The future of NFTs holds immense potential. We saw how the meteoric rise of non-fungible tokens at the start of 2021 led to their implementation across various industries. From gaming to event ticketing, invoicing, art, entertainment, sports, etc.

- Growth and Popularity of NFTs

- Fast Forward to Recent Times

- What Role Will Regulatory Clarity Play in the Future of NFTs?

- Fraudulent Activity as a Key Hindrance to the Future of NFTs

- The Significance of Artificial Intelligence (AI) and Machine Learning (ML) in the Future of NFTs

- Statistics and Forecasts that will Define the Future of NFTs

- Overcoming the Challenge of Exhaustion and Stigma Surrounding NFTs

- Unlocking the Potential of NFTs with Analytics

- Conclusion

The future of NFTs will be marked by innovative growth and diversification across various sectors, including art, gaming, and digital asset management. Advances in AI and blockchain technology are poised to enhance authenticity, valuation, and the overall user experience in the NFT space.

This article will also delve into DroomDroom’s conversation with Entrepreneur Awards Tech Startup of the Year, bitsCrunch. In the conversation, bitsCrunch founder Vijay Pravin shares his hope for the future of NFTs and the challenges that could emerge to stifle growth.

Industry participants are eyeing the next few years with bullishness, as NFTs continue solidifying their position as valuable assets in the Web3 space. Let’s begin with a quick recap:

Growth and Popularity of NFTs

The NFT market peaked between 2021 and 2022 for various reasons. First, blockchain users discovered a method for securely proving ownership on the internet using scarcity and verifiable uniqueness. People were becoming more familiar with the blockchain, and many of them began exploring the possibilities of the new form of internet ownership.

Artists also discovered a direct way to bypass traditional gatekeepers and monetize their digital art. As such, the artist could now control the price, earn royalties via secondary sales, and receive exposure through open NFT marketplaces.

Gaming brands also discovered the future of their industry was somewhat tied to the future of NFTs. Through Non-fungible Tokens (NFTs), gamers could now own in-game assets, and monetize those assets through re-sales or lending. Traditional gaming has long been criticized for blunt ownership of virtual items. With NFTs, players could now authenticate their virtual items, provide proof of ownership, and even transfer ownership from one platform to another.

The concept of tokenizing real-world assets (RWA) started gaining momentum with the invention of the blockchain and the implementation of Non-Fungible Tokens. Despite TrustCommerce introducing tokenization in 2001, the ship seems to have started sailing almost a decade and a half later with the introduction of the blockchain.

Tokenizing RWA involves transforming a real-world asset into a digital token and storing it as a record on the blockchain. Examples of property to tokenize include commodities, real estate, art, and even intellectual property. The rise of NFTs has also meant that investors can buy fractional pieces of a high-net asset or property through NFT fractionalization.

In entertainment and events, organizers began leveraging the power of blockchain ticketing and implementing NFTs as digital tickets. Celebrities also started taking part, the industry began witnessing lots of celebrity involvement and endorsements, particularly by musicians, athletes, film franchises, and sports clubs. High-profit sales garnered by collaborating with celebrities created media attention and made the mainstream conscious of Non-fungible tokens.

Fast Forward to Recent Times

The above factors are only a few of the factors that contributed to the rise and growth of Non-fungible Tokens. This section will explore some of the dynamics that will continue shaping the NFT landscape.

What Role Will Regulatory Clarity Play in the Future of NFTs?

Regulatory clarity is one of those silent yet valuable factors that will define the future of NFTs beyond 2024. The industry is seeking clear regulatory frameworks for the sake of consumers, investors, and creators. With clear compliance mechanics, the space will protect participants and grow into optimum stability and maturity.

Some worthwhile efforts include educating policymakers about the ins and outs of NFTs. There will also be a need for policymakers to understand the differences between cryptocurrencies and NFTs.

One of the biggest lawsuits against the NFT space was against Cristiano Ronaldo when he launched the ‘NFT CR7 Collection’ According to sources, the lawsuit could cost the professional footballer an upward of $1 billion in damages. Meanwhile, a section of the NFT community went on to compare the lawsuit against Ronaldo to going after a knife manufacturer because someone chose to use a knife for all the wrong reasons.

