance. Unlike traditional finance where a company or bank is responsible for your money, with DeFi, no one but you have access to it.

Anton Mozgovoy, Co-founder of Mover.

DeFi operates on the Ethereum blockchain, a leading cryptocurrency known for its rapidly developing smart contracts. Since DeFi is built on a blockchain, it’s considered a safe mode of transaction.

Every transaction takes place on the blocks, which are interconnected like chains. The processing information will move on to the next block for every verified transaction on a block. Since the blocks are interconnected, a change in an existing block will reflect on the others. This is why it’s challenging to alter data on the blockchain system.

Here is an article that further explains how block confirmation works.

DeFi goes beyond being a platform for digital transactions. With smart contract codes, it can activate a specific financial transaction through a peer-2-peer (P2P) model, which will be visible to every involved party. Decentralized Finance allows you to engage in several digital activities with your money.

Centralized Finance Vs. Decentralized Finance

Centralized Finance (CeFi) and Decentralized Finance (DeFi) are two popular financial models you will come across in cryptocurrency. Both models have certain similarities, such as serving as platforms for buying, selling, and loaning crypto assets.

The significant differences between CeFi and DeFi are the organizational and management procedures. In the CeFi financial model, a central authority is responsible for users’ transactions, while Decentralized Finance grants users full permission over their crypto assets. These two financial models also differ in terms of derivative markets. The DeFi derivative markets are more accessible and do not require users’ proof of identity. An example is the popular Synthetix protocol.

Some common CeFi projects include; Nexo, YouHodler, Swissborg, Wirex, and CoinRabbit. Some DeFi common projects include; MakerDAO, Compound, Uniswap, Augur, and PoolTogether, which are further explained below.

Here is a detailed explanation of DeFi common projects in 2023, to look out for.

According to Statista, Decentralized Finance (DeFi) users grew by 300,000 since early 2022. Uniswap was also reported to have a market cap above one billion U.S. dollars in March 2022.

Uniswap

Uniswap is a decentralized exchange where users can trade tokens from their wallets. Every trading process is regulated based on market price through the Automated Market Making mechanism.

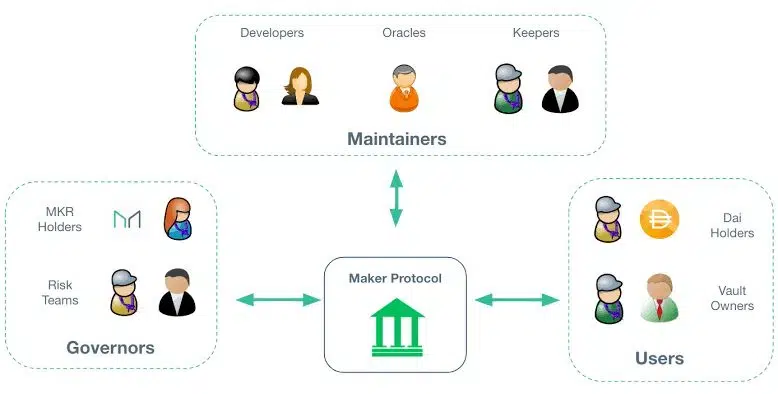

MakerDAO

MakerDAO is known as a decentralized stablecoin and reserve bank. It allows users, including entrepreneurs, to own a stablecoin linked to the U.S. dollar. Holders of the MKR token can also participate in the critical decision-making process that significantly affects the ecosystem.

Compound

The compound is one of the most popular lending and borrowing protocols. Traders can use their crypto assets as collateral, while the platform uses the market demand and supply to adjust the interest rate.

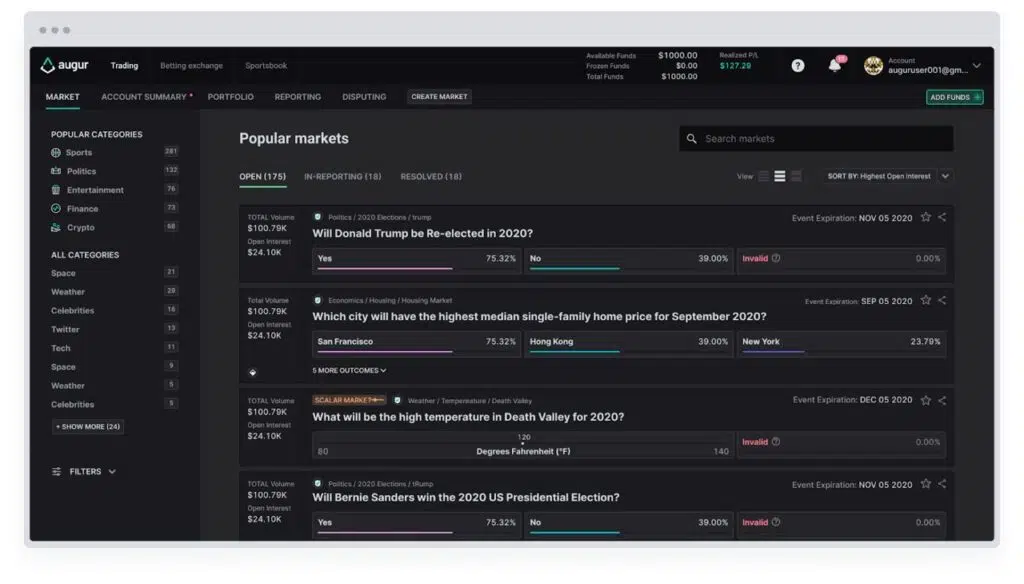

Augur

Augur is one of the first Decentralized Applications (dApps) built on the Ethereum blockchain. It’s a market prediction platform where users predict an event outcome, including the expected market value.

