Investors and traders in the nascent cryptocurrency sector have experienced both euphoric bull markets and gloomy bear markets. There have been several projects that have failed, but there have also been some that have endured the test of time. Due to the cryptocurrency market’s expansion during this period, many projects have emerged and are now competing for market share. To determine a project’s market value, ethos, and long-term viability and strength, it is essential to use a strategic fundamental analysis approach before investing in any particular cryptocurrency project.

Understanding what one is investing in is a prerequisite. Fundamental analysis helps identify strong projects and their intrinsic value. From analyzing on-chain metrics to determining the project’s use cases, a mix of quantitative and qualitative factors is used when conducting fundamental analysis.

Understanding Crypto Fundamental Analysis

Fundamental Analysis (FA), at its core, enables investors to gauge an asset’s intrinsic value by analyzing its metrics and proposition using publicly available data about a project. The primary objective of FA is to discover whether an asset is undervalued or overvalued.

Unlike Technical Analysis (TA), whereby traders or investors study charts and historical trading data to predict future price movements and trends, FA focuses on a more long-term time horizon. Thus, it is generally thought that longer-term investors would benefit most from this type of analysis.

DYOR, or Do Your Own Research, is a common adage in the cryptosphere. This assertion, however, holds true for investing in any financial asset. Traders and investors have used FA for decades in traditional financial markets, such as the stock markets. It has been used to assess the worth of an asset, company, or stock and determine whether it makes sense to buy or sell the asset. However, the FA metrics used in the crypto world are very different from the evaluation metrics used in conventional financial markets.

Traditional business metrics to evaluate a stock’s intrinsic value, such as earnings per share (EPS) or the price-to-earnings ratio (PE ratio), do not apply to the crypto sector. The information flow for fundamental analysts is different due to the decentralized nature of cryptocurrencies.

Cryptocurrency is notorious for being a highly volatile sector. To reduce risk and become well-rounded investors, individuals must grasp fundamental analysis techniques and comprehend the unique metrics that apply to the crypto space. The following section explores three well-known crypto-specific FA indicators and metrics categories that aid both novice and experienced traders in making sound investment decisions.

On-chain Metrics

Cryptocurrency’s underlying technology, blockchain, enables secure and verifiable record-keeping of all digital transactions. Transparency is a critical feature of blockchain technology that aids in promoting trust and accountability in the system. On-chain metrics, also known as blockchain metrics, refer to the capability for users to view and independently verify all transactions stored on a blockchain network. On-chain transparency eliminates the need for intermediaries or trusted third parties by enabling anyone to view the entire history of transactions on a specific blockchain network, including metrics like the number of transactions and active addresses.

Do you ever feel one step behind the crypto market?

On-chain analysis could be the answer. Everyone’s heard of it, but few are experts

On-chain analysis is one of the best sources of alpha.

Here’s you’re intro guide 🧵

— Pothu (@cryptoPothu) June 9, 2022On-chain metrics are critical indicators for investors to gauge a project’s strength, popularity, and long-term trajectory. There are a plethora of online platforms that provide detailed on-chain indicators for investors. Some popular websites include Glassnode, Messari, CryptoQuant, and IntoTheBlock. Some of the most popular on-chain metrics to consider examining are as follows.

