Is Cryptocurrency Investment in India too difficult? Let understand a brief about cryptocurrency investment before we get started.

- Why Is Cryptocurrency Investment Booming in India?

- Steps to Start Cryptocurrency Investment in India

- Understand Cryptocurrency

- Understand and Choose Cryptocurrency Exchange or Broker

- Create and Verify Your Account

- Fund Your Account

- Choose Your Cryptocurrency

- Buy Cryptocurrency

- Select a Storage Method

- Conclusion

Cryptocurrency investment was introduced as assets in 2009. Back then, it was not accepted quickly and was a mere concept. Despite this, many had faith in blockchain technology and predicted a bright and overwhelming future for cryptocurrencies. Fast forward to ten years, and it is slowly getting recognized as an asset. Some believe that cryptocurrencies are a potential replacement for national currencies as a worldwide alternative. Such ideas, however, have a long battle ahead.

Investing in cryptocurrency is similar to investing in the stock market. You first have to choose your preferred exchange. Next, transfer money to the account maintained on the exchange, purchase your preferred cryptocurrency, and store it in a secure place.

In April 2018, the Reserve Bank of India called for a ban on cryptocurrency trading, citing them as Ponzi schemes. However, a three-judge Supreme Bank bench has set aside this ban. This case law became a matter of national interest and spiked interest in cryptocurrencies among many traders. Many investors are still cautious of this sector as no precise regulation or classification exists.

Why Is Cryptocurrency Investment Booming in India?

