The rise of Non-custodial wallets is due to the necessity of higher quality security standards for cryptocurrency users. These wallets underscore the ethos of decentralization by giving back ownership and control to users.

- What is a Non-Custodial Wallet?

- The Rise of Non-Custodial Wallets and their Significance in the Crypto Industry

- Types of Non-Custodial Wallets

- Non-Custodial vs Custodial

- Are Non-custodial Wallets Safe?

- How do you Choose a Good Non-Custodial Wallet?

- The Future of Non-Custodial Wallets

- Conclusion

Using a non-custodial wallet enables you to wield full control over your private keys, which are integral to your cryptocurrency and serve as proof of ownership. Opting for a non-custodial wallet eliminates reliance on third parties but necessitates diligent private key management and sound measures to secure your funds.

In this blog post, we will discuss the rise of non-custodial wallets and their role in enhancing user autonomy.

A custodial wallet involves a third party managing your private keys. This implies entrusting the protection of your digital assets to an external entity, which will subsequently return them to you upon readiness for trading or transfer. Although a custodial wallet spares you from assuming complete ownership of your cryptocurrency, it mandates placing trust in the cryptocurrency exchange, which acts as the custodian.

As the prevalence of cryptocurrency ownership continues to rise, individuals must consider secure management of their digital assets. Opting for a cryptocurrency wallet is one of the safest approaches for storing your digital assets.

The rise of non-custodial wallets has also ensured crypto users gain both safety and control of their funds.

Each wallet contains a private key, a cryptographic code granting access to spend the funds within the wallet and serving as proof of ownership. The storage of wallet information offline adds an extra layer of security, mitigating the risk of potential hacking attempts.

While such security features are fine for everyday, non-technical cryptocurrency users, they accompany a trade-off regarding user experience.

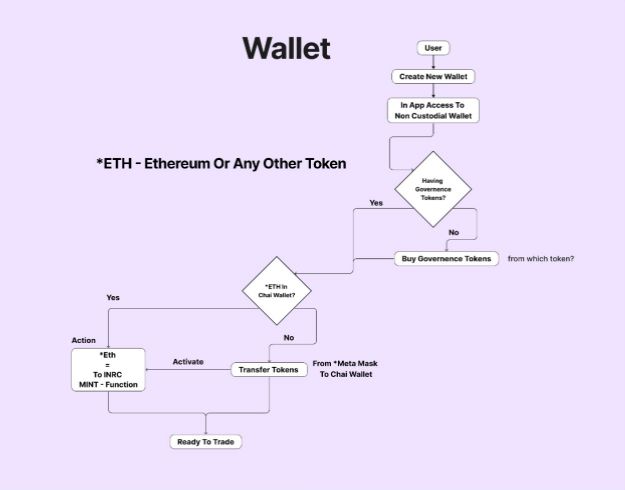

ChaiDEX, a decentralized P2P exchange, and its native wallet, ChaiWallet, have implemented noncustodial solutions to eliminate 3rd party involvement in managing crypto funds.

What is a Non-Custodial Wallet?

A non-custodial wallet is also referred to as a self-custodial wallet. Such a wallet gives you full authority, ownership, and control of your crypto wallet and assets. A self-custodial wallet also offers complete control of public and private keys. These are privileges you can only dream about when using a custodial wallet. With wallet users able to maintain exclusive control over their keys rather, they do not need to rely on 3rd party services such as a centralized exchange.

When utilizing a non-custodial wallet, the responsibility for securing private keys and the wallet rests solely on the user. This decentralized approach resists censorship, as the owner governs access, diverging from the control exerted by host platforms in custodial wallets. This independence from third parties allows owners to safeguard their assets from potential seizure by directly accessing their blockchain address. Besides, independence from 3rd parties is one of the greatest benefits of the rise of non-custodial wallets.

Why You Need a Self-Custodial Wallet Instead of a Custodial Option

Custodial wallets pose substantial risks to crypto holders by exposing funds to potential loss if someone compromises the security/financial stability of the custodian platform.

A stark example is the sudden collapse of the cryptocurrency lending service Celsius Network. The service managed tens of billions of dollars worth of investor funds before abruptly suspending depositor withdrawals. This incident triggered a domino effect, with other crypto lending platforms facing similar struggles, resulting in substantial financial losses for crypto investors.

Moreover, experts have critized custodial wallets for fostering centralization in DEFI, contradicting the decentralized ethos of the cryptocurrency space. Holders relying on custodial wallets may find themselves at odds with both the custodian and government agencies overseeing their operations, putting their crypto assets at risk of seizure. Besides, custodians could often be subject to Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, raising concerns among crypto purists about potential breaches of user privacy.

