Key Insights and Takeaways

- Solana is a global network with over 5,400 nodes distributed across 43 countries and 237 cities.

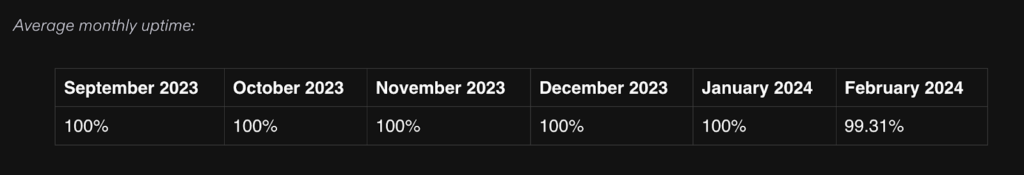

- Solana showcased exceptional performance for nearly a year by maintaining 100% uptime.

- In March 2024, Engineers presented a new feature dubbed Stake-weighted Quality of Service (QoS). Staked nodes reserve more connections to the leader via Stake weighted QoS.

- Since 2023, active discussions have been underway about implementing a governance mechanism for the Solana network. The Solana community aims to establish a solid framework to enhance governance and strengthen sustainability and resilience. Three votes have already passed.

- Everstake and the greater Solana validator community have developed and innovated a new methodology called the Validator Decentralization Score (VDS), which incorporates traditional metrics like stake distribution with additional factors such as geography and data center dispersal.

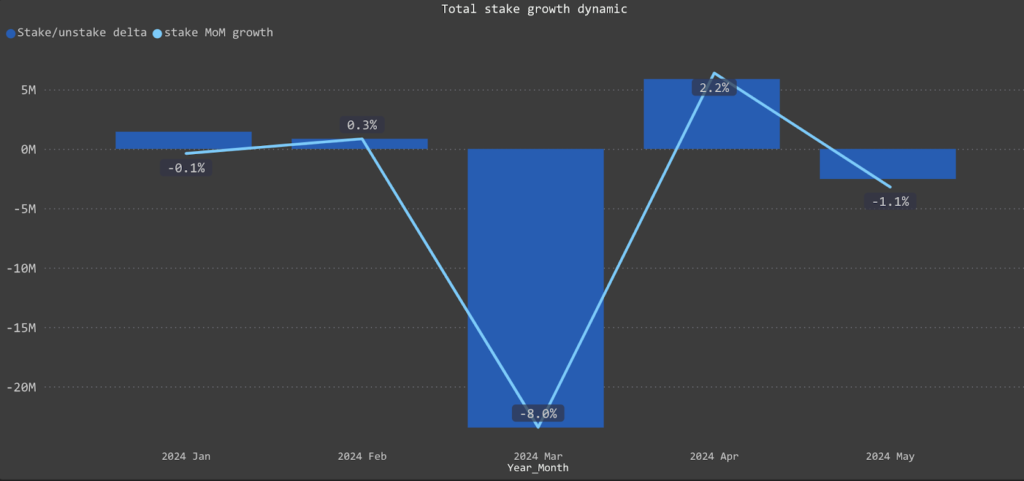

- Analyzing the annual Total Stake Growth chart reveals a notable decline in March 2024, caused by FTX Estate unstaking its tokens as they became available. Since then, the Solana ecosystem has shown stable growth. The total network stake in April increased significantly, reflecting this positive trend.

- Two new validators, Galaxy and Helius, joined the top ranks in the first half of this year.

- Everstake leads in the number of staking accounts, with over 150,000 delegating SOL tokens to the validator. Consider staking SOL with us by clicking here.

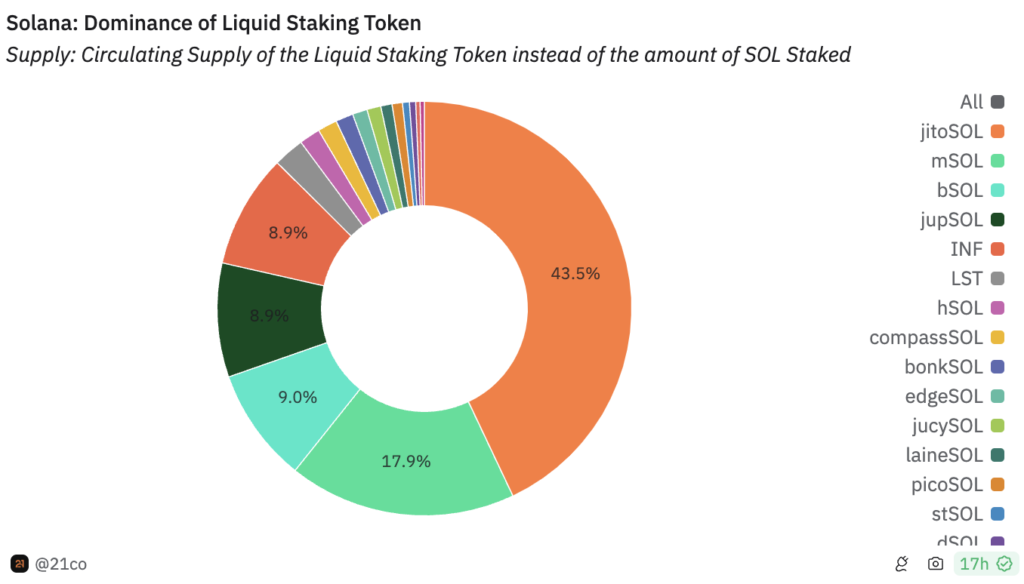

- The most popular Liquid Staking Tokens (LSTs) on Solana, highlighting their market share: Jito (jitoSOL) leads with a significant 43.49%, followed by Marinade (mSOL) at 17.90%. SolBlaze (bSOL) and Jupiter (jupSOL) are close competitors, holding 8.97% and 8.94% respectively. Sanctum (INF) rounds out the list with an 8.93% share.

Methodology

This report analyzes the Solana blockchain, employing the following data practices and sources:

- Key Insights and Takeaways

- Methodology

- Network Performance

- Validators Health

- Validator Decentralization Score

- Validator Clients Progress

- Stake-Weighted QoS

- Solana Governance

- Solana Staking Insights

- Total Stake Growth Dynamics

- Stake Distribution Among Top Validators

- Staking Accounts Distribution Among Top Validators

- Skipped Slot Rates of Top Validators

- Staked Ratio, Supply, and APR

- The Correlation Between Total Retail Stakes and APR

- Liquid Staking Analysis

- Solana Prospects

On-chain Data

We gathered comprehensive data from the Solana blockchain, including raw transaction data and API-sourced information on staking, transactions, inflation, and other metrics.

