Art and technology have always had a complex relationship, often crossing paths to redefine human creativity and commerce.

- Tokenomics: The Engine of Deflationary Precision

- Historical Performance of Resilience and Strategic Growth

- Technical Analysis and Indicators

- Current Price and Trends

- Key Support and Resistance Levels

- Support Levels

- Resistance Levels

- Volume Analysis

- On-Chain Metrics: The Pulse of ARTFI’s Ecosystem

- ARTFI Price Prediction Analysis (2025–2030)

- 2025: Adoption Peak

- 2026: Early Consolidation Phase

- 2027: Continued Growth and Adoption

- 2028: Resurgence of Growth

- 2029: Peak Potential

- 2030: Stabilized Growth

- Art Meets Blockchain, and the Future Looks Bright

Here’s where Artfi, a groundbreaking platform built on the high-performance Sui blockchain that marries fine art with blockchain technology, comes in. By tokenizing blue-chip art into fractional NFTs, Artfi democratizes access to a historically exclusive market, inviting global investors to co-own iconic pieces.

But the platform doesn’t stop at innovation—it leverages deflationary tokenomics, revenue-sharing mechanisms, and staking rewards to create a powerful ecosystem.

ARTFI’s current valuation suggests untapped potential, driven by its expansive and multi-vertical ecosystem. With a foundation rooted in fractional NFT ownership and bolstered by platforms like Artfi Share, Curated, and ShareMarket, the token’s value is intricately tied to the ecosystem’s ability to democratize and innovate within the global art market.

This article dives into its native token, ARTFI’s historical growth, tokenomics, network activity, and technical price outlook through 2030.

Tokenomics: The Engine of Deflationary Precision

At ARTFI, tokenomics is a carefully calibrated machine designed to craft long-term value through a marriage of scarcity and functional demand.

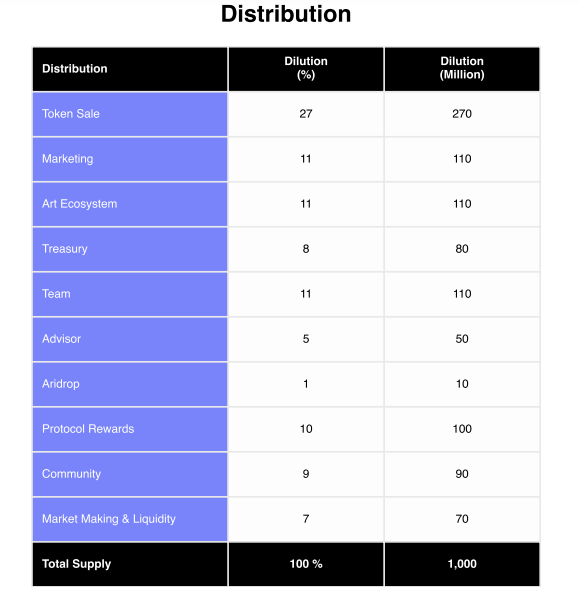

Image description: Distribution of ARTFI’s token supply.

1. Supply Metrics

ARTFI tokens are precision-engineered with scarcity baked into their DNA.

- Total Supply: 1 billion ARTFI tokens—a fixed cap that sets the foundation.

- Circulating Supply: As of November 2024, 130.37 million tokens are in play.

- Market Cap: $1.88 million.

- Fully Diluted Valuation (FDV): $14.45 million.