PoolTogether

PoolTogether is a zero-loss savings platform. Every user participates on this platform by saving funds in a common pot. The savings will be reviewed at the end of every month, with only one person entitled to receive all the interest. However, every other person gets their deposits.

Use Cases and Applications of DeFi

Several crypto traders trust the Decentralized Finance (DeFi) system because it is transparent, permissionless, interoperable, and autonomous. It handles the problems associated with traditional banks, reducing the rate of total dependence on humans. Hence, Decentralized Finance is being applied in several use cases.

THE IMPORTANCE OF DEFI📈

DeFi is the movement of creating an alternate financial system:

• Global

• Permissionless

• Decentralised

• Autonomous

Working with efficiency leveraging blockchain technology

(4/11)

— Komet (@kometverse) July 17, 2023Lending and Borrowing

Lending and borrowing is an everyday use case of DeFi, which creates an avenue for the unbanked who cannot request a loan at a financial institution. Businesses can also connect to Decentralized Finance platforms without the stress of processing lengthy paperwork. This eliminates the huge loan fees associated with requesting a loan at financial institutions or traditional banks.

Investors can also build their investment portfolio through a long-term interest-rate loan. Examples of DeFi projects that offer lending and borrowing services are; AAVE, MakerDAO, and Compound.

Read DroomDroom’s article to learn more about crypto lending and their rates.

Stablecoins

Unlike some cryptocurrencies, stablecoins are less volatile. During poor economic situations, crypto traders can exchange their stablecoins for fiat currencies at a more valuable price. This helps investors to preserve their wealth value and ensure long-term financial security.

As mentioned earlier, MakerDAO is a leading stablecoin platform.

Decentralized Exchanges (DEX)

Decentralized exchanges are commonly used by traders who want to buy or sell crypto assets using a peer-2-peer network. You will also remain anonymous while exchanging cryptocurrencies. However, the platforms don’t allow users to purchase digital assets with fiat currencies.

Decentralized exchanges can either be order book based (such as Idex, Loopring, and PolkaDEX) or liquidity policy based (such as Kyber, Uniswap, Bancor, and Balancer). The order book-based DEXs record all users’ transaction information on the order books in the blockchain. On the other hand, the liquidity policy-based DEXs permit holders to earn interest after locking their tokens for a while.

Derivative Markets

DeFi derivatives are financial instruments whose values are determined by underlying assets, such as cryptocurrencies or stocks. Thus, users don’t need to own a contract before speculating its value based on the market movement.

As mentioned earlier, DeFi derivatives are more accessible than CeFi derivatives. However, there are some downsides to DeFi derivatives, including market volatility, smart contracts vulnerability, and liquidity concerns.

Gaming

Decentralized Finance has advanced, allowing game enthusiasts to explore their skills via blockchain. It’s not used for “mere gaming” activities but allows people of like-minds to connect and earn for themselves. These gaming platforms are called GameFi, where users play games for certain rewards.

An example of gaming blockchain is the move-to-earn system, which was built to encourage users to participate in physical activities such as sports.

Challenges of DeFi

Even though DeFi offers crucial benefits and use cases, it has some potential challenges, further highlighted below.

- Complexity: The complex algorithms and user interface in Decentralized Finance affects users’ experience. It requires a certain level of technical knowledge to navigate through these DeFi platforms successfully. If the processes could be simplified, it would encourage more people to come on board. However, most founders are creating educational resources that could be useful to potential users. Some projects also use the learn-to-earn strategy to encourage the audience

We’re excited to be partnering with @binance to reward our community of enthusiasts & crypto traders 🎁

Stand a chance to win $LEVER rewards by showing off your knowledge of LeverFi during Learn & Earn campaign period!

More info at Binance Academy: https://t.co/WV7WuDlSKo pic.twitter.com/Y1DjyPXBr8

— LeverFi 杠杆金融 (@LeverFi) June 26, 2023- Security: In August 2022, the FBI warned against attacks on DeFi platforms that over $1 billion in assets were stolen within a 3-months window period. Further research revealed that insecurity is one of the significant concerns of DeFi platforms. When smart contracts are vulnerable to cyber attacks, users are at risk of facing a huge financial crisis. However, DeFi security can be heightened when appropriate safety measures are implemented, such as audits.

Learn more about smart contract audit companies, and how to choose the best among others.

- Scalability: Scalability is still an issue that’s being addressed on the Ethereum blockchain. Thus, many projects built on Ethereum strive to implement layer-2 protocols to increase their transaction rates.

Conclusion

It’s expedient to mention that Maersk and IBM collaborated to form TradeLens, to ensure faster payment and document retrieval among blockchain users. This proves DeFi’s impact in providing innovative solutions to businesses and fostering collaborations among top companies. Although there are particular challenges in the DeFi protocol, they are not enough to invalidate DeFi’s impact in the digital space. De