Data Preparation

Employing tools like Python and PowerBI, we meticulously cleaned and formatted the data, merging inputs from various sources for analysis.

Data Analysis

We conducted an in-depth analysis, incorporating graphs, charts, statistical data, and hypothesis testing to identify trends in staking, transactions, and other key metrics.

Interpretation

Leveraging our expertise, we interpreted findings, discussed implications, made comparisons, and offered recommendations for further research or action.

Network Performance

Performance is a critical aspect of the Solana ecosystem, underpinning its ability to scale and support a growing number of applications and users. Solana is designed to achieve high throughput, low latency, and minimal transaction costs.

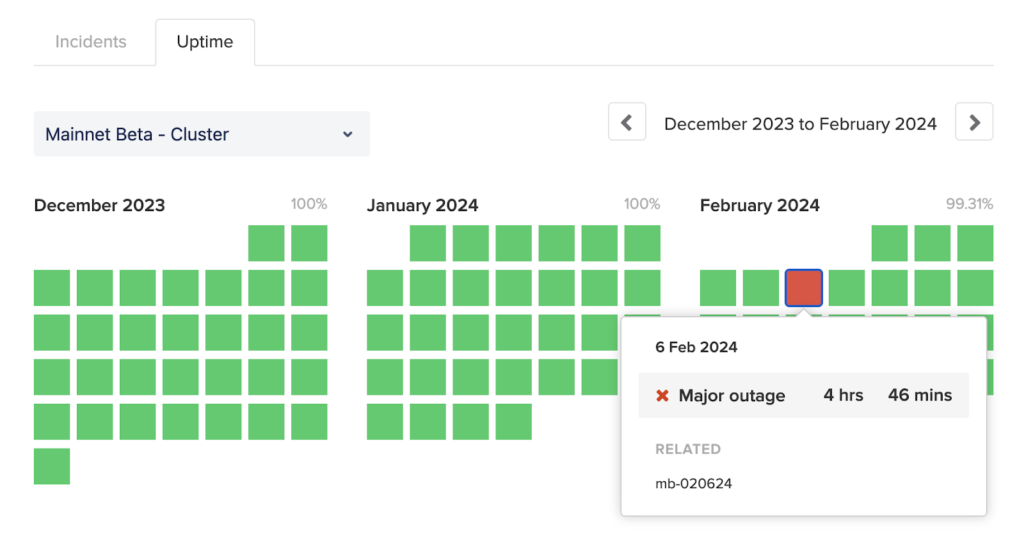

Solana demonstrated exceptional reliability for almost a year, achieving 100% uptime without experiencing a single incident. This streak arguably signifies the success of the ongoing attempts to further optimize the network’s reliability. The period between February 25 (2023) and December 31 (2023) marked the network’s longest-ever stretch without interruptions, lasting 309 days.

That said, on February 6, 2024, at 09:53 UTC, the Solana Mainnet Beta experienced a halt in block finalization. Engineers from various ecosystem teams immediately began working to diagnose and resolve the issue. Meanwhile, validator operators coordinated restart procedures, identifying slot 246,464,040 as the highest optimistically confirmed slot for restarting the cluster and preparing the necessary snapshots. Consensus progress resumed at 14:55 UTC, bringing the incident’s overall duration to approximately five hours.

The deploy-evict-request cycle of a legacy loader program caused an infinite recompile loop in the JIT cache. The chosen mitigation involved backporting the v2 deploy-disable changes to v1.17 and removing the feature gate, making the “v2” deploy-disable effective immediately upon cluster restart. More data on this outage is available here.

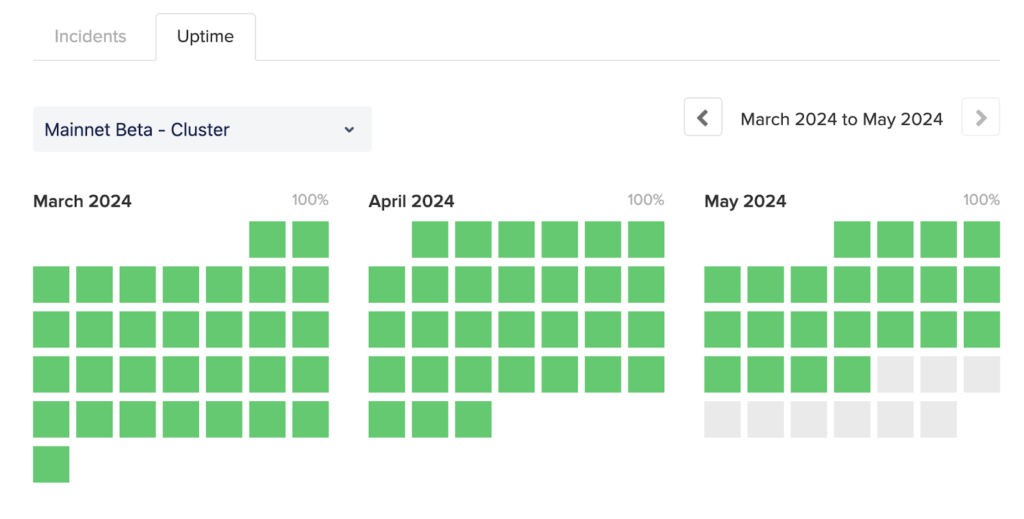

Since then, there have been no incidents, and Solana has maintained 100% uptime. It should also be noted how quickly the Solana team, validators, and the entire community moved to tackle the problem. Their swift and coordinated response was instrumental in diagnosing the issue, implementing the necessary fixes, and restoring network functionality within a very reasonable timeframe.

Seeking to minimize the likelihood of similar problems, the network’s stakeholders, including developers, validators, and the broader community, actively collaborate to identify potential vulnerabilities, implement efficient preventive measures, and swiftly address any issues that may arise.

Validators Health

The Solana validator network’s growth and resilience indicate the ongoing evolution of its ecosystem and the ability to adapt to new demands and challenges. As the backbone of the Solana blockchain, validators play a crucial role in ensuring the network’s security, integrity, and performance.