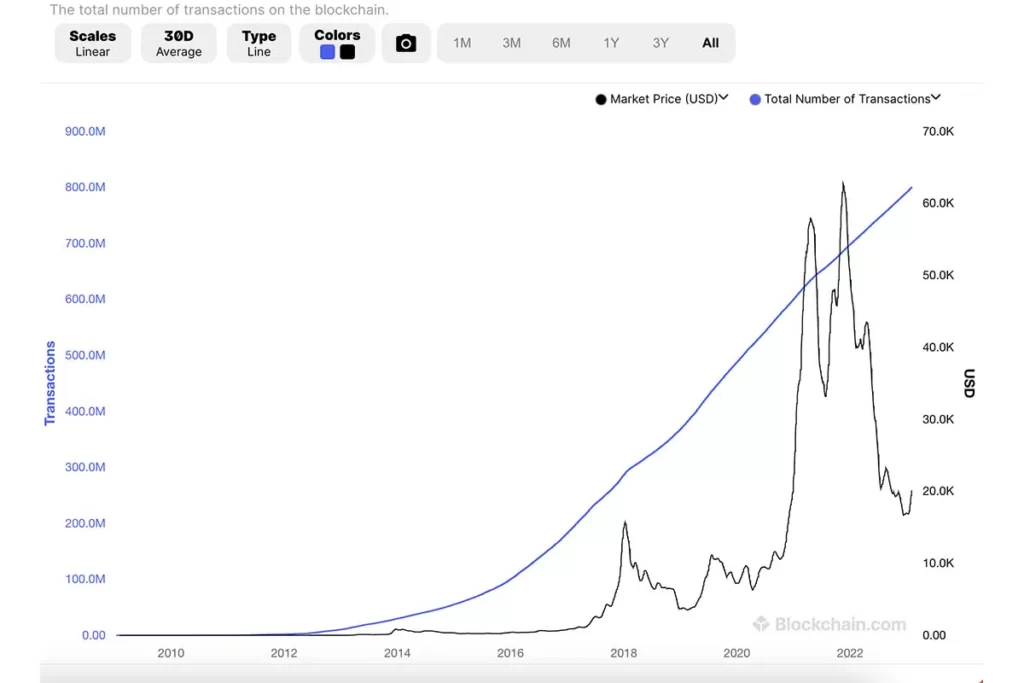

Number of Transactions

An important metric for assessing the usage and adoption of a cryptocurrency or project is the number of transactions on its blockchain network. A large number of transactions suggests that many users are actively interacting with the network. Furthermore, a cryptocurrency’s overall health and potential for growth are frequently indicated by projects that show a high volume of transactions on an upward linear trajectory.

Transaction Value and Fees

Investors can determine the financial health and level of crypto asset adoption by looking at the transaction value and fees. The transaction value is an indicator of the level of economic activity occurring on the network because it represents the total value of all transactions processed on the network. The transaction fees are the price of processing these transactions, indicating the demand for the network’s resources.

Higher transaction values and fees indicate high demand. On the other hand, low transaction value may imply lower adoption and usage. It also helps to determine which blockchain networks are used more frequently by comparing the transaction value and fees across various blockchain networks.

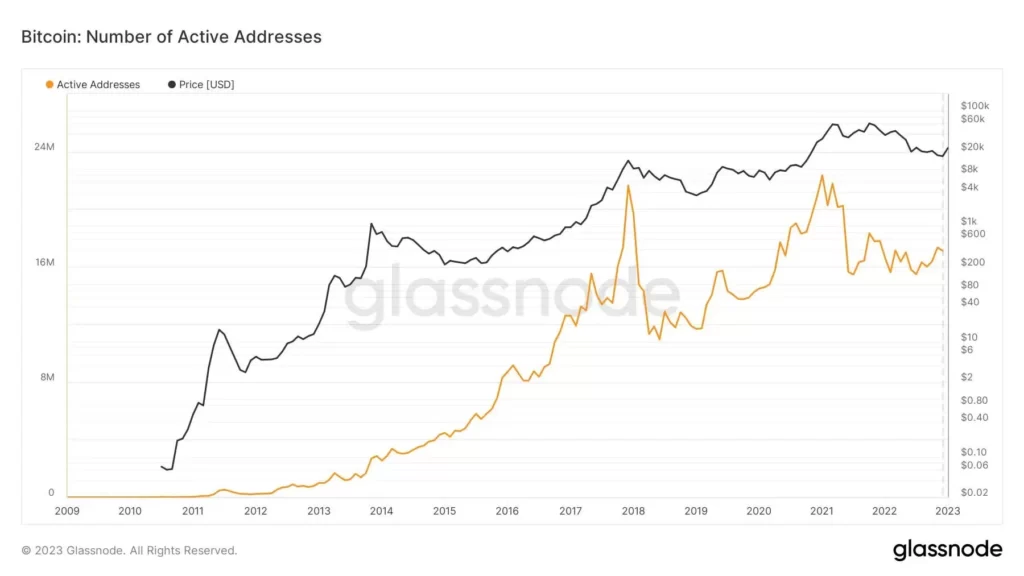

Active Addresses

A solid crypto fundamental analysis technique is to identify the number of active addresses. An active address is a unique address that has completed a network transaction within a predetermined amount of time. Therefore, an increase in active addresses clearly indicates adoption and growth. Additionally, a high adoption rate coupled with a low valuation are typically signs of an undervalued asset.