The United States Securities and Exchange Commission also filed the first NFTs unregistered securities claim against the entertainment company, Impact Theory.

With such uncertainty and lack of clarity, creators, businesses, and investors get left in the dark. This is why regulation is such a gray area for Non-fungible tokens (NFTs).

Besides, the absence of regulation has also invited fraudsters to take advantage of the situation.

Fraudulent Activity as a Key Hindrance to the Future of NFTs

In 2021 and 2022, alot of fraudsters jumped into the scene intending to operate and sell fake NFT collections. Unlike traditional art, which is run by a governing body and has a compliance framework, digital NFT art lacks a framework for the legal repercussions of fake art. Sometimes, this is a problem by fraudsters and marketplaces, where a marketplace ends up listing and selling a counterfeit NFT.

Vijay Pravin told DroomDroom that 1 in every 10 NFTs on tier 1 NFT marketplaces is fraudulent. This trend has not only scared investors away but also led to the loss of upto $4M in retail investor funds. The inventors and creators are still hopeful about NFTs and have considered on-chain data analytics their saving grace. At this juncture, bitsCrunch comes into the picture with its revolutionary tools for providing reliable NFT analytics and statistics.

Often, NFT platforms lack reliable data analytics that would help participants conduct due diligence. This adversely affects the overall community and creates a sea of fraudulent tokens, wash trading practices, and scams that aim to siphon honest participant rewards. The lack of dependable NFT statistics and data analytics tools also complicates accurately pricing or valuing an NFT.

Therefore, it is evident that data has continued and will continue to play a prominent role in the growth and development of the NFT ecosystem. With that said, let’s look at the advent of AI and how it will impact the future of NFTs.

The Significance of Artificial Intelligence (AI) and Machine Learning (ML) in the Future of NFTs

Artificial Intelligence (AI) and Machine Learning (ML) are central to solving some of NFTs’ biggest problems today. According to Vijay Pravin, the CEO, and founder of bitsCrunch, their UnleashNFTs data analytics platform leverages the power of advanced AI and ML algorithms to locate statistical anomalies. These anomalies act as a signal for fraudulent behavior. Hence playing an active role in fraud detection and prevention across the NFT landscape.

At the same time, AI and ML have proved to be great tools for fair price discovery. By factoring historical data, the rarity of a digital collectible, current market perfomance, trends, and overall market sentiment, AI algorithms enable participants to determine the fair market value of NFTs.

Better yet,

NFT recommendation engines are becoming common in the NFT space, particularly across marketplaces. When recommending suitable Non-fungible tokens, these engines utilize reliable statistics, advanced algorithms, and AI to analyze market behavior, user preferences, and transaction history.

This approach towards providing a personalized approach enhances the overall user experience, aiding in discovering new collections and simplifying the process of investing in NFTs that resonate with one’s needs. Moreover, these AI-driven recommendation tools have become valuable tools for creators and artists to serve a more relevant audience.

Non-fungible Token (NFT) Marketplaces also proactively combat NFT counterfeights by leveraging AI to authenticate NFTs. Through Artificial Intelligence, the marketplaces have built advanced authentication systems to validate the legitimacy of an NFT before listing it for sale. Hence helping reduce the chances of investing in a fake digital collectible.

In the next section, let’s delve into some of the industry statistics and forecasts surrounding Non-Fungible Tokens.

Statistics and Forecasts that will Define the Future of NFTs

The global Non-Fungible Token (NFT) market capitalization is approximately $34.40 billion as of January 2024. In 2023, revenue for participants across the NFT market doubled from $892 million in 2022 to $1.6 billion.

If the market continues to grow at the forecasted Compound Annual Growth Rate (CAGR) of 18.55%, the revenue numbers across the NFT market could rise to $2.27 billion by the end of 2024. With this as the case, the revenue could hit $3.16 billion by 2027. (Data by Statista)

However, one statistic seems to stand out amongst these crunches of data. 2023 revealed a pretty nuanced market structure.

Within this diverse spectrum, however, lies a potential challenge for investors. Smaller market capitalizations often correspond to projects with limited resources for robust security measures and comprehensive due diligence. This characteristic may render them more vulnerable to fraudulent activities, necessitating a cautious approach from potential investors seeking legitimacy amid the vast array of emerging projects.