Metrics such as node count, Nakamoto Coefficient, and the diversity and distribution of nodes within the network can gauge the health of validators.

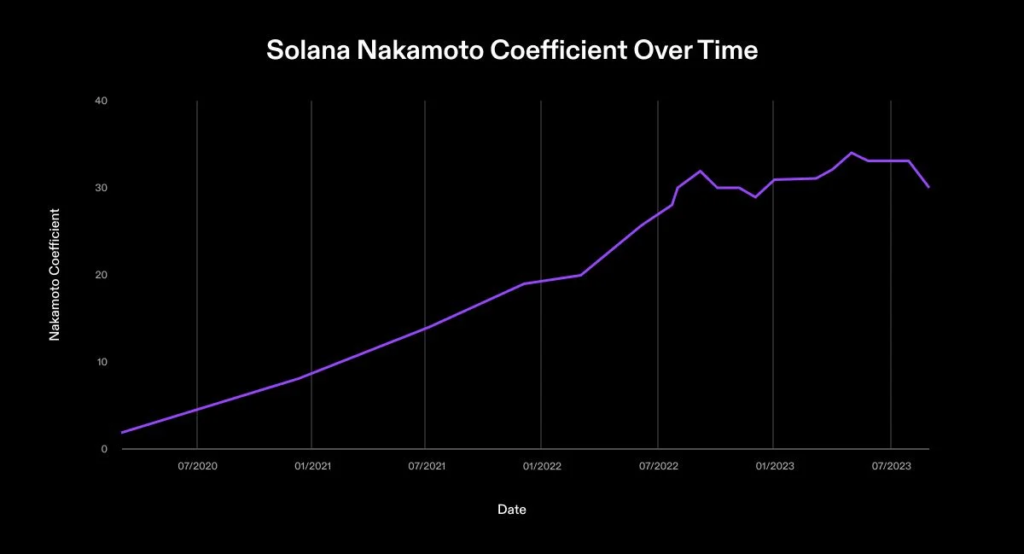

Nakamoto Coefficient

The Nakamoto Coefficient is a metric measuring the decentralization and security of a blockchain network. It quantifies the network’s resistance to a potential takeover by a malicious actor or group of actors. Specifically, the Nakamoto Coefficient represents the number of nodes that must collude in order to control more than 33.333% of stake. A higher Nakamoto Coefficient indicates a more decentralized and secure network, which signifies a greater mining power distribution among more participants. “Nakamoto” refers to Satoshi Nakamoto, the pseudonymous creator of Bitcoin, whose vision for decentralization laid the foundation for blockchain technology.

Solana’s Nakamoto Coefficient is 21 at the time of writing, which indicates a high level of decentralization within the network. This metric surpasses that of many other well-known networks, including Sui (15), Polygon (4), Cosmos (7), MultiversX (6), and others.

It’s worth noting that Solana’s Nakamoto Coefficient has been mainly on the rise since 2020 till the July 2022. This upward trajectory in Solana’s Nakamoto Coefficient suggests growing diversity among its validators and stakers. It also reflects increasing participation from various stakeholders, including individual miners, institutional players, and community-driven initiatives, all contributing to the network’s consensus mechanism. After July 2022, the Nakamoto Coefficient experienced fluctuations, and in July 2023, it saw a significant drop following the movement of the FTX stake.

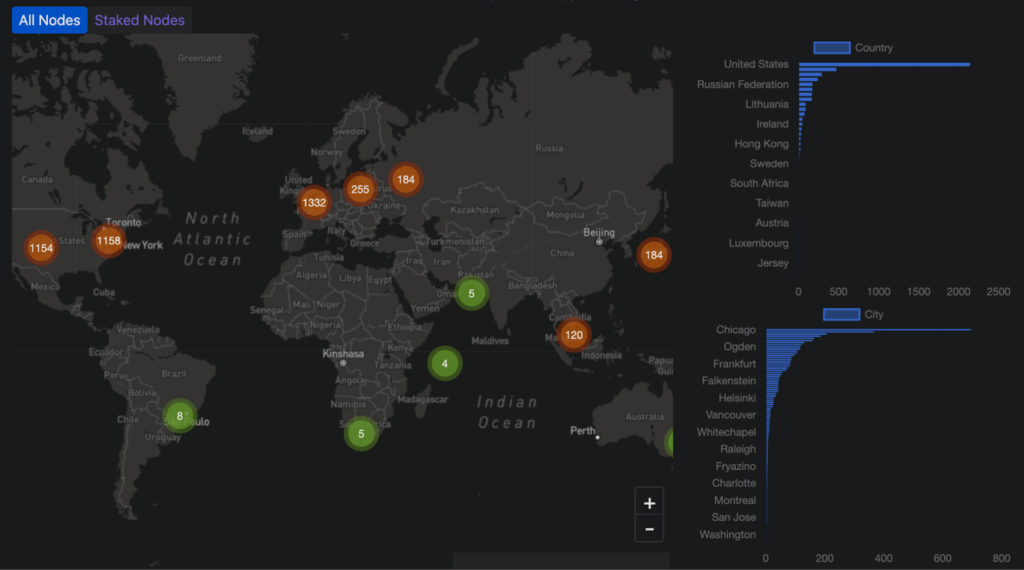

Nodes Distribution

Decentralization is crucial for any blockchain today. At its core, decentralization refers to distributing authority and control across a network, ensuring that no single entity holds undue power. Solana achieves decentralization through its consensus mechanism, which relies on a large and diverse set of validators spread across the globe.

Particularly, Solana is a global network with over 5,400 nodes distributed across 43 countries and 237 cities. The map below displays the locations of all nodes, while the bar charts illustrate the distribution of nodes by country and city.