Monitoring this metric on a systematic basis provides valuable insights into a crypto project’s adoption curve and overall sentiment surrounding the project.

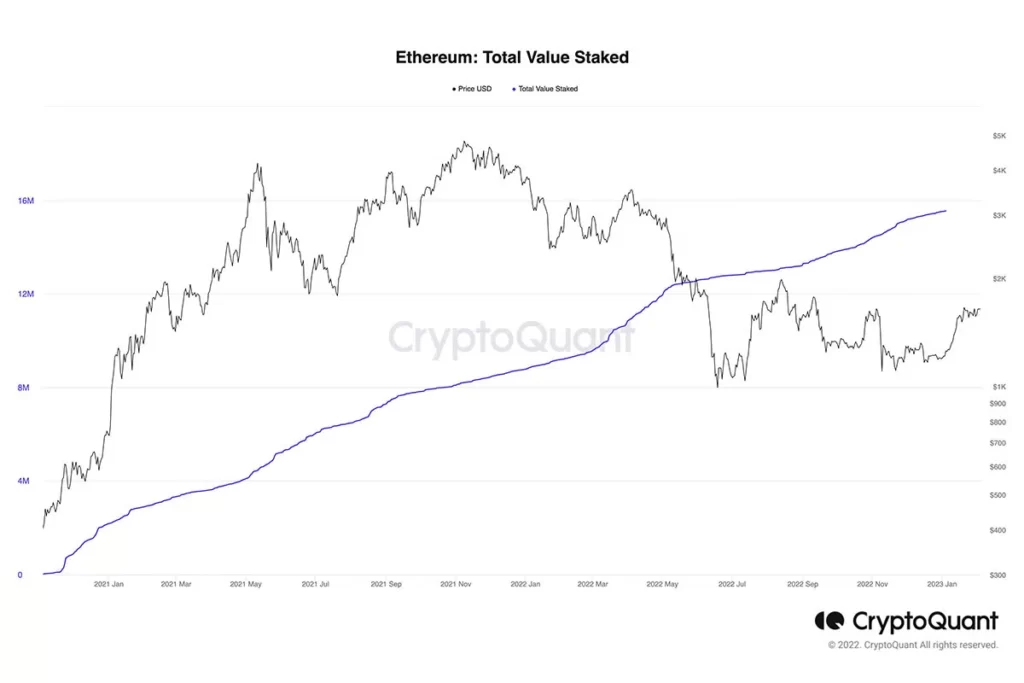

Hash Rate and Staking

Numerous consensus algorithms are used by blockchains today, each with unique mechanisms. Since consensus mechanisms play a crucial role in securing networks, exploring the data surrounding them is a helpful fundamental analysis strategy.

Analyzing the hash rate data in Proof of Work (PoW) cryptocurrencies, like Bitcoin, is a valuable strategy for evaluating a project’s network usage and security. Typically, higher hash rates indicate a more secure network as more miners join the network, thereby making it more decentralized.

The number of staked tokens is a crucial indicator for Proof of Stake (PoS) cryptocurrencies like Ethereum. This is because the network in PoS chains uses staked tokens to validate blocks. A more significant number of staked tokens, therefore, indicates the popularity and security of the blockchain.

Financial Metrics

Understanding the financial metrics of a crypto project is another critical component of fundamental analysis. Financial metrics refer to the quantitative numbers or data behind a crypto project, assessing the asset’s liquidity profile and supply mechanisms to make informed investment decisions.

Platforms such as CoinMarketCap and Coingecko allow users to conduct research on a project’s financial metrics with ease.

