The decentralized finance (DeFi) space has been one of the most innovative sectors carved out since the introduction of cryptocurrencies in 2008. This has helped usher in several groundbreaking feats that have challenged the traditional finance sector with better interest rates, accessibility to better reward systems, and more efficiency and efficacy.

Decentralized Finance is a sector of cryptocurrency that makes it possible to conduct financial activities without the involvement of a central authority but through a peer-to-peer system. DeFi solutions and projects tackle both the centralized finance (CeFi) solutions within the cryptocurrency space and the traditional finances that are common today.

While the trends of DeFi keeps growing and gaining massive attention, we’ve compiled some of the best DeFi projects and their groundbreaking solution.

Top 8 DeFi Projects

Selecting the top DeFi project can be tricky; however, several factors were considered, including market capitalization, total value locked, volume traded on the DeFi project, and overall performance weekly and monthly. Below are some of the top DeFi Projects ins 2026:

Lido

Lido is the leading DeFi project currently. It has captured the attention of many with its innovative solutions introduced in the space. Lido is a liquid staking solution that provides users with a simple way of staking their tokens for extra rewards, adding more usefulness to users’ tokens.

Liquid staking in decentralized finance is one of the primary ways on how one can make hefty gains, Check out this article to learn more.

Unlike other regular staking solutions running on the Proof-of-stake mechanism that allows users to simply stake their tokens for a reward at an expected date, Lido takes it further by allowing users to stake expecting rewards at a specified time and making them participate in other staking opportunities. This is possible through the use of st[token]. Examples of st[token] are stSOL, stMATIC, stDOT, and stKSM.

This means while your token is staked, you can use the st[token] to be involved in other DeFi applications and protocols, like using it as collateral in DeFi lending. Another benefit of Lido is users are open to small deposits or amounts. For example, Ethereum requires a minimum of 32 Ether before being able to stake; however, this isn’t an issue with Lido.

The four main components of Lido are its staking pool, st[token], Lido DAO (decentralized autonomous organization), and Node operators.

What are decentralized autonomous organizations? Read all you need to know in this article.

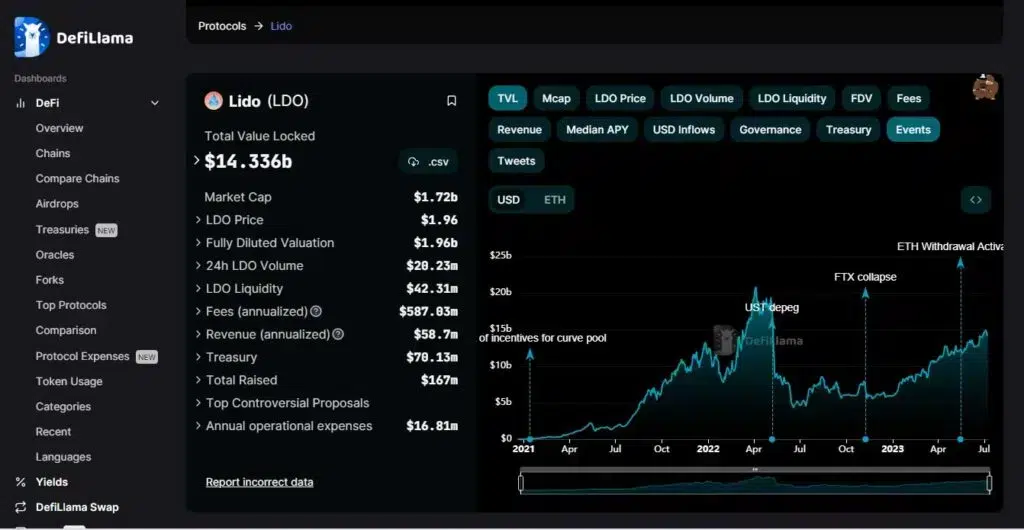

At the time of writing, Lido has a market capitalization of $1.72 billion, an annual fee of $587.03 million, an annualized revenue of $58.7 million, and an annual operation cost of $16.81 million.

So far, over $14 billion worth of tokens have been locked, a reward of over $700 million paid out, and a total stakers of 349,431. Some supported networks include Ethereum, Polygon, and Solana, offering 4.0%, 4.3%, and 5.6% in rewards.

Regarding security, Lido has a good system in position from all indications. From the multiple audits it has undergone; having a DAO that manages risk and also governs it; world-class validators with the likes of DSRV, Kiln, Stakin, and Figment to help minimize staking risk; supporting staking across multiple validators; and relying on non-custodial staking services removing counterparty risk.

In summary, with Lido, users receive liquidity, the opportunity to participate in DeFi, rely on time-proven node operators, and the benefit of governing the DAO.

MakerDao

MakerDao is one of the most innovative decentralized finance platforms launched and has garnered much attention and users onto DeFi. In plain terms, MakerDao operates a collateralized Debt Position (CDP) that allows users to lock their crypto collateral In a smart contract and receive stablecoins. This way, blistering economic activity in the crypto.