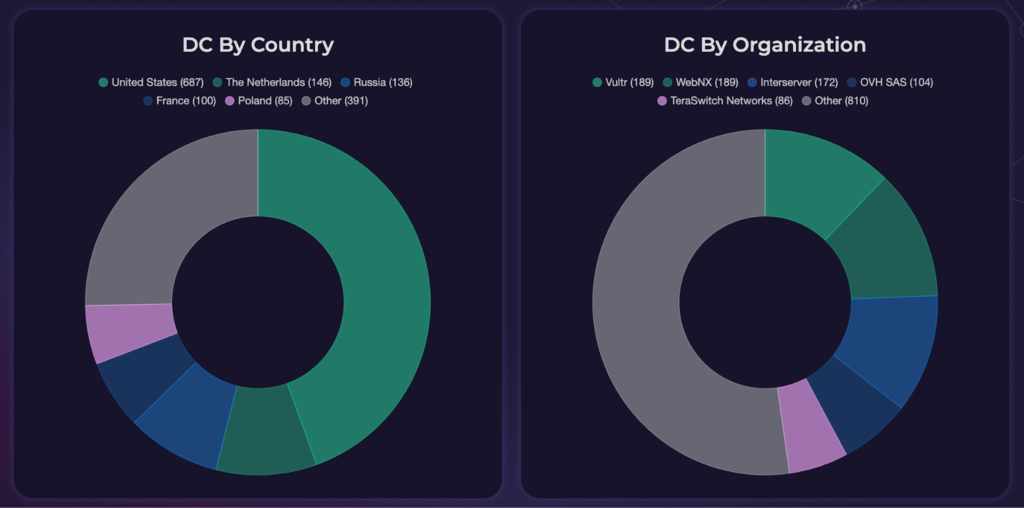

Approximately 1,500 Solana mainnet validators are active globally, spread across 300 mainnet data centers.

The global distribution of data centers is crucial for advancing the Solana network and blockchain technology. It ensures network resilience, accessibility, and decentralization. By dispersing data centers worldwide, Solana enhances security, reduces latency, and prevents centralization.

Validator Decentralization Score

Measuring validator network health holistically is a difficult task, and historically, few (if any) metrics provided a snapshot of validator decentralization across stake, geography, and data center distribution. Seeking a comprehensive portrait of network health, Everstake and the Solana validator community has developed and innovated a new methodology called the Validator Decentralization Score (VDS), which incorporates traditional metrics like stake distribution with additional factors such as geography and data center dispersal.

The Validator Decentralization Score (VDS) is a composite score reflective of a number of different considerations important to network decentralization. We identified four key criteria for evaluating the effectiveness of a potential metric:

- Redistribution sensitivity: no single score should dramatically outweigh others in the composite.

- Weight balance: when an overall increase in nodes aligns with a proposal distribution–—in practical terms, there are more nodes—it produces a better score.

- Understandability: the score should illustrate improvements in decentralization at a glance, without minute differences or dramatic shifts that make it difficult to evaluate change.

- Low-Weight Effects: nodes with near-zero stakes should not significantly affect the score.

In the coming days, we’ll release a comprehensive article on the Validator Decentralization Score (VDS) covering all technical details and calculations.

Validator Clients Progress

Validators are machines with a Solana validator client, essentially serving as the backbone of the Solana network’s operations. Diversifying software clients is crucial for enhancing the resilience and decentralization of any blockchain network, as it mitigates the risk of a single point of failure within the network’s infrastructure. Solana’s newly achieved multi-client status marks a significant milestone for the ecosystem, empowering validators with the freedom to select from various clients to operate.

Recently, the Solana Foundation has dedicated considerable resources to strengthening the health of the validator network’s software infrastructure. Emphasizing this objective, the Foundation has prioritized initiatives to incentivize the creation of new software clients and create a collaborative network of core developers from diverse organizations.

Solana Labs initially developed the first validator client for Solana (Note: the Solana Labs client will eventually no longer be updated). Subsequently, various independent endeavors have emerged to produce additional full or lightweight validator clients for the Solana network.

- Jito: Jito-Solana is the first third-party, MEV-boosted validator client for Solana. Jito Labs released a second validator client for Solana in August 2022, based on Solana Labs’ code but independently maintained.

- Firedancer: Firedancer, developed by Jump Crypto, is an advanced independent validator client for the Solana blockchain that aims to enhance the existing Solana validator client.

- Sig: Sig is an intelligently optimized Solana validator implementation crafted using Zig, a state-of-the-art low-level programming language.

- Agave: Anza is a new development shop within the Solana ecosystem, founded by former executives and core engineers from Solana Labs. One of their key projects is to create a forked version of the Solana Labs validator client named “Agave.” 2.0.x, next version of the Agave client, which will be deployed to the mainnet, will only be released in the Agave repository. The labs client will no longer be supported at that point. Additionally, Anza aims to contribute to other major protocols within the Solana ecosystem.

Stake-Weighted QoS

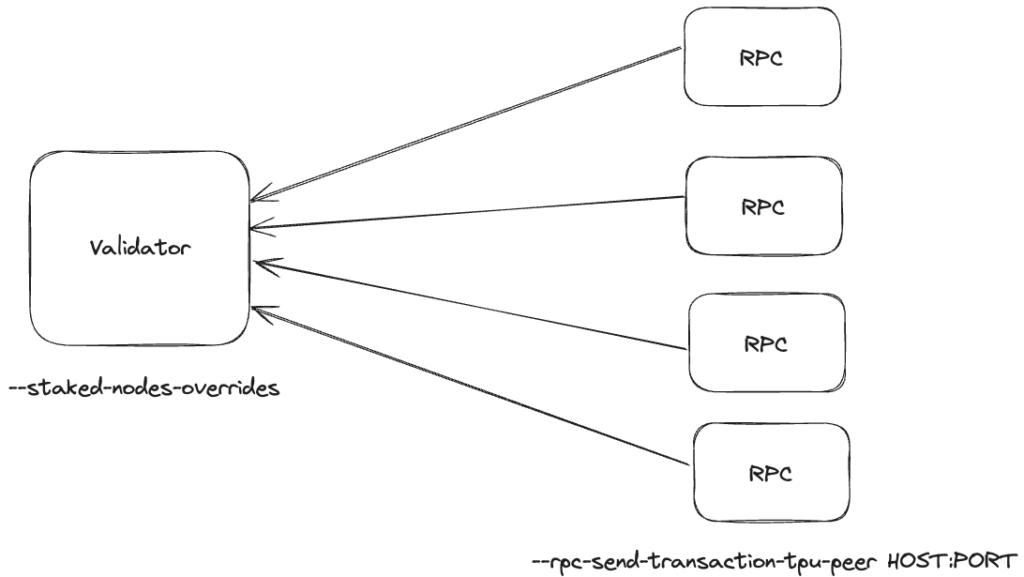

In March 2024, engineers presented a new feature for Solana validators – Stake-weighted Quality of Service (QoS).