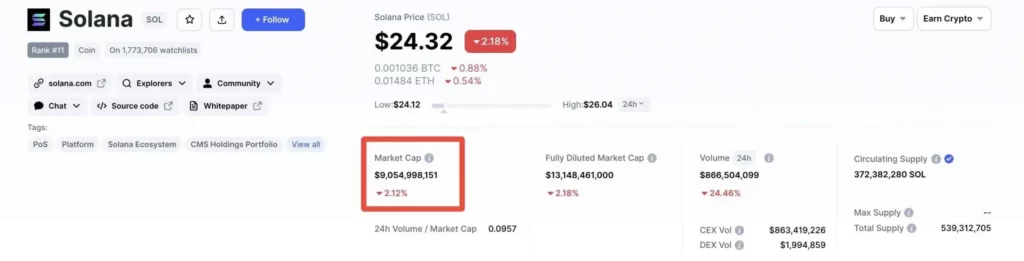

Market Capitalization

Market capitalization, also known as market cap, is a crucial financial metric to assess when conducting a fundamental analysis of a particular crypto asset. A project’s market capitalization estimates a project’s overall size and value. The market cap of a project is determined by multiplying the total supply of coins in circulation and the current price per token. Market capitalization helps to gauge a project’s popularity and demand, as well as its relative size with other cryptocurrencies.

Small or micro-cap altcoins are typically seen as having more room for growth, whereas a project with a higher market cap is frequently considered to be more established and secure. Therefore, analyzing a project’s market cap is critical for investors when deciding where to allocate their resources and capital. However, it is vital to note that market cap is just one of many financial metrics used in fundamental analysis. Therefore, for investors to arrive at a well-rounded thesis on a project’s potential and risk, this metric must be analyzed in conjunction with other indicators.

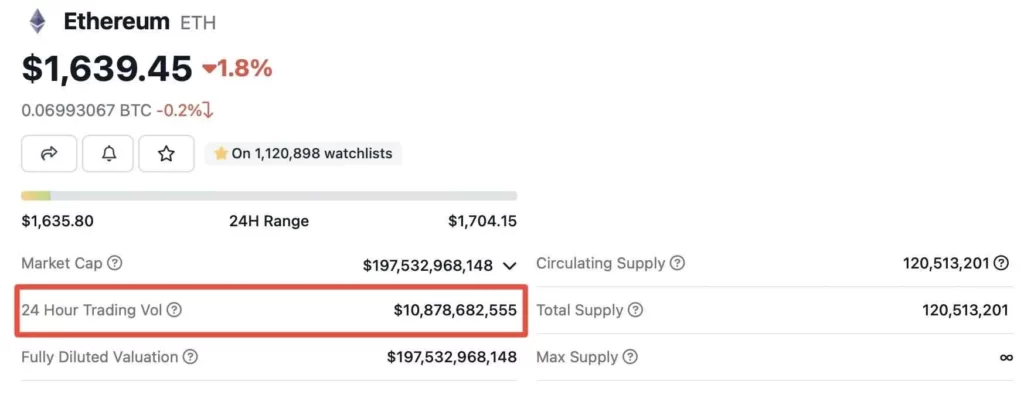

Trading Volume and Liquidity

Another vital sign of the market’s interest in a potential investment is the cryptocurrency’s daily or 24-hour trading volume and liquidity. An asset’s trading volume reveals the total value of all purchases and sales made of that asset over a specific period. A successful project often accompanies a consistently high trading volume.

Furthermore, a high trading volume indicates a high degree of liquidity because it indicates that many buyers and sellers are actively engaged in the market. The quantity of exchange listings is another sign of a project’s high liquidity. Since there are more opportunities for buyers and sellers to participate in the market when a cryptocurrency is listed on more exchanges, its liquidity rises as a result.