If you’re asking, why borrow a stablecoin when you have crypto? The logic is simple; it’s because some users want to hold on to the cryptocurrency for specific reasons like the possibility of a value rising over time; this way, users still have the value of the crypto and can then use the borrowed funds to explore other crypto projects.

MakerDAO introduced the concept of CDP, and it solves a significant problem. Before now, borrowing crypto for crypto was the way, and it had an inherent volatility problem, meaning the value of crypto borrowed can widely differ during repayment periods, causing borrowers to owe more. With the use of a stablecoin, the problem is solved without fearing price fluctuations.

On MakerDAO, users deposit Ether to receive a stablecoin known as DAI, created by MakerDAO itself. Users will only receive DAI if the collateral is 150% more than the DAI, which is more like an over-collateralized loan. This will cushion the effect of loss. Also, when the value of the crypto drops drastically from the value at the initial deposit, users’ positions are liquidated. So far, over 400 apps and services have linked DAI.

Several tokens are currently accepted on MakerDAO as collateral aside from Ether, including USDC stablecoin, Wrapped Bitcoin (WBTC), True USD, MANA, KNC, and other Ethereum-based crypto assets. Besides the DAI token, there is also MKR, the governance token for MakerDAO used by stakeholders to vote on important decisions about the protocol.

At the time of writing, MakerDAO has a market capitalization of $909.13 million, an annual fee and annualized revenue of $104.14 million, and annual operating expenses of $27.66 million.

Aave

Aave remains one of the most recognized decentralized autonomous organizations running a decentralized governance system that gives holders of AAVE—Aave’s native token— stakeholders right.

Before rebranding into Aave, it was formerly known as ETHLend. Aave is a DeFi protocol that provides a platform for lenders to provide liquidity into the crypto market for incentives and allows borrowers to take out overcollateralized or undercollateralized loans. With overcollateralized loans, users put down more crypto than would be collected as loans; the opposite is true for undercollateralized loans.

Aave is one platform dedicated to growth. It has seen versions of the product released over time, making upgrades on borrowing, depositing/lending, tokenization, and structural changes across its V1, V2, and V3 changes.

1/ Aave V3 is here! 👻

The most powerful version of the Aave Protocol to date, V3 brings groundbreaking new features than span from increased capital efficiency to enhanced decentralization. Read what's new in V3 in the thread below👇or visit https://t.co/H3jTyKRqNs to dive in! pic.twitter.com/LXzn7660nA

— Aave (@AaveAave) March 16, 2022So far, it has over $8.8 billion in liquidity across over 11 markets, including Ethereum, Polygon, Avalanche, Arbitrum, Optimism, Metis, Aave Arc, and Fantom.

Aave has a market capitalization of $1.132 billion and a fully diluted valuation of $1.253 billion. Aave has a treasury comprising Aave tokens—the ecosystem reserve— and treasury collectors made from the different fees. The community treasure is worth $120 million, with Aave owning 71% + of the account.

Aave is also planning on taking a similar approach to MakerDAO by launching its stablecoin GHO. According to the team, “GHO is a decentralized multi-collateral stablecoin that is fully backed, transparent, and native to the Aave Protocol.” At the moment, GHO is still in its testnet phase, which will be available on the Ethereum network after a while.

Uniswap

If you’ve ever traded on a decentralized exchange, the name uniswap should be familiar. Uniswap is a decentralized crypto-trading protocol where users can swap, earn, and build on it. This decentralized platform is built for developers, traders, and liquidity providers.

Find out more about decentralized exchanges (DEXs) in this article.

Uniswap is mainly known for its decentralized exchange built on the Ethereum network. In Uniswap, users can trade hundreds of tokens, some of which aren’t available on centralized crypto exchanges.

Uniswap has also gained recognition for introducing the automated market maker model used in its liquidity pool, where depositors put tokens to receive rewards after a certain period. Depositors in this pool are known as liquidity providers, making it possible for many transactions to take place on the chain. The platform also has three versions: Uniswap V3, that’s on six chains which are Ethereum, Arbitrum, Polygon, Optimism, BSC, and Celi, and Uniswap V2 and V1.

Uniswap has a native token known as UNI which allows holders of the token to contribute to the development and critical decisions on the protocol.

Since its inception, Uniswap has hit several metrics; the market capitalization and total value locked (TVL) sit at $4.126 and $4.101 billion, respectively. UNI token price has been trading within $5 and, at the time of writing, trades at $5.47.

Learn all you need to know about the Total Value Locked (TVL) and how it impacts DeFI projects.

Curve Finance

Curve Finance is a decentralized exchange that allows users to conveniently exchange many tokens on its platform at extremely low fees and spillage.

Curve Finance is very similar to Uniswap and runs on an automated market maker; however, its distinction is that unlike Uniswap, Curve Finance’s liquidity pool support the pairing of dollar asset like stablecoins. This is responsible for low fees, spillage, and reduced impermanent loss risks.

