The market is known to be generally more fond of fresh tokens than dino tokens from previous cycles. But getting into them is difficult, and often you find yourself left behind each time a new gem refreshes all-time highs (ATH) over and over again. Let’s break down how to find gems early to get allocations and avoid feeling FOMO.

What Do You Need for Successful Crypto Research to Find the Next 100x Gem?

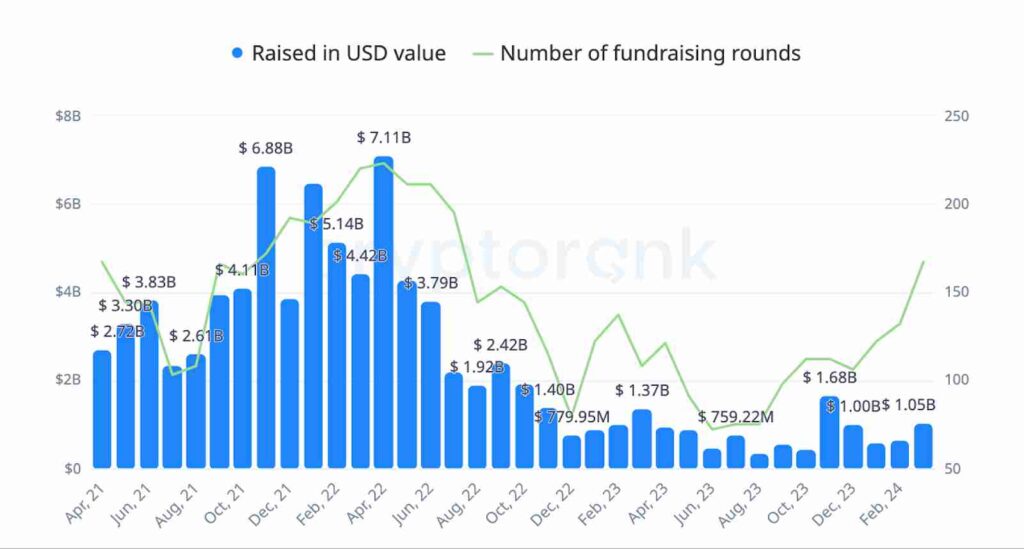

– Define the Right Sentiment. Markets are cyclical, and the crypto market is not an exception. There are periods of growth, and there are periods of decline. If the market is depressed, you should wait for the sentiment to improve, because even the most promising projects hardly show anything in a bear market; most likely, they even postpone launches. It is best to get in during a rising market, not at bearish (because you never know where the bottom lies) or bullish extremes. Look at the market overall, measure investor behaviors, check for overarching trends, and define the right market sentiment. You can start with Bitcoin price action analysis and then check for the crypto fundraising trend.

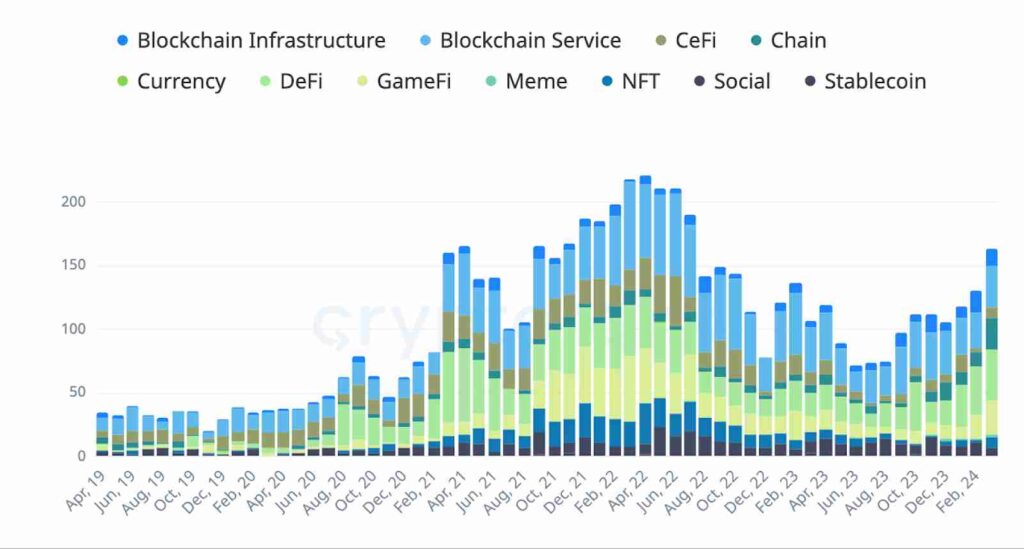

– Study a Specific Crypto Category. It could be either anything you personally like or something trendy and well-funded. It could be DeFi, RWA, GameFi, etc. Deeply research preferred categories to understand their potential and limitations; our researches could be handy to start with.

