What’s the point of stablecoins? Imagine you’re going on a vacation to another country and you want to make sure the money you take will have the same value and won’t change in price while you’re there. You wouldn’t want to carry Rs.100 in your wallet if it went from Rs. 50 to Rs.70 to Rs. 95 throughout the day, right? You need the best flexible solution, which is stablecoins.

Stablecoin is a financial instrument that maintains a stable value by being pegged (linked) to another asset category, like a fiat currency or gold metal or even algorithms.

Understanding the Usage of Stablecoins

Cryptocurrencies are meant to serve a number of benefits such as exclusion of intermediaries during payments, a store pof value as well as as medium of exchange. However, popular crypto like Bitcoin and Ether are not a preferred medium of exchange due to their drastic volatility.

The smaller a market capital of any asset, the more volatile its price will be in the open market (which is the case of cryptocurrencies). Thus, it is hard to enjoy the benefits of Bitcoin (or any other cryptocurrency) for day-to-day transactions when day it’s worth an X amount and the other day it is half of X.

This is where stablecoins interject in the crypto ecosystem. Stablecoins essentially are cryptocurrencies with minimal volatility, they are pegged to an asset, which is either fiat money, exchange-traded commodities, or another cryptocurrency.

For example, the crypto stablecoin Tether or USDT are worth 1 US Dollar and are expected to follow the 1:1 ratio with USD.

You must be wondering how did cryptocurrency and fiat joined hands? Well, stablecoins are a form of F2C vehicle. F2C vehicles were created to provide a stable financial instrument, to be exchanged between parties in the digital world, without volatility.

In short, F2C vehicles like stablecoins provide use cases ranging from

- Reduction in transactions cost

- Increase in speed of execution

- Extension of operating hours

- Instant settlement without the need for a settler (like banks)

- Facilitate retail crypto trading

- Support DeFi through liquidity for exchanges and leveraged borrowing

Talking more about stablecoins – they are blockchain-based coins that can be managed through centralized or decentralized exchanges. So, this means – send your money directly to a friend or transact without any middlemen – making transactions faster and cheaper.

The image below displays the use cases of stablecoins during payments.

While it is true that crypto has the potential for higher returns and losses over a short period of time, it is also true that it is a volatile asset class. Thus to know some of the factors affecting these price swings, check out the article below:

Recommended read: Why Is the Crypto Market Volatile? 5 Factors Affecting Price Swings

How Do Stablecoins Work?

Stablecoins were initially introduced in 2014, but became a household name by mid-2022 when two of the four largest crypto assets in terms of market capitalization were stablecoins. It was Tether USD (USDT) which was the largest stablecoin and also had the highest average daily trading volume surpassing even Bitcoin.

While our understanding maybe considering Bitcoin synonymous to other cryptocurrencies (altcoins), the concept of Bitcoin dominance disagrees.

Stablecoins like USDT, Dai, USD Coin have become essential in crypto markets, and are backed by different approaches such as traditional assets or cryptocurrencies. But before we get into that in more detail, let’s know how do stablecoins work and maintain their peg?

As we discussed earlier that most stablecoins are pegged to the value of either a specific fiat currency such as United States dollar or commodities like gold. It means – their price is fixed. So one stablecoin tracking, say, USD, should be worth 1 USD.

Now, they work similar to other cryptocurrencies i.e. they are minted on a blockchain. Users can buy, sell and trade on any exchange. You can store them in hot/cold wallets like any altcoin.

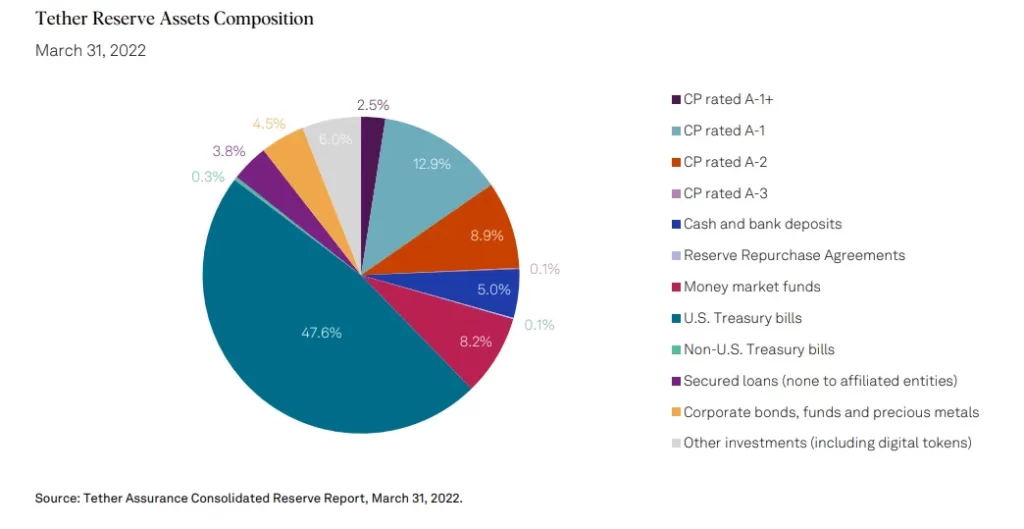

What’s different is – most stablecoins are linked to a reserve of external assets of some kind (it can be a stash of fiat, gold, debt instruments) for maintaining integrity. This means, a stablecoin is backed 1:1 if there are assets worth an equal amount supporting it for every stablecoin in circulation.