Stake-weighted QoS is a feature within the implementation that, upon activation, permits leaders (block producers) to discern and give priority to transactions routed through a staked validator, serving as an extra sybil resistance mechanism.

Enabling Stake-weighted QoS necessitates Validator nodes to be coupled with highly trusted RPC nodes. This setup proves advantageous, particularly when RPC and Validator functions operate within the same infrastructure. Stake-weighted QoS thrives in configurations with high levels of trust, mandating prior agreement between the Validator and RPC before activating the feature.

With Stake-weighted QoS enabled, RPC nodes paired with a validator gain a “virtual” stake, influencing how that leader treats inbound TPU traffic. Typically, RPC nodes lack staking privileges, but Stake-weighted QoS allows them to prioritize transactions, similar to consensus nodes. To enable this feature, both the validator and RPC nodes must be configured to establish a trusted peer relationship. Without proper configuration on both ends, Stake-weighted QoS won’t function.

Read more about implementing this feature in Solana’s guide.

Solana Governance

Governance on Solana is currently minimal and infrequently utilized. Major protocol changes are primarily subject to social consensus, with the final authority residing with the core engineers at Solana Labs.

Governance is crucial in ensuring blockchain networks’ sustained growth and adaptation while upholding their foundational decentralization, trust, and security principles. By providing structured decision-making processes, governance mechanisms enable networks to evolve in response to technological advancements, user needs, and regulatory requirements.

Additionally, effective governance facilitates conflict resolution and the alignment of economic incentives, further reinforcing the network’s integrity and resilience.

Since 2023, there has been an active discussion about implementing a governance mechanism for the Solana network. And there was a discussion about the governance framework on Solana Forum: Aligning the “What” of Governance with the Existing SIMD Process. Solana Improvement Documents (SIMD) describe proposed and accepted changes to the Solana protocol. The SIMD process is well-formed and actively engaged by the Solana core developers and contributors. In the proposed governance approach, participants would vote on SIMDs as they emerge through this structured process. It is assumed that existing participants thoroughly understand the parameters of the SIMD process, which naturally filters and guides their decision-making.

Three votes have already passed:

- “First Governance Advisory Vote by Validators” (October 2023). This proposal determined who would have the right to vote. With over 170 participants and approximately 14.3% of the stake voting, more than 70% have voted for option 1 – Validators vote, votes weighted by the stake.

- “Enabling the Timely Vote Credits Mechanism on Solana Mainnet” (March 2024). The Timely Vote Credits (TVC) feature fixes the delay in voting results that slowed down the confirmation and finalization of blocks, directly impacting the speed at which Solana processes transactions. The final tally is 98.4% in favor.

- “Enabling the Reward Full Priority Fee to Validator on Solana Mainnet-beta” (May 2024). The proposal suggests adjusting the priority fee structure to reward validators with 100% of the collected fees. The proposal passed with 77.77% voting in favor.

These votes showcase the community’s tangible progress toward implementing a genuine governance system. Importantly, it signifies a shift from discussion to actionable steps. Adopting formal voting mechanisms will further boost transparency, inclusivity, and consensus efficiency as the network continues on this trajectory.

Solana Staking Insights

Solana staking involves holding and locking up SOL tokens to enhance network security and gain Solana staking yields. When users stake Solana, they delegate their tokens to trusted network validators, aiding the network’s consensus process and receiving additional tokens as incentives.

It’s important to note that delegation doesn’t involve transferring tokens to another entity. Instead, the coins remain in the delegator’s wallet while being “frozen” by the network’s smart contract for participation in block validation and staking rewards.

Validators are integral to the functioning of Proof-of-Stake blockchain protocols. Their duties include validating transactions, executing them, and appending new blocks to the chain. In recognition of their contributions, validators receive rewards in the form of native blockchain tokens.

Total Stake Growth Dynamics

The total stake showed promising growth throughout the beginning of 2024, steadily climbing upward. However, in March, there was a noticeable negative spike, caused by FTX Estate unstaking its tokens as they became available.

Since then, the Solana ecosystem has demonstrated signs of stable growth. When examining the dynamics of Solana’s total stake changes, the total network stake increased significantly in April.

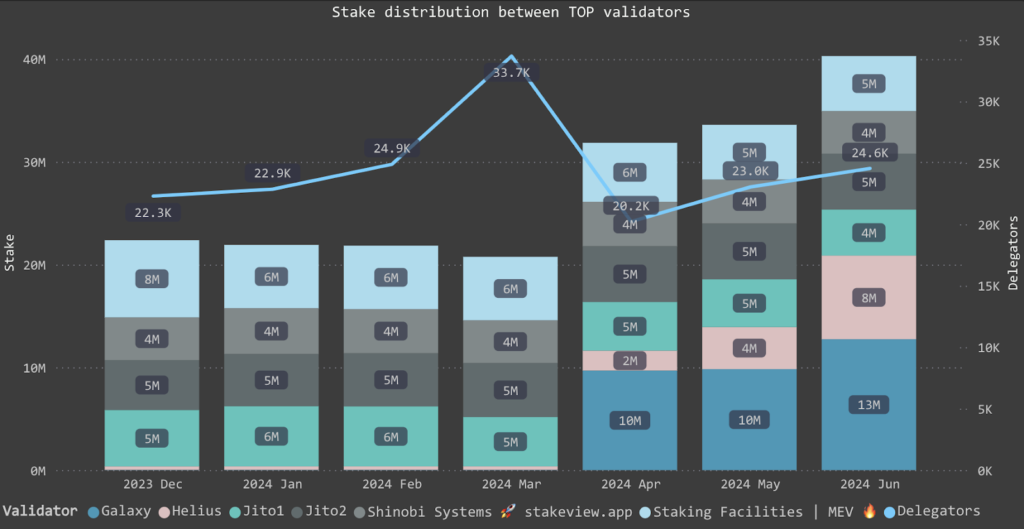

Stake Distribution Among Top Validators

Stake distribution among the top validators reflects the decentralization and security of any network. For Solana, this allocation of stakes offers a glimpse into the ecosystem’s dynamics, highlighting the involvement and influence of key network participants.