Check out this comprehensive guide about impermanent loss in DeFi.

Curve Finance is a liquidity pool where users stake their tokens for rewards. Although it started with stablecoins, Curve now supports other less volatile crypto assets, including wETH, hBTC, GUSD, USDK, TBT, and renBTC. These pools combine tokens like DAI, USDC, USDT, HBTC, and GUSD. So far, Curve Dex, the latest version of the protocol, is supported across twelve different blockchains: Ethereum, Arbitrum, Polygon, Optimism, Celo, Fantom, Gnosis, Avalanche, Kava, Moonbeam, Aurora, and Harmony.

Curve’s token, CRV, is the governance token that gives holders the right to make certain decisions that matter to the platform’s growth. The CRV tokens are either bought or earned as rewards from staking. As a governance token, the holder has the right to accept or decline a proposal to change or introduce some new technology to Curve Finance.

Curve Finance has accumulated a total deposit of over $3.6 billion and a daily trading volume of over $165 million. According to DeFiLama, the staked tokens on Curve Finance represents 78.07% ($556. 98 million) of the total market capitalization. The Curve Finance platform has an intuitive design, not uncommon but straightforward.

JustLend

This is another leading DeFi protocol making waves, but unlike other DeFi protocols that are mostly EVM-compatible, JustLend is solely built for the Tron blockchain.

JustLend is a decentralized lending protocol that allows users to earn interest from depositing into the pool and borrowing to pay interest. Each market on JustLend corresponds to a unique Tron asset, such as TRX, TRC20 stablecoins, and other TRC-20 compatible tokens, including USDT, USDD, BTC, BTT, SUN,

JustLend operates on a floating interest rate algorithmically determined based on the supply and demand of tron assets. This feature allows liquidity providers or lenders to earn higher during periods of high demand and borrow cheaper during periods of low demand. The interests usually change on a block-by-block basis.

Recommended read: block confirmation in cryptocurrency.

JustLend operates as a centralized community where the core teams make decisions and has planned on transitioning into giving full governance to its users, allowing them to submit proposals and even vote on proposals. This is the trade-off since users don’t have the complementary power to contribute to the future of the platform. JustLend has a native token JUST with the ticker symbol JST which is under a $0.05 at the movement.

According to data on JustLend’s sites, they’ve hit a total supply of over $3.85 billion; total borrowing peaked at $114.89 million, and a mining reward per day of $59.20 thousand.

Convex Finance

Convex Finance is a unique DeFi protocol. It’s a liquidity optimizer that allows liquidity providers and token holders of Curve Finance token CRV to earn boosted rewards. Curve Finance is a DeFi exchange on the Ethereum network that allows efficient stablecoins trading.

The process of optimizing a user’s yield works in two ways. First, rather than Curve CRV users holding them, they can stake them on Convex for cvxCRV, making them eligible for more rewards in the form of CVX tokens and a fraction of Convex Finance earnings. CVX is the native token for Convex finance.

The second option is for Curve Finance liquidity providers to deposit their LP (liquidity provider) tokens into Convex Finance, which helps boost their CRV rewards.

Another good aspect of Convex Finance is that there are no withdrawal fees, but a minimal performance fee is charged, which is used as gas and distributed to CVX holders. In simple terms, Convex Finance incentivizes users to earn more on tokens they own. Another additional way to earn is through convex liquidity mining.

Anyone can purchase CVX tokens on centralized and decentralized exchanges, including Binance, Coinbase, OKX, and KuCoin. At press time, data from DeFiLama shows that Convex Finance has a market capitalization of $322.17 million, a Total value locked (TVL), and a fully diluted valuation of $3.244 billion and $403.88 million, respectively. Convex is on three blockchains: Ethereum, Arbitrum, and Polygon.

Coinbase Wrapped Staked ETH (cbETH)

This DeFi project—Coinbase-wrapped staked ETH—was created by the centralized cryptocurrency exchange, Coinbase. However, this doesn’t hinder the decentralized nature of cbETH.

Coinbase allows users to stake and lock their Ether on its platform and users can request wrapped Ether and receive cbETH. Another way to think of it is the liquid representation of staked ETH.

cbETH is a liquid staking token that provides all benefits of staking. Users can engage in on-chain activities and trade for other cryptocurrencies. Rewards from cbETH are similar to holders’ rewards from staked ETH. Users have the liberty to convert the cbETH token for ETH anytime they want to.

cbETH was designed using the cToken model created by Compound Finance, which is an ERC-20-based standard. The total value locked of Coinbase Wrapped Stacked ETH is $2.273 billion.

Conclusion

The above mentioned top 8 defi projects are examples of several innovative DeFi projects that are gradually coming into the space. So far, in 2026, these are the top DeFi project as of 2026. It’s essential to explore these projects before investing in them, identify the pros and cons and weigh them based on an existing standard. Beyond these projects, other DeFi projects are thriving as well.