Some custodial providers have also imposed fees that may erode individual trading profit. Hence, making a self-custodial wallet preferable among those seeking greater control, high-profit margins, security, and adherence to the principles of Web3 in trading. Notably, the demand for control was one of the driving factors behind the rise of non-custodial wallets.

The Rise of Non-Custodial Wallets and their Significance in the Crypto Industry

For crypto purists who want to liberate themselves from the influence of centralized entities, non-custodial wallets come with great advantages by offering unparalleled user control. Nnon-custodial wallets are not susceptible to a single point of failure in case one part of an entity fails. Also, a centralized entity cannot seize or freeze funds on a self-custodial wallet.

With no KYC restraints, individuals anywhere in the world connected to the internet can effortlessly set up a wallet, fostering inclusivity and accessibility. Thereby, facilitating seamless transfer of cryptocurrency funds. This direct interaction grants them unique access to the expanding Decentralized Finance (DeFi) ecosystem, a distinct advantage that is not available on a custodial wallet.

Types of Non-Custodial Wallets

Software Non-Custodial Wallets

Software non-custodial wallets are applications that can be installed on your computer or mobile phone or accessed through a web portal. These wallet types often store private keys within their interface. Accessing this interface is only possible via an internet connection.

The hot storage of private keys on the internet allows convenient access. A good example of a noncustodial hot storage wallet is the Chai Wallet.

Hardware Wallets

Hardware wallets are cryptographic wallets that store private keys offline in a physically secure device not connected to the internet. To access your cryptocurrency holdings, you must plug the hardware device into your computer. The offline nature of private key storage enhances security by minimizing exposure to online threats. Examples of hardware wallets include Stax, Nano X, and Nano S Plus.

Paper Wallets

Paper wallets allow you to store private keys offline by printing the information, including private keys and QR codes, on a physical document. This offline storage method is considered highly secure, as the paper wallet remains completely disconnected from the internet. However, the durability of paper as a storage medium is a potential drawback. A different cryptocurrency wallet app capable of reading the QR code is needed to access your assets. While paper wallets offer enhanced security, their limited durability makes them less common as a storage option.

Non-Custodial vs Custodial

A cryptocurrency wallet must fall into one of two major categories: custodial and noncustodial. Each wallet type depends on who owns the keys. The “not my keys, not my crypto” must have been one of the defining slogans in the rise of non-custodial wallets. this section, we will compare the two and their distinct benefits.

Account Creation

The ease of creating a wallet account significantly impacts the user experience. Custodial wallets require mandatory KYC and AML procedures for robust security, a procedure that consumes alot of time. In contrast, the rise of non-custodial wallets has provided a faster and more flexible account creation process. Thereby maintaining user anonymity.

Access to Funds

Fund accessibility distinguishes custodial and non-custodial wallets. A third party can access every detail of your funds and private keys in a custodial wallet. You retain complete authority over your funds and keys in a non-custodial wallet.

While custodial wallets may relieve you of safeguarding responsibilities, they come with associated risks. On the other hand, non-custodial wallets are adept at data restoration and backup.

Security

Security is one of the many aspects that have given birth to the rise of non-custodial wallets.

Safety is a paramount consideration when choosing a crypto wallet. Custodial wallets ensure security through robust and unique authentication procedures, offering a safe haven for your assets and your data. However, they require a strong internet connection. In custodial wallets, keys are kept confidential, mitigating the risk of unauthorized access.

In non-custodial wallets, security is approached differently. While they may not require a constant internet connection, they place the onus on users to uphold the safety of their private keys. The advantage lies in users’ complete control over their keys, reducing the risk of unauthorized access. However, this control demands users to be vigilant and proactive in securing their assets.

Are Non-custodial Wallets Safe?

The rise of non-custodial wallets and their rapid evolution has made them user-friendly over time. Wallet providers have implemented features to enhance user experience and reduce the likelihood of errors during transactions.

For instance, custodial and noncustodial wallets often remind users to double-check destination addresses, minimizing the risk of lost funds. Some wallets even offer a convenient option to automatically copy an address with the click of a button, further decreasing the chances of mistakes in the transfer process.

Other Solutions go a step further by allowing users to set usernames during wallet creation. This simplifies the process of sending and receiving crypto, as usernames are easier to remember, reducing errors in fund transfers. Additionally, users can choose to make their wallets public or private, providing flexibility in managing their profile within the wallet ecosystem.

Transaction fees are another aspect that impacts user experience. Many crypto wallets preset transaction fees at a medium level to balance between lower fees (resulting in longer transaction times) and higher fees (ensuring faster speeds). This approach allows users to send transactions with average processing times.

However, it’s worth noting that sending tokens with a noncustodial wallet can still be challenging or frustrating for the average, non-technical user.

Custodial wallets are more convenient when making regular token transactions than noncustodial ones. Conversely, the rise of non-custodial wallets has led to the acceptance of self-custody as the superior choice for long-term storage and secure asset preservation, provided the user diligently safeguards their seed phrase.