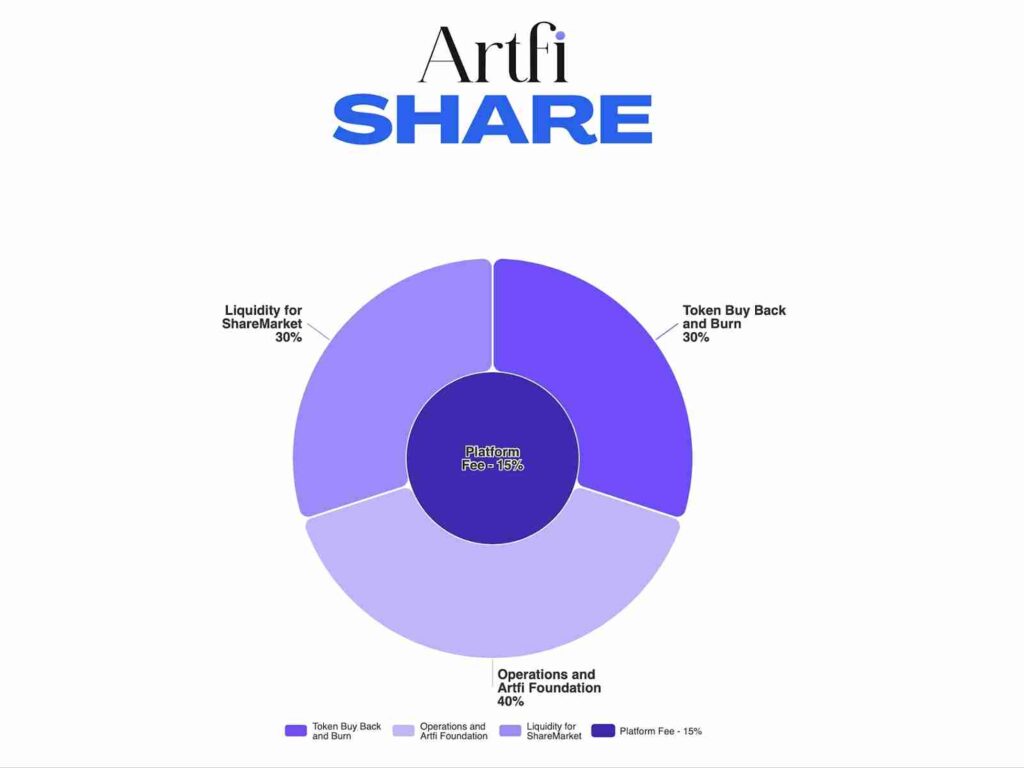

2. Revenue Distribution

Artfi allocates 30% of its revenue to repurchase and burn ARTFI tokens, reducing the overall supply. This isn’t a throwaway marketing promise—it’s an on-chain commitment.

Whether it’s revenue from art sales, NFT marketplace fees, or subscriptions, 30% of every dollar flows into repurchasing tokens. These tokens don’t just sit idle—they’re permanently burned, reducing supply like a phoenix rising from digital ashes. The result? A tangible, transparent reduction in token availability, improving scarcity and value.

3. Staking and Governance

ARTFI tokens aren’t just assets—they’re a passport to passive income and a voice in the ecosystem’s future.

- Staking Rewards: Token holders can stake their assets and earn passive income, effectively locking tokens out of circulation. This reduces supply and aligns incentives with long-term engagement.

- Governance Rights: Owning ARTFI tokens means you get a say in how the ecosystem evolves. From strategic pivots to operational tweaks, the community drives the ship—a true decentralization of decision-making.

4. Utility

ARTFI tokens are the lifeblood of a multifunctional economy.

- Fractional NFT Ownership: Democratising access to high-value art through fractional ownership.

- Payments: Cover transaction fees, marketplace costs, and subscriptions seamlessly.

- Real-World Integration: With Artfi Debit Card functionality, your digital assets become tangible, usable in everyday transactions—a step toward merging art with real-world utility.

The Artfi token forms the backbone of a growing ecosystem encompassing diverse verticals—from fractional ownership platforms like Artfi Share to decentralized marketplaces such as Artfi ShareMarket and data aggregation tools like Artfi Connect. Each vertical reinforces token demand through utility, driving both liquidity and long-term value creation.

Historical Performance of Resilience and Strategic Growth

ARTFI’s journey in 2024 highlights the symbiotic relationship between the ecosystem’s growth and token stability. Platforms like Artfi ShareMarket and Artfi Curated began gaining traction, increasing engagement within the ecosystem and setting the stage for broader adoption. From its launch to its consolidation phase, the token’s performance shows the interplay of investor sentiment, partnerships, and much larger economic forces.

Launch and Early Adoption

June 17, 2024, marked ARTFI’s debut at an initial price of $0.039868, buoyed by simultaneous listings on heavyweight exchanges like KuCoin and Gate.io. The opening act was anything but quiet—early trading was a frenzy of speculative interest, sending ripples through the market.

Yet, as is often the case with new launches, the euphoria proved short-lived. Profit-taking behaviors and macroeconomic turbulence pushed the token to a local low of $0.008128 within weeks.

Recovery Phase

July 2024 saw ARTFI trading on the rebound, thanks in part to savvy strategic alliances. Collaborations with UNITY1 and CryptoWallet.com were cosmetic and reignited investor confidence and expanded the token’s utility.

The ecosystem’s reinvigoration was visible in the numbers because ARTFI climbed to $0.025 as liquidity deepened and trading surged on platforms like MEXC and Cetus Exchange.