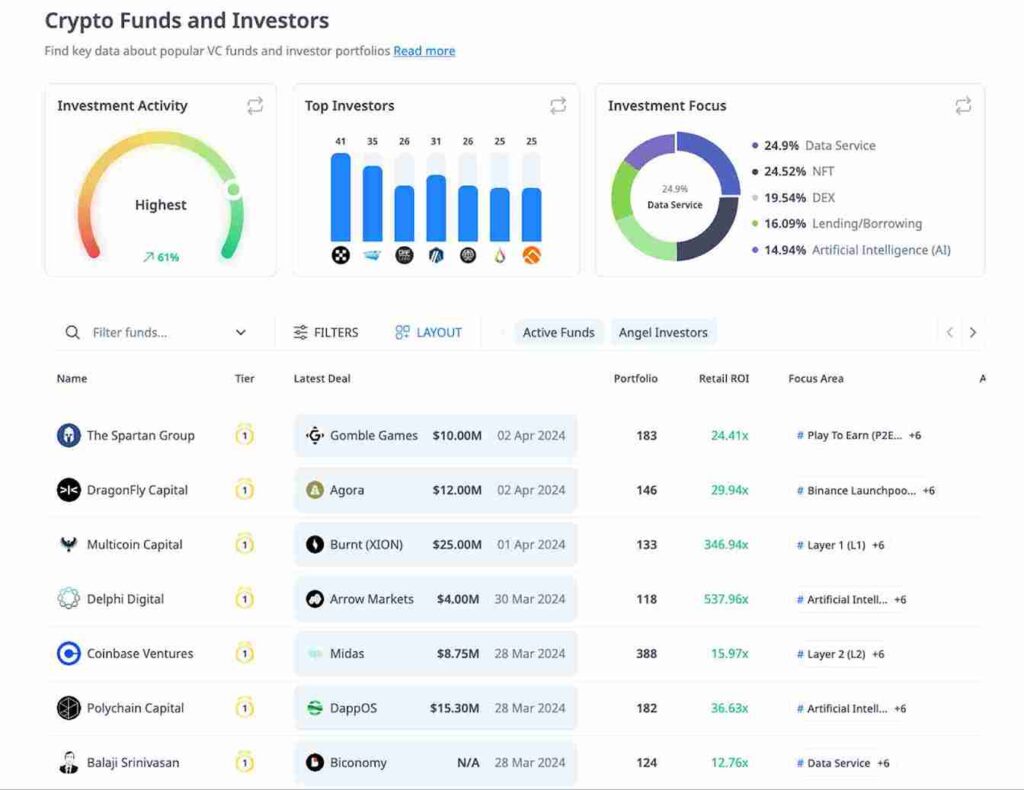

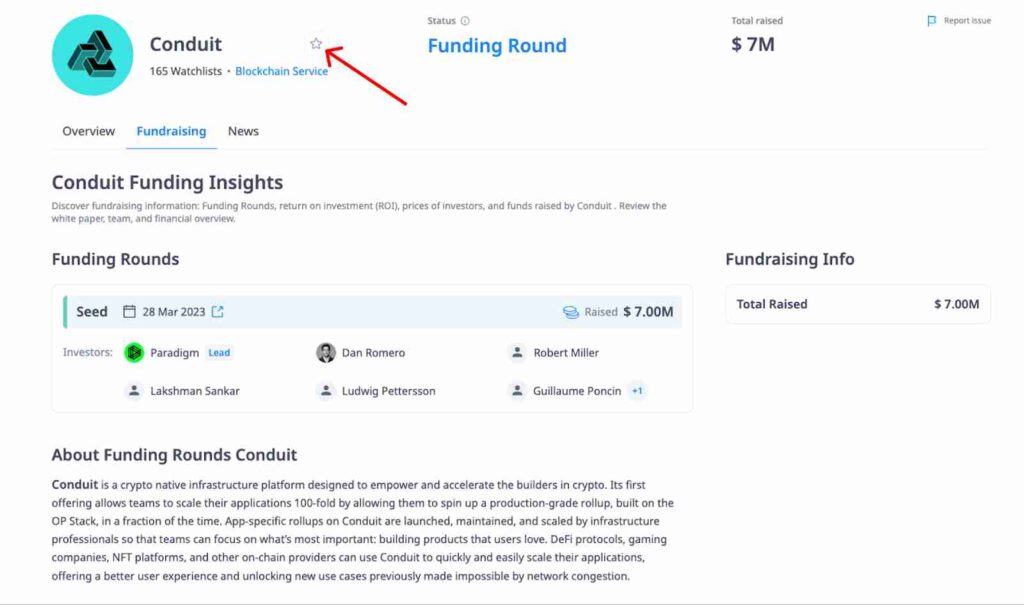

– Track the Most Active and Profitable Investors. While their entry points and profitability metrics may differ drastically from those of a retail investor, it’s always a good idea to keep an eye on those who are investing professionally. There is a Funds page on CryptoRank where you can check investment activity, determine top investors, and current investment trends. You can apply different filters and sort the funds by the round number, or ROI. Also, each listed fund on CryptoRank has its own page to explore with detailed fundraising info and performance of their investments.