Examining the stake distribution among leading validators uncovers their commitment, reliability, and impact on the network’s operational framework.

To enhance clarity, we’ve categorized the top 20 validators based on commission fees into two groups: 0-5% and 6-10%, providing a more precise representation of the data on the graph. Private nodes were not included in the analysis.

0-5% fee

The top validators with a 0-5% fee rate are listed below.

- Galaxy

- Helius

- Jito2

- Staking Facilities

- Jito1

- Kiln

- Shinobi Systems

In the first half of this year, two new validators, Galaxy and Helius, joined the top ranks. In April, Galaxy received a delegation of 9.6 million SOL, and than 3M SOL in June. Helius also started running their validator in April, offering 0% fees and 0% MEV fees. Since April, Helius has attracted more than 7,000 delegators and 8 million SOL in stake, receiving a three million SOL delegation from one address in June.

Additionally, the chart shows a significant increase in delegator activity. On March 18, Solana’s market capitalization surged to an all-time high of $92.5 billion, surpassing the previous peak of around $77.9 billion back in November 2021. Furthermore, on March 21, the Solana network set a new record for daily new addresses on the blockchain, reaching 1.61 million. Also, the public interest in Solana hit record levels amid the recent surge in meme coin popularity on the network.

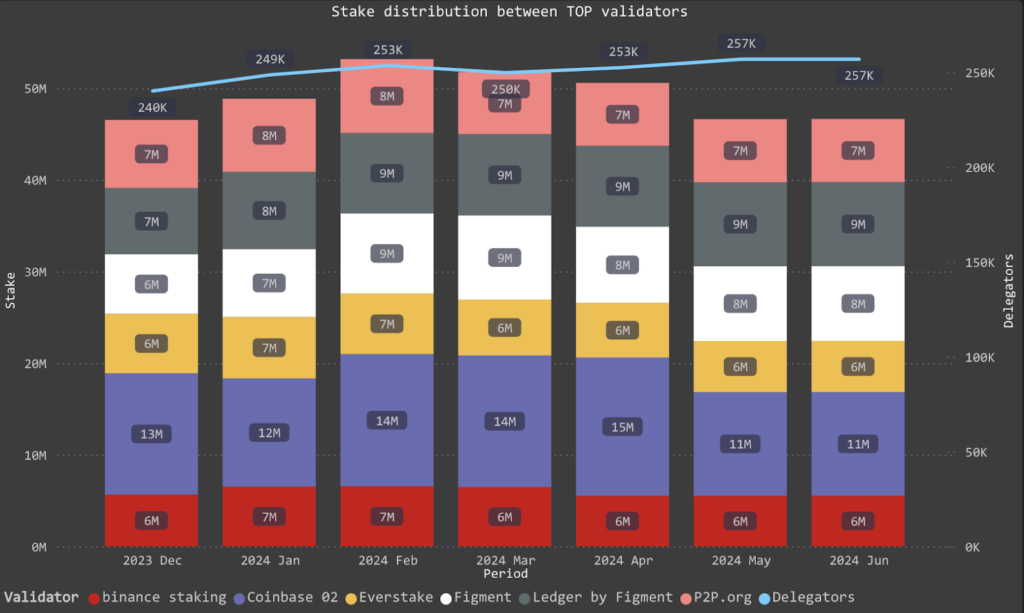

6-10% fee

The top validators with a 6-10% fee rate are listed below.

- Coinbase02

- Ledger by Figment

- Figment

- P2P

- Everstake

- Binance

From February to April, we observed an increase in stake for the validators Coinbase02 and Ledger by Figment. At the same time, delegations to P2P, Figment, Everstake, and Binance decreased over the same timeframe.