Furthermore, a key revelation from the market distribution research is the significant concentration of market capitalization within the top echelon. The top 50 NFT projects, despite representing less than 1% of the total projects, command a staggering 52% of the entire market capitalization. This concentration signifies a scenario where a considerable portion of capital is tied to a select few projects, amplifying the impact of their performance on the overall market dynamics.

At the same time, this statistic indicates the highly competitive nature of the NFT market, which has created the trouble of wash trading. In NFTs, wash trading occurs when traders artificially inflate the price of Non-fungible Tokens by repeatedly buying and selling a collection amongst a team of traders. The goal of wash trading is to create an impression that a certain collection has high demand, which also has the potential to pump the collection’s price.

In an earlier 2022 report, bitsCrunch reported flagging approximately 3.9 million transactions out of 252 million NFT transactions happening across Avalanche, Ethereum, and Polygon blockchains.

While concentration in successful projects is not inherently problematic, investors should be attuned to the potential ramifications of such market dynamics. Rapid fluctuations in the value of these top projects could have cascading effects on the broader NFT market, necessitating a keen understanding of the interplay between top-performing projects and the market’s overall health.

In 2023, ‘The Merge’ became the most valuable NFT with a whopping $91.8 million sticker price. While there are NFTs like the ‘The Merge’ that can sell for millions of dollars, half of all NFT sales fetch below $200.

This particular NFT, ‘The Merge’ represents the market’s upper echelon, showcasing the potential for certain digital assets to command exorbitant prices, potentially fueled by factors such as rarity, cultural significance, or the artist’s reputation.

However, juxtaposed with these high-value transactions is the observation that a substantial portion of NFT sales, specifically half of them, are transacted at a much lower price point. This underscores the broad accessibility and democratization of the NFT space, wherein many transactions occur at more modest price levels.

The coexistence of NFTs with multimillion-dollar valuations and those transacting at lower amounts reflects the diverse nature of the NFT market.

While the market for high-profile and high-value NFTs garners attention and significant financial investments, there is also a considerable volume of transactions involving more affordable or entry-level NFTs.

This dual dynamic suggests that the NFT market accommodates a wide range of participants with varying budgetary preferences, contributing to the overall resilience and inclusivity of the digital asset ecosystem. In the future, the numbers could grow stronger and contribute to a more diverse ecosystem if the market overcomes another bigger hurdle.

Overcoming the Challenge of Exhaustion and Stigma Surrounding NFTs

Aside from fraudulent activity across the NFT sector, bitsCrunch wants to solve another challenge through data and awareness: the negative sentiment surrounding NFTs. There is a public perception that NFTs are a technology for propagating online scams. Through price estimation tools, data analytics and advanced price discovery algorithms could help participants understand the real value behind NFTs. This could also see the general public change its perception towards the sector, and attract a fresh breed of creators, investors, and businesses.

While the exhaustion and stigma are not general, they still could shape a not-so-good narrative around digital assets. Thereby creating a negative perception even for newer entrants.

Despite these few challenges, the NFT market still strives for a healthier future. At the moment, investors and businesses have realized the benefits of due diligence (DD), the significant role of data in thorough DD, and the importance of Artificial Intelligence. All these technologies and tools are rapidly growing, with the industry already at the height of execution and implementation.

It is for this reason that we believe in the innovative potential of Non-fungible Tokens and share in the hope that more people will discover their utility, leverage an analytical platform like UnleashNFTs by bitsCrunch when measuring perfomance, gauge metrics, establish legitimacy, and determine the fair value of a Non-Fungible Token project.

Unlocking the Potential of NFTs with Analytics

A strategic approach to analytics is crucial when unlocking the potential of NFT assets. This approach should include price discovery, suitable asset recommendation, and thorough risk management.

The immense growth of the NFT sector has introduced both a challenge and an opportunity. A challenge to secure our onchain investments and an opportunity to multiply our investments in an industry with high potential.

bitsCrunch has positioned itself as a revolutionary data platform for blockchain investors, researchers, and traders who want to capture on-chain activity. The analytics platform comes in handy when identifying suspicious on-chain activity, evaluating the actual value of assets, generating/verifying compliance reports, and detecting fraudulent behavior.

