Peer-to-peer trading, much like any P2P activity, involves several individuals trading with each other directly without relying on a middle person. Also referred to as P2P or decentralized trading, the mechanism does not store user funds and leverages a multi-signature escrow to eliminate risks of theft.

- What is a Peer-to-Peer Trading Platform?

- How Does a Peer-to-Peer Trading Platform Work?

- Use case: The Future of ChaiDEX

- Why Decentralized Exchanges Need Their Native Token?

- ChaiDEX’s Native Token, Chai T ($CHAIT)

- Benefits of Peer-to-Peer Trading Platforms

- How to Succeed in Peer-to-Peer Trading

- Understand the peer-to-peer trading platform

- Validate Counterparties

- Security

- Clear Communication

- Diversify your Offerings

- Final Words

Decentralized exchanges prioritize safety and transparency, hence making peer-to-peer trading a viable option for both staters and established crypto investors. In this article, we delve into reasons why peer-to-peer trading is gaining more traction compared to centralized trading.

For years, trading on centralized exchanges has been the norm. Lack of control, loss of funds, risk of manipulation, and high transaction costs are some of the downsides of trading on a centralized exchange.

Another situation that demonstrated the danger of using centralized trading platforms was 2022’s FTX fiasco. In crypto, protecting yourself is mandatory, as such, users are opting for non-custodial peer-to-peer trading platforms such as ChaiDEX to safely exchange crypto.

Unlike many peer-to-peer trading platforms, ChaiDEX is here for three things.

- Eliminate middlemen when buying or selling cryptocurrencies.

- Introduce an escrow contract.

- Implement an identification system for each trade

When conducting peer-to-peer trades, the decentralized exchange secures funds from both parties on the escrow. Once both parties meet certain conditions for a trade, the escrow releases the funds. Another condition upon which the escrow releases funds is when the allotted time expires.

Since peer-to-peer trading occurs on decentralized exchanges, governments cannot easily shut them down. As such, peer-to-peer trading platforms help facilitate crypto trading in crypto-restricted regions. Besides, a decentralized exchange or P2P trading platform will always come with multiple payment options. The likes of ChaiDEX support 30+ payment methods via which you can deposit funds.

There are a few downsides to trading on a DEX or P2P platform. One of those downsides is slow trading speeds. As such, price differences while waiting for settlement might affect the final bottom line.

What is a Peer-to-Peer Trading Platform?

Peer-to-peer trading platforms come in different shapes. To trade efficiently, one must choose the one that suits their needs. In essence, traders must start by comparing the available cryptocurrencies, fees, methods of resolving conflict, customer support, and available features.

Peer-to-peer trading platforms, unlike centralized exchanges, offer more flexible exchange rates and lower fees. For this reason, trading on P2P platforms can help maximize profits when trading cryptocurrencies. Large decentralized exchanges come with higher liquidity, particularly the top-tier ones. This means traders are more likely to find compatible clients and exchange desired cryptocurrencies.

While centralized exchanges are more strict with regulations, peer-to-peer trading platforms tend to be relaxed with requirements. Hence, traders need not undergo hectic sign-up processes and KYC requirements. The process of buying or selling crypto on the peer-to-peer trading platform is also simple, less costly, and allows the trader to store their assets in separate custodial wallets.

There are times when the term P2P and crypto marketplace will appear interchangeably to denote the same platform. This is because a peer-to-peer trading platform operates in the likes of Craiglist or eBay. Cryptocurrency buyers and sellers usually create crypto advertisements on the peer-to-peer trading platform, as they would have done when advertising stuff on Craiglist. As such, interested customers can buy or sell to them.

The difference between Craiglist and a peer-to-peer trading platform is that the latter only lacks an escrow system and cannot facilitate P2P exchanges. On the other hand, the likes of ChaiDEX peer-to-peer trading platforms have an escrow and a feedback rating system to facilitate P2P exchanges by protecting all participants.

Examples of Peer-to-Peer Trading Platforms

ChaiDEX

To increase safety across crypto transactions, ChaiDEX has also implemented a way for blockchains to communicate with each other. As such, traders can move from one chain to another without relying on token bridges.

Hence, eliminating the need for wrapped tokens when initiating token transfers and swaps.

X and his team discovered a way to solve the limitations of trading on majority DEXes, these limitations include finding a suitable protocol to work with and a limited variety of supported tokens. On the other hand, major CEXes provided more token variety and options for protocols. However, these exchanges were less secure and required maximum trust to store your funds with the platform. ChaiDEX aims to solve this by replacing bridges with atomic swaps. Furthermore, the peer-to-peer trading platform intends to replace exchange custodial with a separate cryptocurrency custodial wallet. Traders on the P2P exchange will store their funds in this wallet.

