The crypto ecosystem came to fruition with the emergence of Bitcoin in 2009. Since then, the space has matured tremendously. Growing not only as a legitimate asset class but also in terms of market capitalization and size. Over the last decade, a plethora of cryptocurrencies have appeared. These altcoins have accelerated the growth of the crypto market while impacting Bitcoin’s dominance over the years. That said, Bitcoin remains the largest cryptocurrency in market cap and share, with a major influence on the entire crypto ecosystem. Therefore, Bitcoin’s dominance has appeared as an indicator to spot trends in Bitcoin, the altcoin sector, and the market as a whole.

- Understanding Bitcoin Dominance

- Factors that Influence Bitcoin’s Dominance

- The Importance of Bitcoin Dominance

- How to use Bitcoin Dominance to Spot Trends

- Identifying Alt-coin Seasons

- Identifying Other Market Cycles through BTC Dominance Patterns

- Incorporating Technical Analysis to Evaluate BTC Dominance

- Closing Thoughts and Considerations

Bitcoin dominance refers to the ratio or percentage of Bitcoin’s market cap compared to the rest of the cryptocurrency market. While Bitcoin’s dominance has declined, this ratio continues to serve as a useful indicator to analyze market trends.

Understanding Bitcoin Dominance

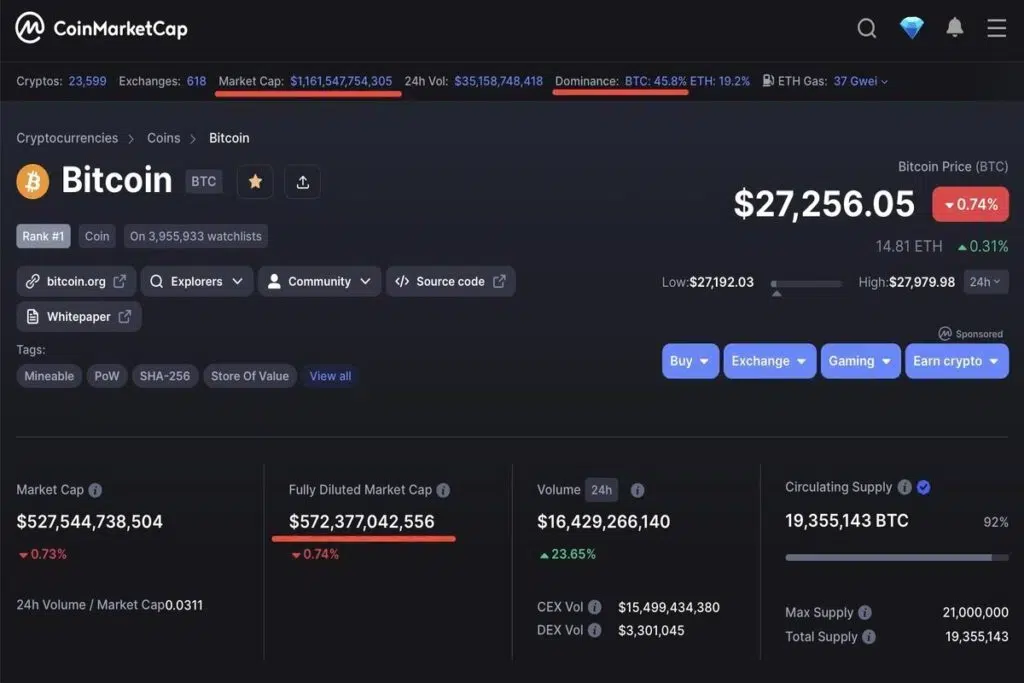

Before delving into Bitcoin’s dominance, it is useful to understand the term market cap. The market cap simply refers to the total value invested in a given asset. A cryptocurrency’s market cap is determined by multiplying the total number of tokens or coins in circulation by the current price. For example, a total circulating supply of 19,355,143 BTC multiplied by the current price of each Bitcoin at $27,256.05, equates to a market cap of $572 billion.

Once Bitcoin’s market cap is determined, its dominance can be calculated by dividing it by the current global crypto market cap. Therefore, if Bitcoin’s market cap stands at $534 billion and the total crypto market is at 1.16 trillion, BTC’s dominance stands at 45.8%.