How do you Choose a Good Non-Custodial Wallet?

Why Does the Wallet you Choose Matter?

The choice of your wallet plays a crucial role in determining your assets’ safety, ease of interaction with the blockchain, and, ultimately, financial autonomy and success.

While there are a few advantages with custodial wallets, achieving true financial sovereignty requires access to the recovery phase of your wallet. Even with a reputable custodial wallet, there are evident drawbacks, including transaction delays when the need arises to sell or lend your crypto assets quickly.

Moreover, custodial wallets have inherent security, privacy, and management risks, emphasizing the pivotal disruption that came with the rise of non-custodial wallets like Chai Wallet.

Choosing the Right Non-Custodial Wallet

Cost

Fees and transaction costs are crucial when selecting a wallet, as they can impact your overall cost and speed.

Some wallets may impose high transaction fees, while others offer lower fees at the trade-off of longer confirmation times. If you are in it for the long run, seeking a wallet that minimizes fees without compromising transaction speed and confirmation times is advisable.

Striking a balance between speed and cost is essential, and some wallets, like Valora, built on the Celo blockchain, aim to provide the best of both worlds. With gas fees as low as $0.001 and near-instant transactions, such wallets offer a cost-effective and efficient solution for users seeking both affordability and quick transaction processing.

Reputation

Reputation is a subjective yet crucial factor to consider when selecting a wallet for your cryptocurrency journey.

To gauge the reputation of a wallet, delve into user reviews, assess the frequency of updates and maintenance, scrutinize the development team, and evaluate the wallet’s longevity. These factors collectively contribute to a wallet’s genuine reputation and track record.

By considering the experiences and feedback of other users, staying informed about ongoing developments, and verifying the credibility of the wallet’s team, you can make an informed decision about the reputation and reliability of the wallet you choose. A strong reputation often reflects a commitment to security, user satisfaction, and the overall success of the wallet in the dynamic landscape of digital assets.

Speed

The speed of transactions is a significant factor influenced by the native blockchain’s network capacity and the size of transactions. Although these external factors play a role, the speed of your wallet is still an essential consideration, given the considerable variation from one wallet to another.

Confirmation times and transaction speeds are pivotal in determining how swiftly you can send and receive funds. This makes them critical aspects of your wallet’s overall performance. When selecting a wallet, it’s worthwhile to factor in transaction speed, especially if quick and efficient fund transfers align with your preferences and usage patterns.

Hot or Cold Storage

The choice between hot and cold storage is one of the advantages of the rise of non-custodial wallets, allowing users to tailor their security preferences.

Hot storage keeps your device connected to the internet, enabling you to buy, sell, trade, and interact with apps and Web3 applications in real-time. While hot wallets provide immediate accessibility, they come with some security considerations.

On the other hand, cold storage entails storing your recovery phrase offline, making it a safer and more secure option. Cold storage is often considered a reliable choice if your primary goal is to secure cryptocurrency for the long term.

Ultimately, choosing between hot and cold storage depends on your usage preferences. A hot wallet offers convenience if you actively engage with decentralized applications and use your funds regularly. However, if security and long-term storage are your top priorities, opting for cold storage is prudent.

Learn best practices for keeping your hot crypto wallets secure.

Design and user-friendliness

Design and user-friendliness are key factors in ensuring a smooth and seamless experience in the world of digital wallets. It’s essential to seek a wallet with an intuitive user interface, facilitating effortless transactions of sending and receiving funds.

Like the ease of navigating through apps and features on your smartphone, your digital wallet’s interface should empower you to interact freely with the broader ecosystem of digital assets. A well-designed and user-friendly wallet enhances convenience and contributes to a more enjoyable and accessible journey in managing your cryptocurrency and engaging with the evolving landscape of digital assets.

Security

Security is paramount in the realm of crypto and Web3, akin to the importance of a key to a lock. When seeking a self-custody wallet, you’re on the right path, as non-custodial wallets grant you access to the private keys, allowing you to enhance security through additional measures.

However, choosing a wallet is crucial, and opting for one with robust security features is imperative. Thanks to the rise of non-custodial wallets, you can have a wallet incorporating strong encryption, two-factor authentication, and biometric authentication. These elements collectively fortify the protection of your assets and ensure a more secure and resilient experience in the dynamic world of cryptocurrency and decentralized technologies.

DApp Compatibility

Consider the dapps (decentralized applications) and blockchains you intend to utilize when selecting a wallet. Wallets are tailored to work with specific blockchains, so it’s crucial to choose a wallet compatible with the native platform of the dapps you plan to engage with.