Consolidation Period

By September 2024, the initial rollercoaster gave way to a more measured phase. ARTFI entered a consolidation period, with prices stabilizing between $0.014 and $0.02. This wasn’t stagnation; it was a sign of maturity. The speculative hype had cooled—making room for more deliberate, value-driven participation.

The market sentiment steadied, and ARTFI’s narrative evolved. No longer just the new kid on the block, the token had begun carving out its niche—a promising sign for long-term growth.

Technical Analysis and Indicators

As of December 3, 2024, ARTFI’s market dynamics paint a picture of cautious optimism. With indicators signaling potential shifts, the token finds itself at a crossroads, poised for either a breakthrough or a retest of its support levels.

Current Price and Trends

Image description: The chart above highlights ARTFI’s key technical indicators, including RSI, Moving Averages, Bollinger Bands, and critical support/resistance levels.

- Trading Price: $0.0186

- Relative Strength Index (RSI): Approximately 60.36, indicating neutral to slightly bullish momentum.

- Moving Averages: Short-term and long-term moving averages signal a “Buy,” reflecting upward price momentum.

- Bollinger Bands: A narrowing range suggests declining volatility—a classic precursor to a breakout event. Will it be to the upside or a downside correction? Time, and trading volumes, will tell.

ARTFI’s price dynamics and technical indicators, such as RSI hovering in neutral-to-bullish territory, suggest that the token is positioned for upward momentum. The undervaluation becomes particularly apparent when comparing its market cap to its fully diluted valuation, which highlights a misalignment in market perception versus potential.

Key Support and Resistance Levels

Every price movement in ARTFI’s chart echoes a tactical skirmish between buyers and sellers.

Image description: ARTFI/USDT chart shows $0.01400 support, $0.02000 resistance, Bollinger Bands for volatility, EMA for trends.

Support Levels

- $0.01400: The current floor, providing a reliable safety net.

- $0.01000: A critical psychological barrier, signaling deeper market confidence if held.

Resistance Levels

- $0.01582: The short-term exponential moving average (EMA), a tactical hurdle for bullish momentum.

- $0.02000: A historical peak post-consolidation and a target that could ignite renewed market enthusiasm.

Volume Analysis

- Liquidity Pool: The ARTFI/SUI pool on Cetus Exchange stands at $260.32, indicating a modest yet growing liquidity base.

- Average Daily Trading Volume: $95,000—a steady flow that shows consistent trader interest without overwhelming volatility.

Volume remains the lynchpin of ARTFI’s breakout potential. Increased trading activity is not just desirable; it’s essential for pushing through resistance levels and confirming bullish trends.

Despite trading volumes averaging $95,000 daily, ARTFI’s liquidity base remains modest compared to its potential market reach.

On-Chain Metrics: The Pulse of ARTFI’s Ecosystem

On-chain data reveals the heartbeat of a project. For ARTFI, these metrics highlight adoption, trust, and a carefully constructed system of incentives designed to align with community values.

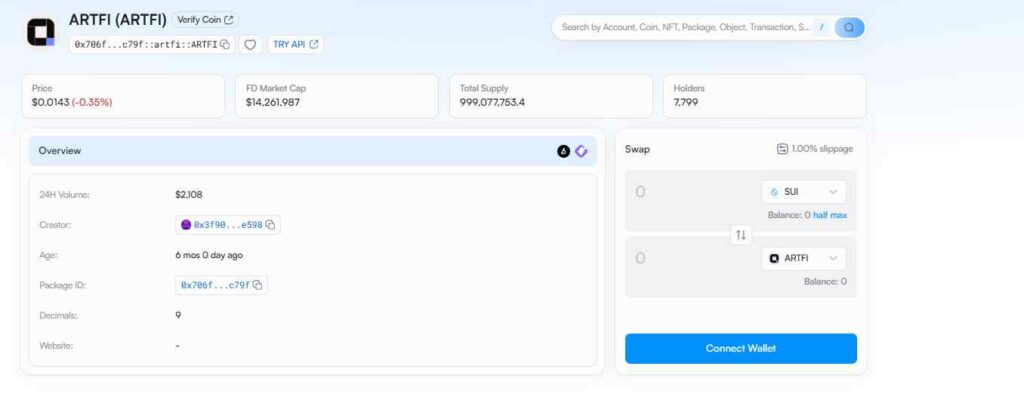

Image description: Artfi’s holders details

Wallet Distribution: Who Holds What

- Total Wallet Holders: With 7,799 wallet addresses in play, ARTFI’s adoption is steadily growing. This isn’t just a number—it’s evidence of a community gaining momentum, one wallet at a time.