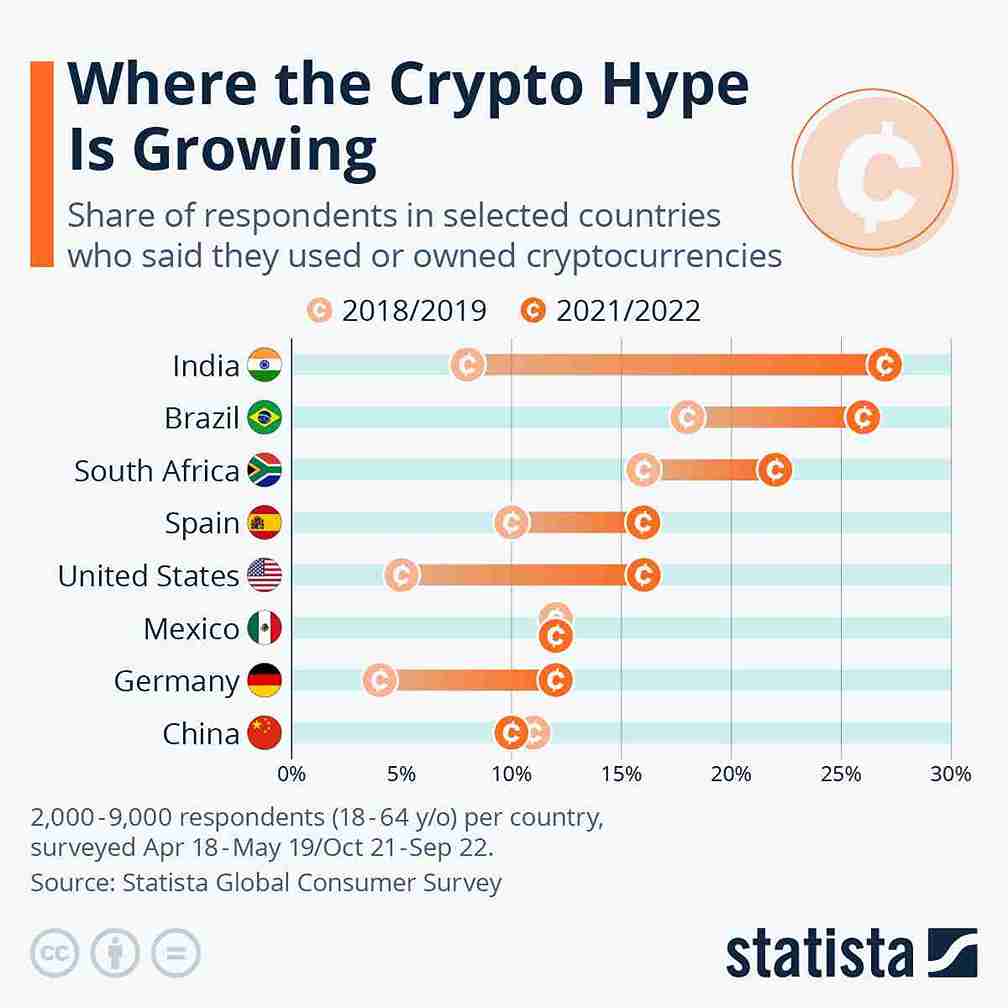

The earliest investments were in the form of gold and real estate. Then came the era of stocks, deposits, and banks. A new asset class for investments has emerged in recent years: cryptocurrencies. Five years ago, India had no exchanges for digital currency. According to Reuters, citing industry estimates, there are already between 15-20 million investors holding more than $5.3 billion in cryptocurrency investment in India. This makes them the second-largest group of crypto traders globally.

JUST IN – 🇮🇳 Indian Railways IRCTC to issue Soul Bound NFT Ticket on polygon. pic.twitter.com/Xu690u13su

— Crypto India (@CryptooIndia) March 14, 2024The growing popularity can be attributed to several factors. India is leading the world in terms of internet adoption. The combination of tech-savvy millennials and early adoption has led the way for the right consumer segment for cryptocurrencies. In recent years, several blockchain-based games have appeared. These games allow gamers from tier 2 and 3 cities to make a healthy income every month simply by playing the games and obtaining rare things.

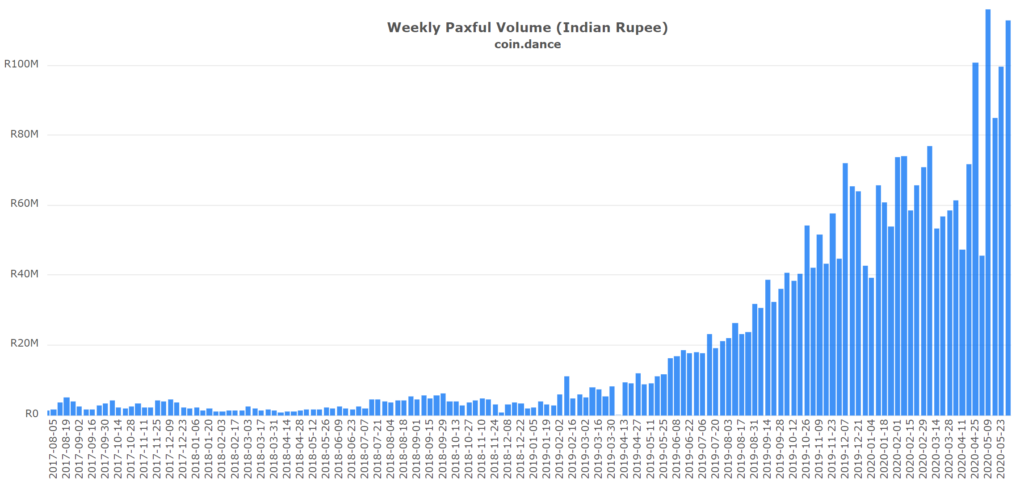

Another reason contributing to the emergence of cryptocurrencies is the enormous volume of transactions on peer-to-peer (P2P) systems. Cryptocurrency can be transported across borders without using any middlemen. Most people see them as a viable alternative to more established investment options such as the stock market and mutual funds.

In comparison to the technology behind cryptocurrency, the procedure for cryptocurrency investment is far more manageable. This detailed article will show you how to start a cryptocurrency investment.