How to Pick High Potential Projects Which Can be the Next 100x Gem?

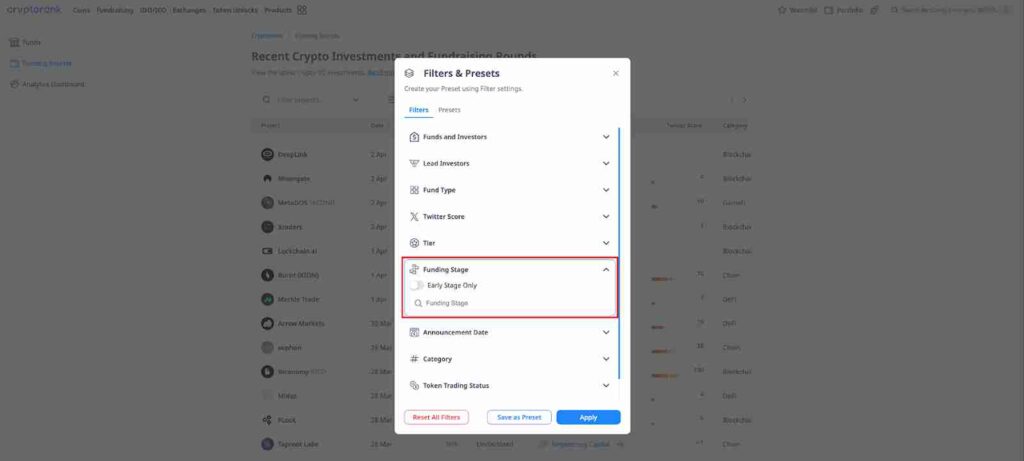

When the preparatory phase is complete, you can start looking for specific projects. Once again, CryptoRank offers an all-in-one tool for doing that. The main page here is Recent Crypto Investments and Fundraising Rounds.

There are plenty of filters available to apply. To avoid being drowned in a sea of projects, it makes sense to limit yourself to the top tiers and favorite categories at first. Don’t forget to turn on the “Early Stage Only” filter to get rid of mature projects.