- Top Wallet Concentration:

The top addresses collectively hold 15.14% of the total supply, a figure that reflects a healthy balance between distribution and influence.

Platforms like KuCoin manage 4.42% to ensure liquidity and accessibility without over-centralization.

Staking Activity: Incentivizing Commitment

Staking is an important part of ARTFI’s strategy to promote long-term holding. Active staking programs not only reduce the circulating supply but also reward participants with tangible benefits. The result? An ecosystem where holders are incentivized to think big, stay committed, and actively shape the project’s trajectory.

Revenue Transparency

ARTFI’s buyback-and-burn mechanism is an on-chain fact. Transparent and verifiable, every burn aligns with community expectations, giving a level of trust that’s rare in the industry.

Image description: ARTFI’s tokenomics and revenue distribution model

In the world of blockchain, numbers don’t lie, and ARTFI’s on-chain metrics speak volumes. From growing wallet adoption to robust staking activity and transparent revenue practices, ARTFI’s ecosystem is designed to inspire trust, foster engagement, and deliver measurable value.

ARTFI Price Prediction Analysis (2025–2030)

While exact price predictions are speculative and subject to market conditions, analyzing trends and fundamentals can provide a general outlook. ARTFI’s undervalued status provides an attractive starting point for exponential growth, particularly as market recognition grows.

ARTFI is projected to reach a minimum price of $0.0169 and a maximum price of $0.0581 by the end of 2024, with an average price of $0.0268.

2025: Adoption Peak

With anticipated mass adoption of tokenized art and increased token burns, ARTFI’s price is expected to increase by approximately 20x from the current price by the end of 2025. Price forecasts range between $0.35 and $0.45, signaling unprecedented demand for fractional ownership of tokenized art, delivering up to 2000% ROI for early investors.

2026: Early Consolidation Phase

By 2026, ARTFI is anticipated to enter a pivotal consolidation phase, a period where the market stabilizes after significant surges. Prices are expected to maintain their strength, with forecasts ranging between $0.45 and $0.60, and an average price of $0.52. This phase reflects a gradual shift from speculative trading to demand driven by real-world utility, as the platform solidifies its position in the tokenized art market.

2027: Continued Growth and Adoption

As the calendar flips to 2027, ARTFI’s trajectory is forecast to build on this strong foundation. Predictions place the token’s price between $0.60 and $0.80, with an average of $0.70—a range that reflects the ecosystem’s continued integration into the tokenized art market and broader acceptance among investors.

2028: Resurgence of Growth

In 2028, the ARTFI token is projected to experience a resurgence in growth as the platform expands its offerings and captures a larger market share. The increasing recognition of tokenized art as a viable investment class, coupled with broader blockchain adoption, is expected to contribute to price growth. A maximum price of $1.00 reflects renewed optimism and potentially larger institutional involvement in the ecosystem.

2029: Peak Potential

The year 2029 emerges as a high point for ARTFI, marking what could be its peak potential. With tokenized fine art gaining traction as a coveted asset class, ARTFI benefits from amplified liquidity and mainstream adoption. A projected maximum price of $1.20—representing substantial ROI from current levels—signals a transformative period where ARTFI’s position as a market leader in blockchain art is firmly established.

2030: Stabilized Growth

As 2030 approaches, the market shifts gears, embracing stability over exponential growth. ARTFI’s maximum price of $1.50 reflects this new era of maturity, characterized by reduced volatility and steady performance. With tokenized art now firmly accepted as a mainstream investment option, ARTFI transitions into a reliable asset within diversified crypto portfolios.

Art Meets Blockchain, and the Future Looks Bright

ARTFI isn’t just a token; it’s a movement. By blending blockchain’s transparency with the art market’s untapped potential, ARTFI’s multi-vertical ecosystem redefines innovation. From Artfi Share’s seamless ownership experience to the dynamic trading capabilities of ShareMarket, each platform contributes to a cohesive system designed for growth.

Its fractional NFTs democratize ownership, while a deflationary tokenomics model ensures long-term value creation. ARTFI’s undervalued position in the market today creates a compelling opportunity for investors.

Yes, risks remain—uncertainty is the ever-present shadow of emerging markets. But ARTFI’s fundamentals, from strategic partnerships to visionary leadership, suggest a future of sustained growth. For retail investors seeking a stake in innovation or institutions looking for a foothold in the tokenized art revolution, ARTFI stands as a compelling choice—one with a story that’s only just beginning to unfold.