To make matters worse, Person Y also claims their NFT is the original one. In such a case, how can Person X or an investor determine which of the two has the original NFT?

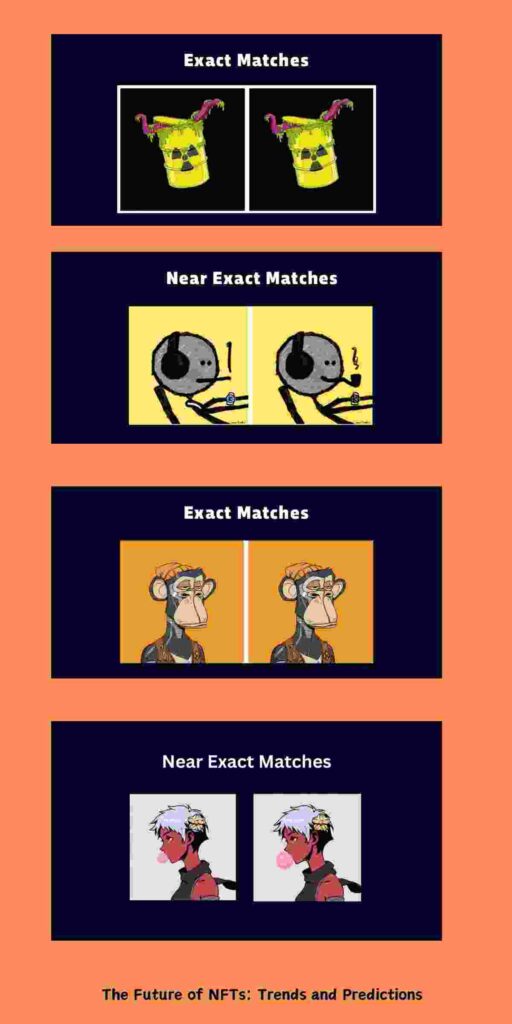

Using the bitsCrunch Forgery Detection AI-powered tool, UnleashNFTs discovered 144 exact matches of the Bored Ape Collection, which had sold at least $2 billion by 2022.

Since UnleashNFTs only studied 850,000 NFT storefronts on OpenSea against the top 40 Ethereum NFT collections, they found more reason to believe more duplicate NFTs are circulating.

In the same study, UnleashNFTs realized that 231 NFT pieces were exact matches of each other, and 814 others were extremely similar to each other. For this reason, the brand created a categorization of 6 findings, as shown below:

| Categories | Sales (USD) for the last 2 yrs | Cumulative Count |

| Mildly Similar | 3,201,331 | 4,492,807 |

| Moderately Similar | 834,377 | 1,291,497 |

| Similar | 194,242 | 457,099 |

| Extremely Similar | 188,635 | 262,857 |

| Near Exact Matches | 45,410 | 74,222 |

| Exact Matches | 28,811 | 28,811 |

At the same time, tracing an NFT’s original source to determine its legitimacy requires the right analytical and interpretational tools.

This shows that without UnleashNFTs and other revolutionary data analytics platforms like bitsCrunch, making sense of the NFT market would be complicated and problematic.

One of the things that bitsCrunch gets right is flagging copycats on behalf of the user and also providing users with the NFT’s original wallet address. This means that one can easily compare the authenticity of all NFTs existing on all blockchains since each NFT piece contains unique metadata.

If UnleashNFTs flags down an address as potentially fake, it means that a potential buyer may end up with the wrong collectible. Besides, UnleashNFTs also price estimations and NFT recommendations using its advanced price discovery features.

Conclusion

Nonfungible Tokens have redefined how people exchange value and provide proof of ownership via the blockchain. The ability of NFTs to grow in value has also testified to their potential as a digital investment asset. Despite their potential, the industry has faced various challenges, including theft, fakes, copycats, wash trading, cybersquatting, and several other risks.

Investors who forgo the need for research and analytical tools have often found themselves between a rock and a hard place. For the longest time since they became popular, NFTs have been the target of blockchain criminals.

Most of these criminals want to steal your hard-earned NFT investments and call it a day. For this reason, we suggest testing out a quality NFT analytics platform to help mitigate some of the mentioned risks.