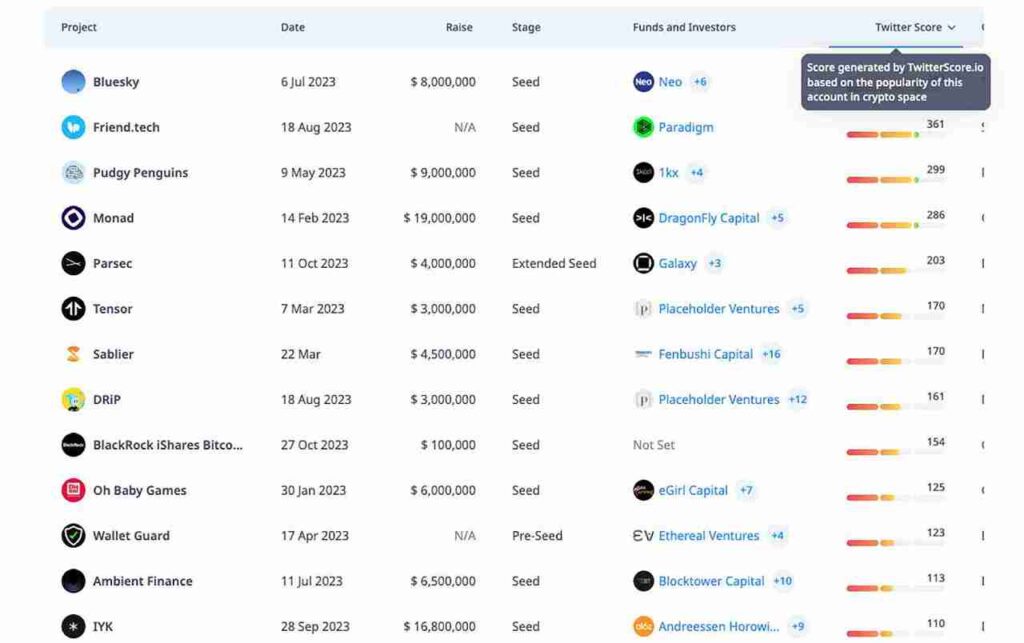

Sorting by Twitter Score will often give a much quicker and better idea of a project’s potential than a careful selection based on the amount of funds raised. X (Twitter) is the main social platform where crypto users and projects communicate and share their insights. Thus, X activity and followers’ quality are crucial metrics for every successful crypto project.

When picking projects, add them to the watchlist so that you don’t lose them. Once the selection is complete, you can closely study the pages of each project to make more specific decisions.

How to Get Allocation Easily?

Basically, there are only two options: participation in token sales and receiving airdrops for being an early user. A combination of those options is possible as well. This means you need to understand exactly how the project will enter the market. Even if the project does not openly state this, it is not difficult to guess the actual approach from the formal signs.

Token Sale. Once the most popular form of token distribution to the public, token sales are becoming an increasingly unlikely choice for protocols. Projects would rather give up the quick and convenient approach to cashing out than accept the risk of becoming an unregistered security. The era of all those ICOs and IDOs is left behind, with a peak in 2021, at least until the proper regulatory rules are in place. Nevertheless, not all projects have abandoned token sales.

Unexpectedly for many, the Tier 1 project Sui decided to hold initial exchange offerings on major exchanges instead of an airdrop. The reason for this decision was most likely a combination of factors: a lack of sufficient user base for airdrop (only testnet users), the inability to exist without a token, and lack of funding due to the necessary buyout of former FTX’s share. Sui, being the Layer 1 chain, can’t function without its token $SUI, in contrast to Layer 2s and various dApps on top of existing chains.

So, if a project can’t function without its token, that can be justification for a token sale. On the contrary, the token sale of a governance token isn’t a sign of good-quality projects, but it can still be very profitable.

Airdrop. Airdrop is the best way to launch a token, not only from a regulatory perspective but also from a marketing perspective. There is no need to explain the benefits of the product to users to get them to use it when they will use the product willingly in anticipation of the reward. And if there is a referral system, they will also promote the product for free. And then a project team can show the juicy stats to investors to get more fundraising.

Action Plan for Each Project

After researching the market and selecting projects, it is critical to develop a specific action plan for each token. It should vary both from project to project and from market cycle to market cycle. If the market is prone to decline, it’s best to get rid of everything as soon as possible, as the price after the launch may be the peak and there won’t be any ATH for several years or ever. On the contrary, if the market is bullish or at least coming out of a bear market, you can sell off the allocation in portions as price targets are reached.

There can’t be a universal plan for each token play. However, you can develop universal rules, such as selling in portions, selling on schedules, etc.

Mistakes to Avoid

- Don’t invest life savings. That can cost everything. You should invest only what you can afford to lose;

- Don’t fall in love with the project. Even if the project is actually great, it can still fail. You should diversify both attention and investments.

- Don’t overstay after the TGE (token generation event). Greed can turn profits into losses faster than you may imagine. You should take back the invested amount, at least.

- Don’t follow X’s (Twitter’s) influencer calls. Once influencers start shilling a project or token on X (Twitter), it is probably too late. You should look for projects on your own.

Output

Finding gems at an early stage can be an overwhelming and time-consuming venture, which is why a comprehensive approach divided into phases is so important. Start by identifying the market sentiment and category of interest, continue by searching and researching specific projects, and finish with a specific plan of action.

Those are handy tips. However, there is no one-size-fits-all approach, except the one you’ve suffered through yourself. DYOR.