For instance, if you intend to interact with apps on the Celo blockchain, a wallet like Valora, designed specifically for the Celo blockchain, would provide you with access to a diverse ecosystem of apps and financial tools. This compatibility ensures that you can seamlessly swap, borrow, lend, and earn cryptocurrency within that specific blockchain environment.

Making an informed choice based on the compatibility of your wallet with the targeted dapps and blockchains is key to maximizing your experience in the decentralized ecosystem.

Platform Compatibility

Platform compatibility is a crucial consideration when selecting a self-custody wallet. Ensuring that the chosen wallet aligns with your predominantly used operating system is essential.

Whether you are more inclined to use your wallet on a desktop or mobile device or prefer a web-based version, finding a wallet that seamlessly integrates with your preferred platform enhances user experience and accessibility. This compatibility ensures that you can conveniently manage and access your digital assets, regardless of the device or operating system you choose for your financial activities.

The Future of Non-Custodial Wallets

In an era dominated by digital advancements, the stakes for security have never been higher, even with the rise of non-custodial wallets.

Centralized security systems hold customers’ identities, privacy, and financial information, forming a critical but often overlooked aspect of our increasingly interconnected lives. While we may take the reliability of these systems for granted, those involved in trading financial assets, especially cryptocurrencies, are acutely aware of the potential consequences should these security measures fail.

For crypto traders, the risks of violations of financial sovereignty and the looming threat of unrecoverable theft underscore the paramount importance of security considerations. Consequently, the blockchain and cryptocurrency industries continually explore innovative solutions to enhance asset security.

One promising avenue is integrating more noncustodial technology into cryptocurrency platforms and exchanges. This approach aims to significantly elevate the safety of transactions and accounts, simultaneously returning control to the hands of users. By empowering users with full control over their funds, this concept has the potential to propel the industry forward, offering an optimal scenario for security.

Read about the rise of decentralized P2P trading on this detailed DroomDroom guide

Custodial wallets, which often manage millions of dollars on behalf of customers, highlight the pivotal difference between an account frozen during a transaction and the freedom to trade at one’s own discretion. The key here lies in empowering the customer to control their financial assets.

Even in traditional markets, the advent of the Internet has led to a decentralization trend. While still overshadowed by the massive traditional finance markets, noncustodial solutions are acknowledged as the next wave, attracting substantial capital inflows from millions of individual accounts. Notably, platforms like Celsius have amassed over $300 million in deposits within a year, capturing the attention of legacy organizations.

Noncustodial technology’s undeniable potential and necessity in securing accounts in the digital age and its role in decentralizing and distributing security underscore its importance. As cryptocurrency, digital assets, and tokenization gain wider acceptance, the associated Achilles’ heel of bearer instruments necessitates adopting noncustodial technology.

Increasing awareness and education about the rise of non-custodial wallets is needed to address this. Moreover, ongoing efforts to enhance their reliability and user-friendliness are essential for driving continued adoption and facilitating a seamless transition to a decentralized and secure financial landscape.

It is worth highlighting the decentralized exchange behind the Chaiwallet non-custodial solution.

ChaiDEX

ChaiDEX is a P2P decentralized exchange that pays extra attention to noncustodial storage when securing customer funds. The blockchain-agnostic exchange achieves cross-chain transactions, trades, and affordable fees by employing a hybrid trading model.

Why a hybrid DEX model? First of all, the traditional crypto DEX has faced limitations when processing multichain assets. As such, a DEX like Uniswap must only operate on the Ethereum blockchain, support ERC-20 tokens, or wrap them. Again, this also depends on the availability of liquidity on both ends of the transaction. Hence introducing extra costs and increasing the cost of trading. The hybrid DEX model enables ChaiDEX to implement a centralized model’s efficiency and low cost and the ability to operate within a decentralized model.

Chai Wallet is a multichain cryptocurrency wallet with high-quality noncustodial security features, low gas fees, and reliability. As a self-custodial wallet, ChaiWallet allows users to control and manage their keys, funds, and assets. While you can use the ChaiDEX exchange with other types of crypto wallets, Chai Wallet is the most suitable.

Conclusion

In conclusion, the rise of non-custodial wallets marks a revolutionary shift in the cryptocurrency and blockchain sectors.

As users increasingly recognize the significance of retaining control over their digital assets, non-custodial wallets have emerged as a core part of user empowerment in Web3. The ability to manage, secure, and transact with cryptocurrencies without relying on third parties has enhanced financial autonomy and aligned with the principles of decentralization.

The rise of non-custodial wallets signals a departure from traditional custodial models, ushering in an era where individuals have the keys to their financial sovereignty. The emphasis on security, privacy, and ownership resonates strongly with a growing community of users who seek to navigate the crypto landscape on their terms.

As these wallets become more user-friendly and seamlessly integrated into the evolving Web3 ecosystem, they are poised to play a valuable role in shaping the future of decentralized finance (DeFi) and digital asset management.

.