Mantra(OM), one of the key supposed players in the RWA space went off crashing in March 2025 after several of its large token holders dumped their crypto large token holders and dumped their $OM on the market currencies on the market, crashing the price below $1 from $8.7.

Although there is no way of perfectly knowing which crypto bill and which not yet there are many checks and balances which could limit your exposure to such cryptocurrencies. This article explores five such precautions that we learnt through our years of experience working in the crypto markets.

How to minimize your risk exposure in DeFi? Exposing DeFi’s Red Flags

Read The White Paper in Detail

Every blockchain project that is genuine releases a detailed white paper where everything about the project from the technology to the way users are supposed to use it is mentioned.

Crypto buyers who are interested in investing in any project may be at a pre ICO stage or at a post launch stage should refer to the White Paper in as depth as possible and try to understand it with every jargon that is mentioned in it.

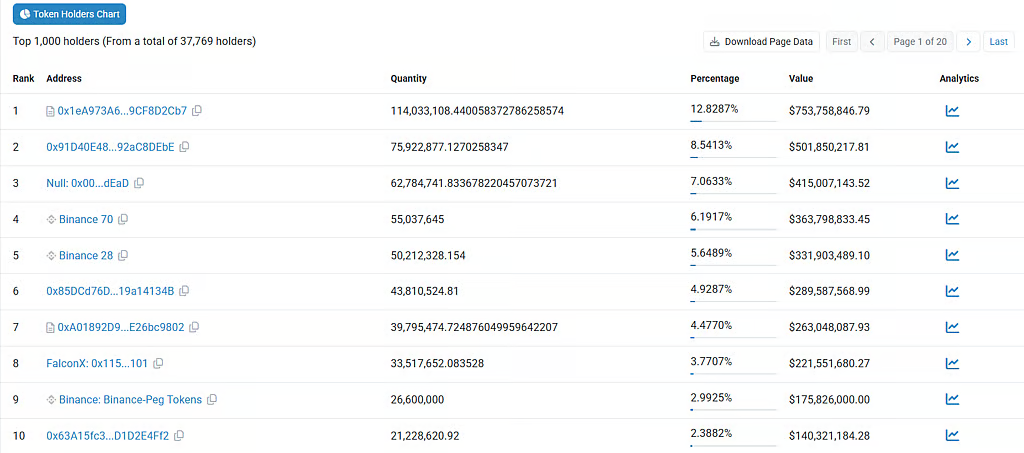

In the case of mantra a large part of the token holding was allegedly allotted to internal members. As high as 12.5% of the tokens were in the control of a single wallet, and 52% of the token supply was being controlled by just 10 wallets.

As soon as the project reached a certain price approximately to $8.4 (from $1, within 6 months), several token owners dumped the $OM tokens. The crypto markets termed it as a pump and dump operation.

Explore Socials

Though it is very cheap and easy to create a perfect set of social media pages for any crypto project, yet many fake ones do not have even those. These projects can be detected through bad social media visuals, non professional posting and reply behaviour, and amateur grade captions or texts.

Do you know, there are several airdrop scams targeting users like you?

A perfect social media is not the certificate of genuinity for any project but it tells you a lot about projects that are trying to cheat you. Even a brief overlook can manytimes save you from investing in junk grade cryptocurrencies.

Understand Project Viability

Understanding project viability is the key to succeed in crypto investing especially if you’re operating in pre launch project markets. Many projects which look cool but do not have a viability often carry the risk of failure. Even the smallest periods of bear markets could easily wipe out those projects.

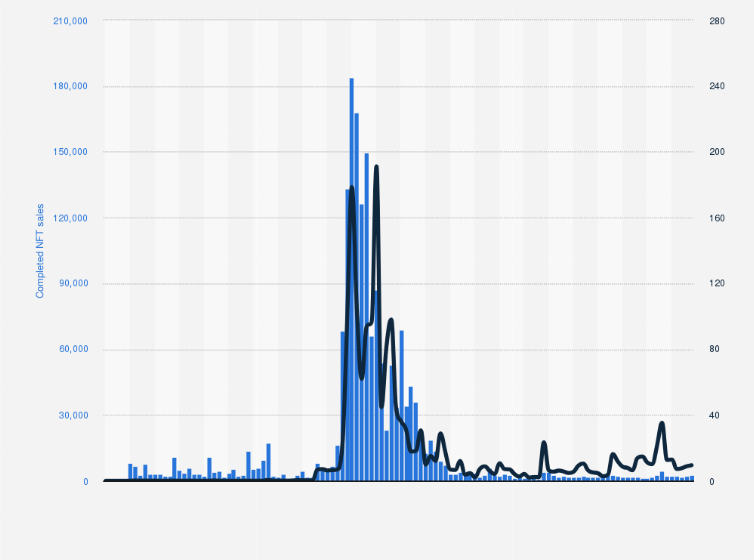

One of the biggest examples of this is the fate of the NFT markets. Though they looked cool to own and were a multi-billion dollar market in the 2021 bull run, yet a couple of years later, NFT markets are virtually non-existent despite Bitcoin rallying 200% from its 2021 highs. NFTs never came out of the bear markets.

A certain way of defending your crypto capital is by avoiding FOMO traps.

Smart Contract Audit To Check For Loops

Every project has a smart contract on which its token platform decks or exchange is created. It is necessary for project owners to get their smart contracts examined by an independent expert only after which they are allowed for listings. Certik is the most common smart contract auditor in the crypto world.

Auditors check for loops, backdoors, token minting algorithms and many other loopholes to see if the owners are really creating a project as per the white paper or have manipulated some part of the code to suit their best interests.

When PYUSD was launched by PayPal, netizens found an uncommon freeze and erase function in PYUSD’s smart contract wherein it was possible for PayPal to freeze or confiscate any wallet.

Seek Expert Opinion

Although it is impossible for anyone to tell whether a project will be a hit or flop based on their current vitals, yet many experts do have a hunch that a certain project might not survive a bear market or maybe it could just be a ultra short trend.

One such example is the existence of memecoin markets. Despite having no real life utility, coins rallied much for the year 2024 with some gaining up to 10,000% in growth.

Here is Marty Bent, Managing Partner of Ten31 Funds, commenting on the survivability of memecoins and expressing doubt on their future even before the memecoin rally of late 2024 and early 2025.