Steps to Start Cryptocurrency Investment in India

Understand Cryptocurrency

The first step for making any investment, whether cryptocurrency or otherwise, is to understand the asset class and why it is a good idea to invest in it. The cryptocurrency market is highly volatile, and any investment entails risk. Cryptocurrency investment is similar to stock investment, but not the same. Industry experts believe that investors should not hold more than 5 to 10 percent of their investments in digital tokens. In the last ten years, many cryptocurrencies introduced to the market have either plateaued or vanished entirely. This implies that every cryptocurrency investment you make could lose all of its value.

Digital tokens contain underlying principles, just like any other asset type. Accessibility, mining technique, community engagement, and intrinsic value are the key factors of a cryptocurrency. Backed by various blockchain technologies, more than 17,000 cryptocurrencies are in the market, as per an RBI report, making the scope gigantic. How does one pick a risk-free cryptocurrency? For this, a thorough study and understanding of cryptocurrencies are crucial.

Understand and Choose Cryptocurrency Exchange or Broker

Investment in any asset class first requires a medium for investment. To start a cryptocurrency investment, you can either invest with a broker or through an exchange.

Cryptocurrency Exchanges

The reason many experts warn against crypto trading is that there is no crypto regulation in India, leading to no uniformity in trading. However, this shouldn’t discourage you. With the help of research and an alert mind, you can quickly start trading.

All around the world, cryptocurrency investment is made through exchanges. Some famous cryptocurrency exchanges in India are WazirX, UnoCoin, CoinDCX, and CoinSwitch Kuber. Cryptocurrency exchanges are digital spaces where you can buy, sell, or trade digital assets. There are two kinds of exchanges, namely, centralized and decentralized cryptocurrency exchanges. Each has its own set of pros and cons.

Centralized Cryptocurrency Exchange (CEX)

A centralized cryptocurrency exchange is similar to the various stock exchanges we have around the world. All stock exchanges are supervised by the centralized bank of the respective country, making them centralized entities. This is the same concept for CEXs. They are the intermediary between the buyer and the seller and earn their money through commissions and transaction fees. The advantages of a CEX are that they are user-friendly and reliable. However, CEXs are prone to hacking because of the volume of transactions, and many have high transaction fees.

Decentralized Cryptocurrency Exchange (DEX)

The concept of decentralized finance, or DeFi, is ground-breaking. This concept is in sync with the cryptocurrency ideology of not handing power to a centralized, single entity. The main aim of DEX is to achieve financial inclusion for all members of society without using an intermediary to facilitate transactions. The advantages of DEX are that the digital asset owner is the custodian, there is no market manipulation, and there is less censorship. But, DEXs are complex to use, lack fiat payments, and have liquidity struggles.

In comparison to brokers, exchanges have relatively less transaction fees. But they have more complex interfaces, multiple trade types, and advanced performance charts, which can be intimidating to a new crypto investor.

Cryptocurrency Brokers

There is not much difference between brokers in the stock market and the cryptocurrency market. The job of both is to remove the complexities of trading. Cryptocurrency brokers offer easy-to-use interfaces. Some impose costs that are higher than exchanges. Others make the promise to be “free” while making a profit by selling data about what you and other traders to giant brokerages or funds. They also compromise the best deal by failing to execute your trade at the best market price.

To newcomers, they are practical, but one has to be careful, as brokers can restrict the movement of their cryptocurrency holdings.

If you are new to cryptocurrency investment, please make sure you choose an exchange or broker that supports transactions and purchases made in fiat money like GBP or INR. Some exchanges do not support fiat money, forcing investors to trade cryptocurrency using another cryptocurrency. This would prove to be troublesome for newcomers as they would have to find another exchange to purchase the tokens their preferred exchange supports.

Create and Verify Your Account

After deciding on the medium of your trade, you have to open a trading account with them. This account is similar to your bank account. In India, most of the exchanges are CEXs. A CEX follows all the compliances for secure and easy crypto investing for its users. Before using the resources offered by CEXs, users must authenticate their personal information. If the user is corporate, it must give company information for the verification procedure.