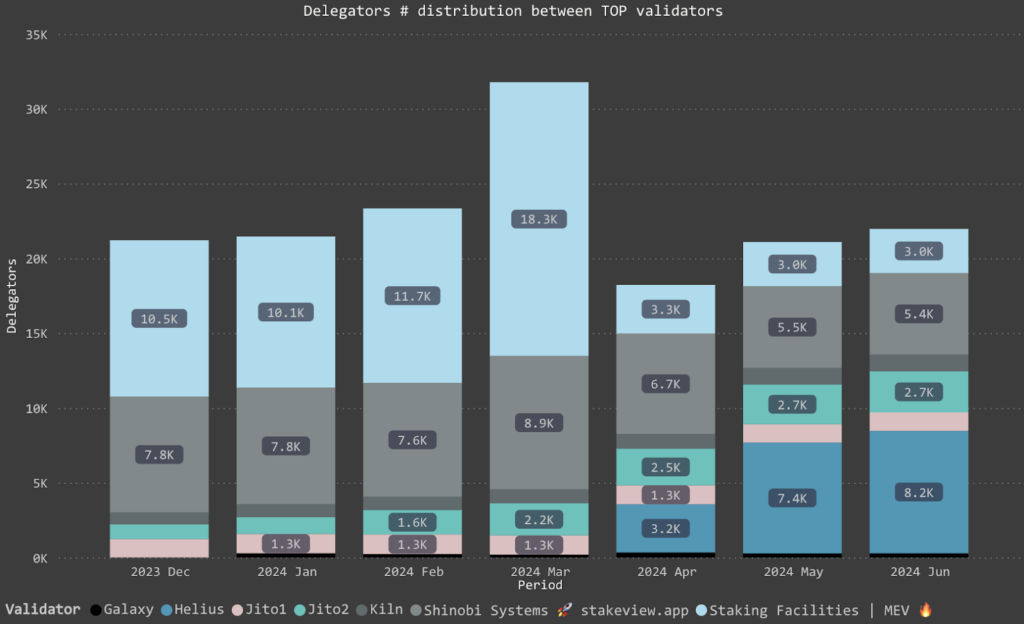

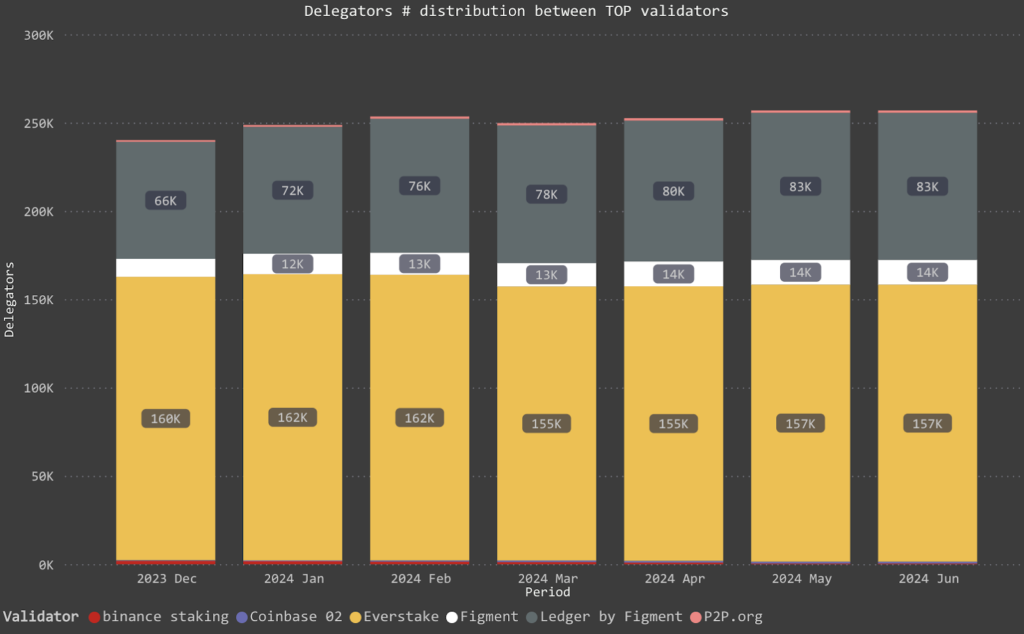

Staking Accounts Distribution Among Top Validators

A Solana stake account allows users to delegate tokens to network validators, potentially earning rewards for the account owner. That said, each stake account can only delegate tokens to one validator at a time. In other words, one must create multiple stake accounts to allocate portions of their tokens to different validators. For more details, refer to the Solana documentation.

We have also segmented the top validators into distinct groups based on their commission rates to simplify data analysis.

0-5% fee

The graph indicates a significant increase in delegators in March. Notably, Staking Facilities (marked in pink), Shinobi Systems (marked in black), and Jito2 (marked in green) experienced a substantial rise. As mentioned before, in March 2024, the Solana network set a record for daily new addresses on the blockchain, reaching 1.61 million.

In April, there was a notable decline in delegators for these validators. Since its launch, a new validator, Helius, offering a 0% fee, has attracted many new delegators.

6-10% fee

Among this group of validators, Everstake (marked yellow on the chart) clearly maintains its strong position as the leader in terms of the number of delegators, with over 150,000 accounts entrusting their SOL tokens to our platform. Click here to delegate your SOL to Everstake with 7% APR.

We are proud of our resilient and battle-tested infrastructure, which ensures high availability and performance for staking Solana. Furthermore, our reward distribution system is designed to optimize returns for our delegators, making staking with us a highly rewarding experience.

While Ledger by Figment has shown an increase in delegator activity, Binance has demonstrated a decline in this metric.

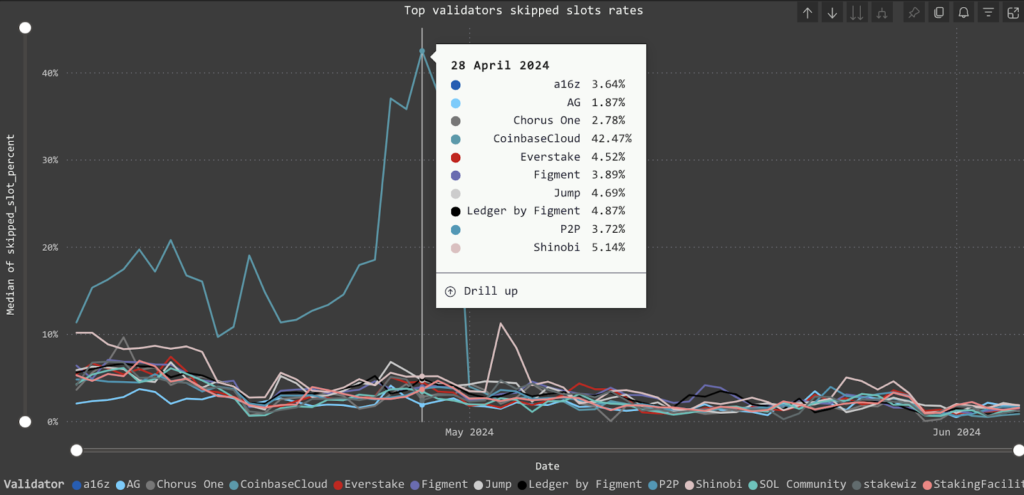

Skipped Slot Rates of Top Validators

The skipped slot rate indicates the percentage of times a leader fails to produce a block during their designated slots. A lower skipped slot rate signifies a higher success rate in block generation.

It’s important to note that this metric does not affect the staking annual percentage rate (APR) for delegators, as it is not factored into the calculation of staking returns. Still, it does impact the additional rewards validators receive for block production and serves as a key performance and health metric for Solana validators.

On April 28, the CoinbaseCloud validator recorded a skipped slot rate of 42.47%, the highest among all validators. This sudden increase is related to internal operational issues specific to CoinbaseCloud, as no similar patterns were observed in other validators.

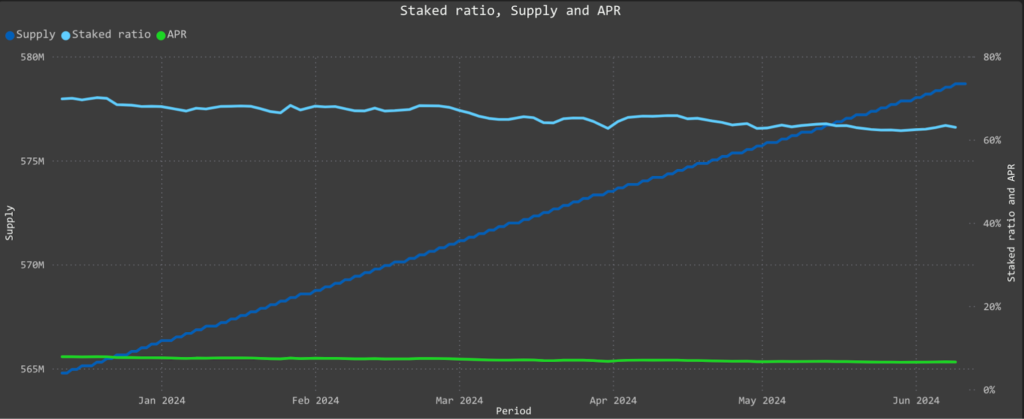

Staked Ratio, Supply, and APR

The staked ratio is a metric that indicates the percentage of a cryptocurrency’s total supply that is actively being staked with network validators. In the context of Solana, it represents the proportion of SOL tokens that participants currently stake to support network operations and security. This ratio reflects the level of commitment and participation within the network, as a higher staked ratio suggests greater involvement from token holders in maintaining the blockchain’s functionality and security.