However, if the value of stabecoins like USDT (backed by US Dollar) fluctuates dramatically in either direction of 1:1, traders hoping to benefit from the price difference will come in to narrow the gap.

What Are the Different Types of Stablecoins?

The extreme fluctuations in the world of crypto have led to a rise in the popularity of stablecoins. And now that you have understood, in brief, about how stablecoins work, it is time to understand their types. Types, you ask. Yes, there are different types of stablecoins to check on the volatility caused by crypto market.

Usually, stablecoins can be identified by their underlying collateral structures, which fall into four distinct categories.

Fiat-backed stablecoins:

Fiat-backed or fiat-collateralized stablecoins are the simplest and have a 1:1 backing of a fiat currency. These stablecoins has real fiat currency for backing it up so that the entity managing them can maintain a reserve for all the stablecoins in circulation.

USDT (backed by the US Dollar) is the most popular example of a fiat-backed stablecoin. Tether offers different coins tied to popular fiat currencies – USD, EUR, CNH etc.

Source: S&P Global Ratings

Commodity-backed stablecoins:

Commodity-backed stablecoins are the ones that have the backing of different types of interchangeable assets – such as precious metals (gold or silver). It is also called tokenization of physical assets. It can be hard to categorize them as such but one such example of a commodity-backed stabelcoin is the ERC-20 token on Ethereum blockchain Digix Gold (DGX) stablecoin. One DGX is pegged against one gram of gold.

Cryptocurrency backed stablecoins:

The irony of crypto-backed stablecoins has not missed me but these stablecoins do exist and offer decentralization and improved liquidity. So, yes, crypto-collateralized stablecoins use other cryptocurrencies such as Ethereum as collateral. MakerDao’s DAI stablecoin backed Ethereum is an example of a cryptocurrency backed stablecoin.

MakerDAO is a decentralized organization, made up of a smart contract service that manages lending and borrowing of cryptocurrencies without a middleman. It is part of the “DeFi” movement. If you want to know more about DAOs like these, check out the article below:

Recommended read: DAOs Contribution in Expanding the Crypto Community

Algorithmic stablecoins:

Algo-backed stablecoins are not collateralized by “real-world” cash or cryptocurrencies. Algorithmic stablecoins follow an algorithm for controlling the stablecoin supply, offering stability according to maket supply and demand. The excessive trial and error in bringing algo stablecoins to successful functioning in crypto ecosystem produces Terra’s UST stablecoin failure.

Stabecoins: TL;DR

We have discussed that –

- Stablecoins are cryptocurrencies tied to stable assets, usually fiat currencies.

- However, there are existing stablecoins that are either backed by a commodity, a cryptocurrency or follow an algorithm.

- Most of the stablecoins in circulation are backed against a reserve of fiat or other commodities.

- This type of reserve serves as a collateral for the stablecoin, meaning whenever a holder cashes out, an equal amount of the asset is taken from the reserve.

Regulatory Challenges of Stablecoins

Stablecoin are expected to meet the same criteria as traditional payment systems (i.e. same activities, same risks, same regulations) so as to ensure they are operating safely and in line with regulatory objectives. And, we certainly know that having a clear and transparent legal basis is the core of payment, clearing and settlement arrangements throughout the globe.

Earlier we briefly discussed about F2C instruments. CBDC is essentially another F2C instrument like stablecoin, except in the case of CBDC, the stability is based on the central bank’s backing. It is a digital version of fiat currency issued by central bank.

According to a report by Bank for International Settlements (BIS) on “Investigating the impact of global stablecoins”, it defines CBDC as –

CBDC is a “digital form of central bank money that is different from balances in traditional reserve or settlement accounts”.

It is important to note that stablecoins are under scrutiny by regulators due to their rapid growth and potential to affect the broader financial system.

Additionally, in a May 2021 press release, the Federal Reserve announced plans to research its own Central Bank Digital Currency (CBDC), which indicates a potential transformation for e-commerce.

The U.S. SEC also relies on the Howey analysis – which refers to a framework for determining if an arrangement is an “investment contract” under the Securities Act, 1933. It is thus a possibility that the SEC may argue that a stablecoin backed by real-world assets is covered under similar securities.

You may read this DroomDroom’s article on the SEC’s Approach to Cryptocurrency.

Conclusion

There is no doubt that the world of stablecoins is about to undergo radical transformation and naturally, there are likely to be different responses to this development within the broader ecosystem of 16,000+ cryptocurrencies. The article also clearly showcases the various ways in which stablecoins are collateralized. The four distinct types of collateral used for stablecoins define their types, such as fiat-backed, commodity-backed, crypto-backed, and algorithmic stablecoins.