To explore more about the ChaiDEX trading platform, visit them here

How Does a Peer-to-Peer Trading Platform Work?

A peer-to-peer trading platform operates similarly to a Facebook Marketplace. Both platforms bring together different buyers and sellers to transact together. However, unlike the Facebook marketplace, a P2P crypto marketplace utilizes an escrow contract as a mechanism for inbuilt trust.

Counterparties on a Facebook marketplace have nothing to establish trust, no escrow, just two strangers hanging out on the internet. For a P2P exchange, there is a rating system to guarantee trust and an integrated escrow to enforce agreements.

As such, scammers cannot block a buyer after taking their money through the marketplace. Besides, the rating and feedback system can evaluate the legitimacy of a trader by checking alongside their profile for a 95 – 100% success rate.

Use case: The Future of ChaiDEX

According to the founder, DEXs will be the future as the industry has already confirmed the harm of centralized exchanges.

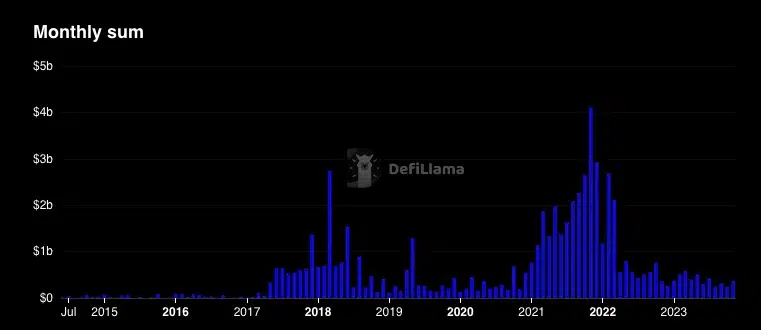

In 2022, a lot of centralized exchanges crashed thereby introducing a host of trust issues with the centralized model in crypto. As such, ChaiDEX emerged to solve such trust issues and bridge the gap between one chain/protocol with another without utilizing token bridges.

Why Decentralized Exchanges Need Their Native Token?

Decentralized exchanges (DEXs) usually have a main utility token for various reasons. Here are some of the most common reasons:

Native tokens are vital for governance since they give the community a voting decision in the development of the DEX’s ecosystem. Such voting decisions could be protocol upgrades or changes in fee structures.

Distributing incentives to the users as a way of rewarding their participation. For example, the users who hold the DEX’s token receive fees, discounts, and sometimes airdrops of the token to attract more users.

Liquidity pools and staking are crucial features of any decentralized exchange. Since these features rely on consensus amongst participants, holding a common token is vital. Staking the native token guarantees liquidity and earnings for the people who staked.

Decentralized exchanges may opt to pair their native tokens to build diverse trading pairs. For instance, ChaiDEX may opt to pair trading Cardano against its main utility token, Chai T ($CHAIT).

In other cases, innovators may opt to bootstrap their projects through Initial Coin/Token Offerings by distributing a token to select early adopters, crucial stakeholders, and developers. This ICO creates a fresh user base and community around the decentralized exchange.

ChaiDEX’s Native Token, Chai T ($CHAIT)