The supply of SOL tokens refers to the total number of tokens in circulation within the Solana ecosystem.

Solana’s staking APR, or annual percentage rate, denotes the yield that participants earn by staking their SOL tokens.

The graph above illustrates the relative steadiness over the staked ratio and APR over 2023. Meanwhile, the SOL supply consistently trended upward, indicating ongoing expansion.

It’s important to distinguish the rising supply of SOL tokens from traditional inflation, though. This increase is a deliberate mechanism designed to support growth, sustainability, and continuous innovation within the Solana ecosystem.

The Correlation Between Total Retail Stakes and APR

Total Retail Stake refers to the cumulative amount of SOL tokens staked by individual retail participants within the Solana network. It represents the combined contributions of these investors who lock up their SOL tokens for a designated period to participate in staking. This metric is a crucial indicator of retail investor engagement and the level of network decentralization.

A declining trend in the APR is typical for Proof-of-Stake networks: as more tokens are staked, the overall reward rate decreases. Still, it’s important to highlight that Solana systematically reduces inflation over time, regardless of the staking rate. This strategy enhances the long-term stability and sustainability of the Solana ecosystem, offering users a dependable and predictable framework for their participation in the network.

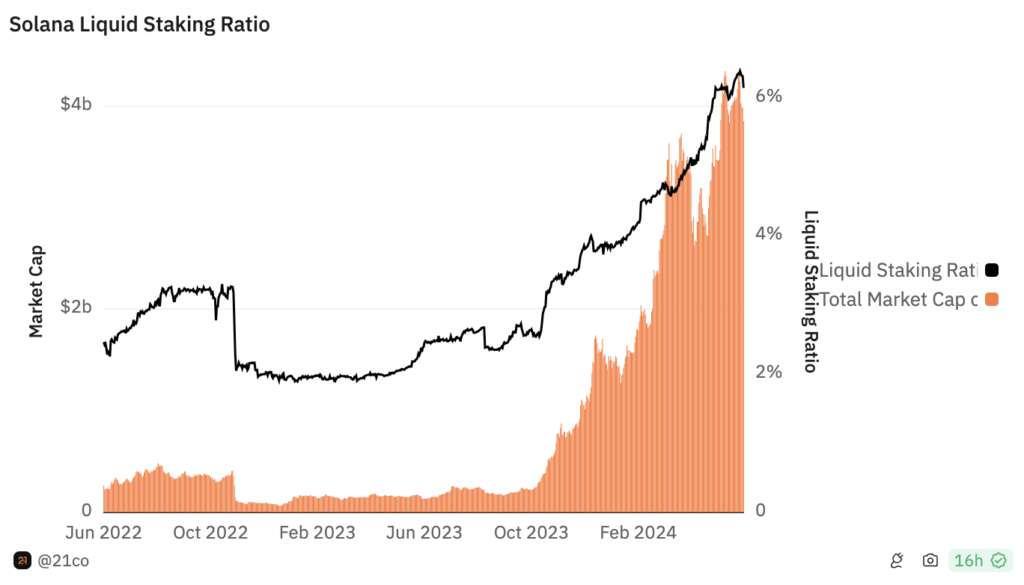

Liquid Staking Analysis

Liquid staking is a decentralized finance (DeFi) innovation that allows users to stake their cryptocurrency assets and earn rewards while maintaining the liquidity of those assets. Unlike traditional staking, where assets are locked up and cannot be used or traded until the staking period ends, liquid staking enables users to receive a tokenized version of their staked assets. These tokens can be freely traded, used in DeFi applications, or even staked further.

According to Dune, the Solana Liquid Staking Ratio stands at 6.31%, with the total market capitalization of liquid staking tokens (LSTs) reaching $4.02 billion. These figures and the accompanying graph indicate users’ growing interest in liquid staking. This trend has become a popular topic within the Solana community, leading to the recent emergence of numerous new projects.

The most popular Liquid Staking Tokens (LSTs) on Solana and their market share are as follows at the time of writing.

- Jito (jitoSOL) – 43.49%

- Marinade (mSOL) – 17.90%

- SolBlaze (bSOL) – 8.97%

- Jupiter (jupSOL) – 8.94%

- Sanctum (INF) – 8.93%

The key benefits of Solana liquid staking include:

- Liquidity: users can stake their SOL tokens and still retain liquidity through derivative tokens. This allows them to participate in other DeFi activities like lending, borrowing, or trading.

- Staking rewards: users continue to earn staking rewards on their SOL tokens while potentially earning additional yields from DeFi activities using the derivative tokens.

- Flexibility: liquid staking provides greater flexibility than traditional staking, enabling users to diversify their investment strategies and optimize returns.

Solana Prospects

Solana’s hallmark features have been its rapid transaction speeds and scalability. Yet, continuous advancements in its blockchain technology are crucial, with expected upgrades focusing on performance improvements and network stability. A primary aim for Solana developers at the moment is achieving optimal performance, and the team’s efforts seem to be successful since the platform has reached 100% uptime.

The expansion of DeFi projects and NFT platforms on Solana is expected to drive significant user engagement. The high-speed, low-cost transactions on Solana make it an attractive option for developers and users alike. Strategic collaborations with other blockchain projects, financial institutions, and technology companies can enhance Solana’s ecosystem. Such partnerships will help integrate Solana into more diverse applications and increase its utility.

The Solana ecosystem’s prospects for the next half of the year look promising, assuming it continues to advance technologically, expand its ecosystem, and efficiently navigate regulatory and market challenges. The support from its community and developers and strategic partnerships will play a significant role in shaping its future success.