Verifying your identity is essential to safeguard yourself from fraud. You might be able to purchase or sell cryptocurrencies once the verification process is finished. The platform might want you to post a selfie to show that your appearance matches the documentation you provide, along with a copy of your passport or driver’s license. Notably, unlike traditional stock markets, cryptocurrency exchanges are open 24/7.

Fund Your Account

After steps one to three, the next step is transferring funds to your account to start a cryptocurrency investment. There are various options to fund the account; some popular ones are UPI, online banking, bank transfers, and a cryptocurrency wallet. Cryptocurrency exchanges have different transaction fees for different payment methods. Hence, consider every option carefully before moving forward.

Choose Your Cryptocurrency

One of the biggest challenges is choosing the correct cryptocurrency to get the desired rate of return. Out of the thousands of coins, Bitcoin and Ethereum account for over half of all cryptocurrencies’ combined market capitalization. It would help if you also considered the demand and supply variables for cryptocurrencies. Rising demand and limited supply drive up the price of every digital asset, and Bitcoin is no different.

To learn more about a particular cryptocurrency, read the white paper. A white paper consists of all the information required on a cryptocurrency project, including its characteristics, such as its intended usage, the problems it will solve, the technology it uses, etc. The white paper examines the currency’s application cases critically. Application cases are one of the most important factors affecting its investors. If the coin’s use case is limited, it is more likely that its value will fall over time, and eventually, it will perish.

Buy Cryptocurrency

The laborious part of starting a cryptocurrency investment is over, and it’s time for the exciting part. The money is in your exchange/broker account; you have researched the cryptocurrency and are now ready to place your crypto order. This step is easy compared to the previous steps. Once decided, enter the ticker symbol of the cryptocurrency you want to buy (Bitcoin’s is BTC, for example) and the number of coins you want to buy. Most exchanges and brokers allow you to buy fractional shares of cryptocurrencies from expensive tokens like Bitcoin or Ethereum that would otherwise cost thousands of dollars to hold.

On your screen, there should be a Buy button for each cryptocurrency. To complete your transaction, click on that.

Select a Storage Method

No law backs crypto exchanges; hence they do not have insurance coverage in case of theft or hacking. That’s why it’s important to store them securely. If you purchase from a broker, you have little control over how your assets are stored. If you purchase via an exchange, you have the following options:

Keep the Cryptocurrency on the Exchange

If you are trading through an exchange, then one of your options to store cryptocurrency is with the exchange itself. Cryptocurrencies are usually stored in a highly secure wallet containing a pair of keys that helps you access the cryptocurrencies. You could relocate it from the exchange to a different hot or cold wallet if you don’t like the provider your exchange partners with or if you want to store it somewhere safer. You may have to pay extra money to achieve this, depending on the exchange and the quantity of your transfer.

Hot Wallets

Hot wallets run on internet-connected devices such as tablets, phones, and computers. Hot wallets are based on desktop extensions or programs. Hot wallets are incredibly convenient since they are always connected to the internet. However, this very characteristic also makes them more susceptible to attacks.

Cold Wallets

Cold wallets are entirely offline, making them the most secure option for holding cryptocurrencies. Cold wallets are hardware devices like USB devices or hard drives. This address, which consists of a private and public key pair, would be generated independently of the internet. While the private key serves as the password for the email ID, the public key can be your email address. The key pair is not exposed to the internet in a cold wallet, providing the highest protection level. Cold wallets require caution, though, as you could never be able to retrieve your cryptocurrency if you lose the key code connected with them or the device malfunctions.

These are the simple steps to start cryptocurrency investment in India. A Seychelles-based cryptocurrency exchange, KuCoin, has estimated that by 2030, the total value of cryptocurrency investment will cross $241 million in India. Everyone would want to be part of this rising sector sooner rather than later.

Conclusion

Investing in cryptocurrencies is far easier than believed. However, the topic is still controversial in India. As with any investment, assess your investment goals and present financial circumstances before investing in cryptocurrencies or specific companies with a large stake. Cryptocurrency investment is still very speculative because of how volatile it can be—just one tweet can send its price tumbling. It is strongly advised that you exercise prudence and only invest money you can afford.