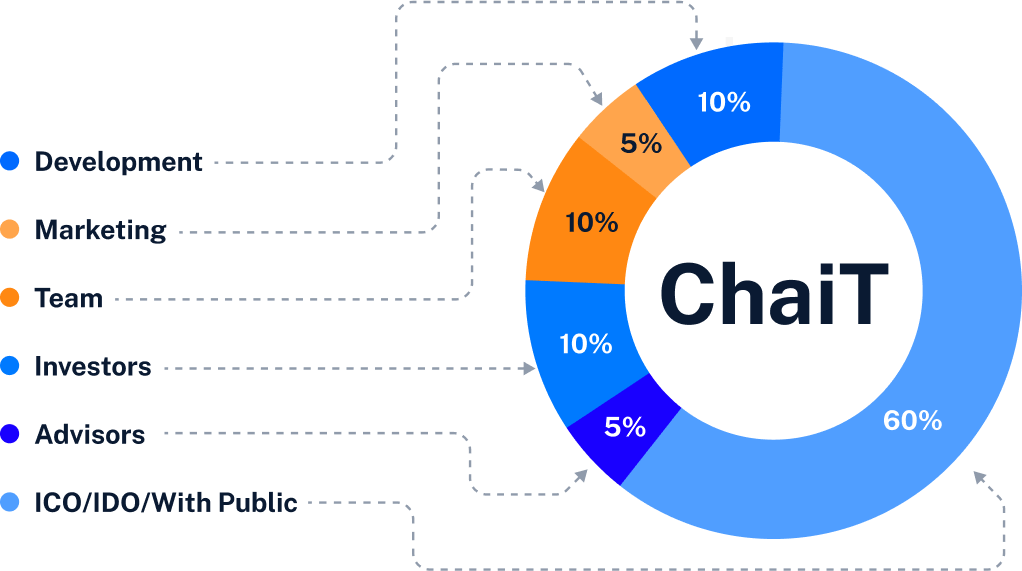

The ChaiDEX protocol also has its native cryptocurrency, the Chai T ($CHAIT). The utility behind this cryptocurrency includes governance, trading, and paying for gas fees. Chai T ($CHAIT) runs on the Solana Chain SPL standard, Thanks to the robust and lightweight nature of the Solana protocol, ChaiDEX can offer high-speed transactions and ultimately low gas fees.

CHAIT will be burned in stages until the total lifetime supply reaches 5 billion. This will be achieved through a buy-back and burn mechanism. Initially, for the first year, 50% of the fees accumulated by the DEX each month will be bought back and burned. After one year, there will be a staggered burning.

Something else that’s not able to be pointed out is the liquidity pool for ChaiDEX which consists of USDT, BUSD, and USDC. The peer-to-peer trading platform blockchain will convert the liquidity pool’s funds into USDC, as a backing mechanism for the protocol’s stablecoin, the INRC.

Additionally, all transactions taking place on ChaiDEX will remit a 0.1% gas fee. The peer-to-peer trading platform will allocate 50% of the gas fees to the maintenance pool, while 50% will go to the APY pool.

ChaiDEX also has a separate custodial wallet where users can manage their funds, accounts, and keys. The unique thing about ChaiDEX is it has managed to isolate the custodial wallet from the exchange, hence mitigating the risk of theft that targets centralized mass storage.

Benefits of Peer-to-Peer Trading Platforms

Traders get access to a decentralized user-centric approach when trading on a peer-to-peer exchange. This capability comes with several benefits, these include:

Peer-to-peer trading offers a decentralized and user-centric approach to exchanging assets, providing a myriad of benefits that reshape traditional trading landscapes.

- Transactions are fast and less costly since users don’t have to rely on a central or third party.

- Decentralized peer-to-peer trading platforms are secure and feature escrow protection.

- Parties to a transaction are private since decentralized exchanges do not request user credentials verification.

- DEXs have a reputation rating mechanism where users can rate the users they have transacted with. As such, one can use the ratings to determine whether an exchange is legitimate or not.

- Peer-to-peer trading platforms provide dozens of payment methods, from bank transfers to debit/credit cards, gift cards, and international wire transfers. Furthermore, users can opt for depositing or withdrawing funds in crypto.

How to Succeed in Peer-to-Peer Trading

Understand the peer-to-peer trading platform

Understand the peer-to-peer trading platform first. Familiarize yourself with each feature, security measures, risks, and the user interface. Also, learn the rules and the platform’s method for conflict resolution. Not all platforms are the same, hence study each of them to carefully understand the terms and conditions.

Validate Counterparties

Trust is vital in peer-to-peer trading. Ensure you have validated the trustworthiness of every counterparty before entering a trade. Most if not all peer to peer-to-peer trading platforms offer a user rating mechanism that allows traders to verify the trustworthiness of each trading partner.

Security

Security of your funds begins with you. Prioritize your wallet’s security and enable multi-factor authentication. Also, make sure you choose a peer-to-peer trading platform with robust security measures. Furthermore, be careful when browsing to avoid falling prey to phishing attempts. Every time you want to communicate with support, ensure you are using the official verified channels of the P2P trading platform.

Clear Communication

Clear communication is paramount when trading on a peer-to-peer platform. While you have the option of choosing the payment method when executing a P2P trade, some counterparties might require your attention on the chat feature. Ensure you respond promptly and in a transparent manner and avoid coming out as a scammer. Also, scammers might trick you into accepting a payment when they haven’t paid you. Such behavior is a common red flag in P2P trading.

Diversify your Offerings

Hedge your trading portfolio by diversifying your offerings and providing more than 1 asset. This will prevent your portfolio from crashing in case the price of a crypto goes down. As such, offer several cryptocurrency assets on your peer-to-peer trading platform account. This will also generate more revenue in the long run. Also, diversify your payment methods and offer multiple options. This way, you can have more customers buying or selling to you.

Final Words

The likes of ChaiDEX and other DEXs are winning in 2023 going forward as crypto traders opt for decentralization instead of centralized exchanges.

The industry is set to take a similar upward trajectory in 2024, as the crypto verse continues to innovate in favor of complete decentralization. If you just embarked on your journey to peer-to-peer trading, we hope you learned something from The Rise of Peer-to-peer Trading Platforms.