Tokenomics and Supply

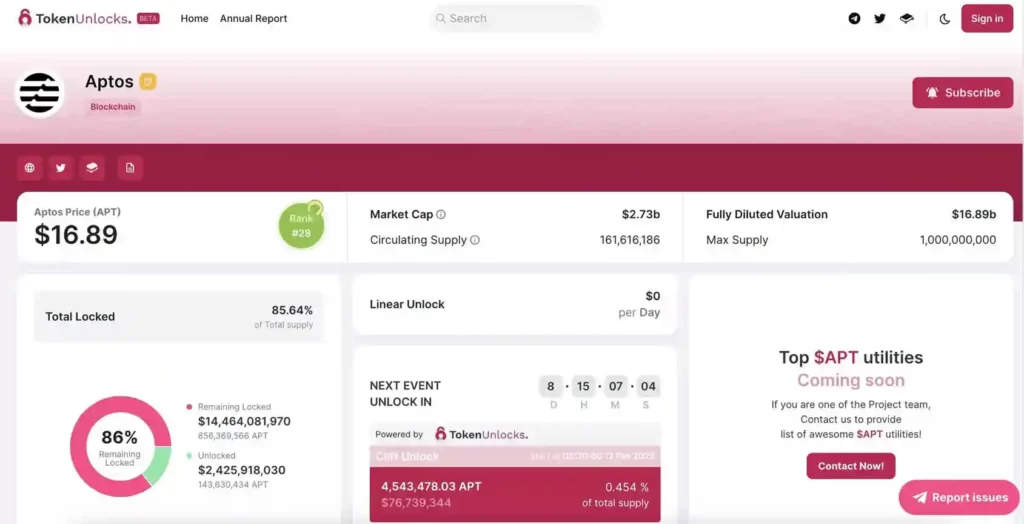

Before investing in a cryptocurrency project, it’s crucial to research the token design or tokenomics and its supply mechanisms. This entails looking at the maximum supply of a cryptocurrency project along with the current circulating supply, vesting schedules, and token unlocks.

After months or even years of lockup, many cryptocurrency projects have token unlock schedules that allow seed investors to access their tokens. This frequently increases the selling pressure on the market and can result in sizeable price corrections.

Given that supply factors like vesting periods have a significant impact on a cryptocurrency’s valuation and performance, it is crucial to take them into account. A token analytics platform, Token Unlocks, gives investors valuable information on upcoming token unlock events for specific crypto projects.

Project Metrics

Analyzing project metrics is the third and essential category to consider when performing fundamental analysis in the crypto space. This is distinct from on-chain and financial metrics because it employs a qualitative method to assess a cryptocurrency’s performance. This entails examining the project’s use cases and roadmap through its whitepaper, evaluating the project’s team, and conducting a competitive analysis.

Whitepaper

A crypto whitepaper is a comprehensive technical document that outlines a project’s goals, objectives, and technology. Analyzing a project’s whitepaper is foundational in understanding the problem a project aims to solve, the development roadmap and future potential, information about the team, and token economics.

Investors can track a cryptocurrency project’s development with the help of its whitepaper. Investors can determine whether a project is on track to achieve its desired goals by analyzing the project roadmap in the document and comparing it to the established timelines.

Therefore, an essential aspect of fundamental analysis is examining a crypto project’s whitepaper. A missing or poorly written whitepaper is a clear red flag in the crypto community. On the other hand, credible projects have whitepapers that are easy to follow and are found on their official websites or platforms like CoinMarketCap.

Background Analysis

The team behind a cryptocurrency project should be thoroughly investigated as part of a fundamental analysis. Detailed information about the team members, including their backgrounds, track records, and prior experience, is frequently provided by credible projects. A project’s likelihood of success can be determined by looking for a project that has a team of dependable individuals with a long history of success in the sector.

Comparing Competition

Investors must conduct a competitive analysis to understand how a particular crypto project fits into the larger ecosystem of the crypto market. This entails evaluating a potential project’s adoption curve and market position compared to similar projects that offer comparable features, technologies, or use cases. By assessing competitors’ strengths and weaknesses, investors can better understand the likelihood of a project’s long-term success.

Closing Thoughts

The importance of understanding fundamental analysis among crypto enthusiasts is gaining traction. Influencers and industry experts across the cryptosphere reiterate the need for thorough fundamental analysis to maximize returns while minimizing risk in the ever-changing crypto landscape.

Fundamental analysis lets investors assess the potential and risks of investing in a specific cryptocurrency. As a result, individuals can make well-informed investment decisions based on a deeper understanding of the crypto world. This can be done by leveraging the transparency provided by blockchain technology, utilizing the plethora of online resources, and by evaluating key project metrics that affect the success of a crypto project.