Many of us believe investing in cryptocurrency is magical until we encounter a crypto crash that could become a nightmare in a lack of hawk-eye planning.

- Cryptocurrencies: The Past and Present

- Why is Crypto the Choice of New-age Investment?

- What Should You Do Now

- Invest What You Are Ready to Lose

- Book Your Principal Amount and Stay Invested in the Profits

- Diversify Your Portfolio

- Keep Your Crypto in Non-Custodial Wallet

- Understand the Crypto Rotation Cycle

- Conclusion: Surviving the Crypto Crash

A crypto crash is often referred to as a down fall in the crypto market that marks the beginning of a crypto bear market season.

There is a famous saying “What goes up, must come down” by mathematician Isaac Newton. Initially, it meant that gravity pulled every and anything back to earth. The saying holds true for the crypto market although with much greater forces.

Cryptocurrencies: The Past and Present

In its starting days, 2009 precisely, Bitcoin (BTC) was the only traded cryptocurrency. With a delay of almost 2 years, two new cryptos, Litecoin, and Namecoin joined the wagon. The second largest crypto as per its market share, Ethereum (ETH) came into existence in 2015. As per the latest records dated March 2022, more than 9000 cryptocurrencies are trading in the decentralized marketplace.

Why is Crypto the Choice of New-age Investment?

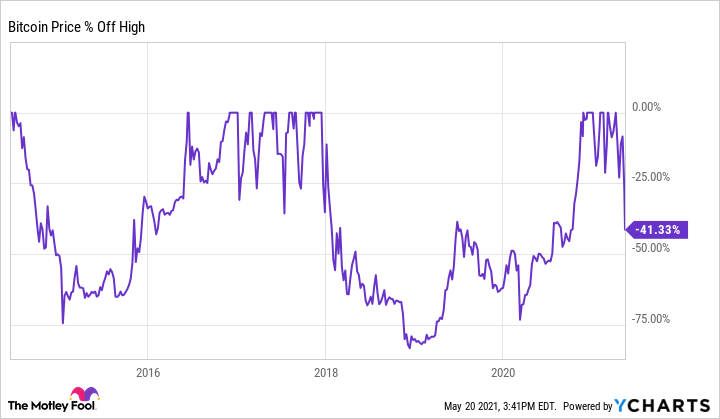

Most of the talks about cryptocurrency are BTC based and rightly so, as it is the flag bearer. The price journey of BTC is captivating. From trading at a minuscule value of $0.01 in 2010 to an all-time high (ATH) price of $69,500 in November 2021; it remains the highest-paying asset class ever.

Predicting the reversal of any bear market is nearly impossible. Yet, smart investors understand that this dip is an excellent chance to build their crypto portfolio as the fall is in response to legit geopolitical and social causes. The major reasons for the 2021-22 crypto crash are:

- A bankruptcy filing by crypto exchange FTX, forced liquidation of Three Arrows Capital on a loan default, and withdrawal freeze by Celsius Network

- Solana hack

- Announcement of plans for stringent governance of cryptocurrencies by many nations

- Rising inflation concerns and Federal Reserve’s interest rates tightening

- Investing through leveraging, resulting in panic selling

What Should You Do Now

High-interest paying schemes come with high risks. While the crypto market is still in its nascent stages, the stock market is well-established and a witness to the same. Despite a significant fall, BTC is yielding a smoking return of 196.7% since its inception (10-year CAGR).

Undoubtedly, long-term investments in the cryptocurrency have yielded bumper returns. But the returns need monetization timely before every gain turns into dust. Considering the volatility and susceptibility of the crypto market, here are 5 proven tips to protect your money during a crypto crash:

Invest What You Are Ready to Lose

To date, long-term investments in both, stock markets and cryptocurrency have proved to be beneficial. However, returns depend upon many factors such as the quality of the cryptocurrency, your entry timing, geopolitical events, etc. One bad investment is capable of wiping out all your previous gains.

As with stock markets, the cardinal crypto investing or trading rule remains the same. Always put the money you can afford to lose in the worst-case scenario. As a novice investor, you can start small or invest systematically in place of lump sum deposits.

#Bitcoin now 💪 pic.twitter.com/D5ufOM16gq

— CoinMarketCap (@CoinMarketCap) February 19, 2024A tweet showing BTC pump after years of crypto crash.

Factors such as fear of missing out (FOMO) on the price action, often force investors to buy crypto at higher valuations. This leads to massive losses during the reversal of the buy-sell cycle. As an investor, stay in control of your greed and carry out a thorough analysis before investing in cryptos to get a fair price.

Book Your Principal Amount and Stay Invested in the Profits

This is the method I prefer to follow with my portfolio. Once, I’m sitting on handsome profits, I withdraw my principal amount and stay invested in the profits earned. This approach provides me with 2 primary benefits. One, I’m officially investing risk-free. Secondly, I possess a sufficient amount to re-invest, in case the need arises.

Another proven strategy to conserve your investments is averaging out during the dips (Crypto crash). If you have successfully fought the FUD (fear, uncertainty, and doubt) during the crypto crash and did not participate in the panic selling, dips (Crypto crash) allow you to average at attractive valuations. But remember, averaging out turns out profitable for blue-chip currencies only.

Diversify Your Portfolio

Except for monumental volatile intraday movements, crypto markets follow many principles of the stock market. So, never risk your everything for the success of one venture. Evenly distribute your principal amount in significant- and mid-cap currencies and practice portfolio rebalancing as and when needed.

During a bear market, avoid investing in low caps owing to the lack of liquidity and trading exchanges and their extremely volatile nature.

Keep Your Crypto in Non-Custodial Wallet

Investing after due diligence always pays better returns. As mentioned earlier, cryptocurrency trading is still in the nascent stages and retail users need to be made aware of its key features. One of the key concepts is custodial and non-custodial wallets.

To keep your money better protected from scams and freezes, always choose a non-custodial wallet. Although they come with their risks, they give users complete control through private keys.

Understand the Crypto Rotation Cycle

Crypto rotation is as real as sector rotation in stock markets. Not all coins can outperform others all the time. Usually, the currencies in the limelight for a period undergo profit booking or consolidation before the next round of bull run.

To protect your money, you should understand these rotations and take a timely exit after the considerable bull run. You can re-invest in other promising coins based on high volumes or positive news flows.

Another defining event in the crypto market is BTC halving. After every 210,000 BTC mined (roughly every 4 years) its mining rate is cut in half. Previous halving events in 2013, -17, and -21 marked major bull runs. Although this occurrence isn’t stone-marked, there remains a possibility. Such events provide investment opportunities to new as well as re-entrants.

Conclusion: Surviving the Crypto Crash

Each bull run in a crypto market leads to a bear market (Crypto crash chart) and vice-versa. As history proves, reliable cryptocurrencies have bounced back stronger after every fall. Investing in them comes with its own set of risks. But, learning the foundation of the trade and implementing the risk-management strategies serve lucrative returns in the long run. Follow the rules strictly during your investment journey to reap unprecedented benefits.

Risk Disclaimer: Cryptocurrencies investments are subject to market risks, please consult your financial advisor before investing.