Factors that Influence Bitcoin’s Dominance

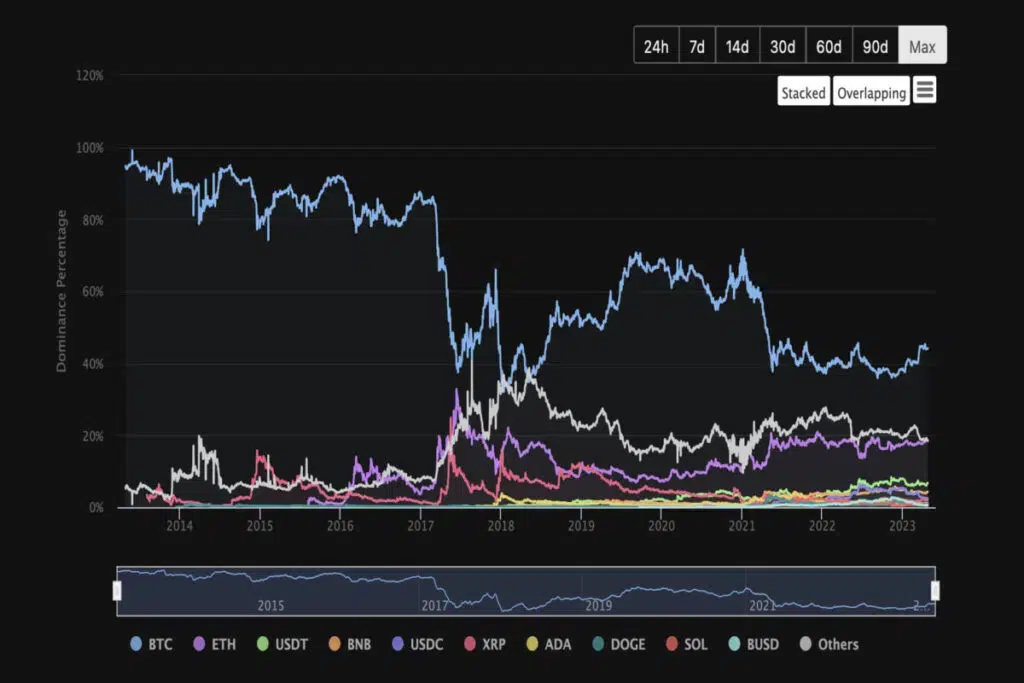

Bitcoin dominance is a constantly changing metric. Bitcoin’s share in the crypto market has gone from over 90% a decade ago to below 50% at the time of this writing. The decline in Bitcoin’s overall dominance can be attributed to the rise of thousands of altcoins. The utility of altcoins has brought different narratives to the space, such as decentralized financial (DeFi) services, gaming, and non-fungible tokens. This has resulted in substantial interest and investment flowing into the altcoin sector and thereby diluting Bitcoin’s dominance.

The degree of Bitcoin dominance is also influenced by Bitcoin’s price action and increased usage of stablecoins. Furthermore, history has shown that the percentage of BTC dominance is greatly influenced by market cycles. Bitcoin is a relatively stable asset compared to lower market-cap altcoins. This has led investors to allocate funds to Bitcoin as a safe haven during bear markets and conversely move into riskier altcoins during bullish phases.

The Importance of Bitcoin Dominance

Given that the Bitcoin dominance ratio moves in a cyclical fashion in tandem with trends and market conditions, it has evolved into a leading indicator for crypto traders and investors. Platforms like TradingView, CoinGecko, and CoinMarketCap provide a graphical illustration of BTC dominance through charts.

The bitcoin dominance chart can be used as a helpful tool to understand where funds are being allocated into the crypto ecosystem. The chart can be used as an indicator to determine market sentiment in altcoins over Bitcoin and vice versa. Market analysts view a rise in BTC dominance as a sign of investors moving from speculative altcoins to Bitcoin. Conversely, a decline in dominance is viewed as people allocating their capital toward altcoin projects. This data can be used to reassess one’s risk tolerance and investment thesis based on trends and sentiment.

How to use Bitcoin Dominance to Spot Trends

Bitcoin dominance can indicate the level of strength in the market, the possible onset of bull and bear markets, and the potential dawning of an alt season. However, the question arises, how do we identify such trends using the dominance chart? The following section outlines certain chart patterns that traders have used in the past to adjust their investment approach.

Identifying Alt-coin Seasons

Bitcoin’s price along with its dominance ratio can be analyzed concurrently to spot potential trends in the altcoin sector. For example, if the price of Bitcoin is in an uptrend but the dominance is declining, this is often seen as a potential bull market for altcoins. This was evident in the last crypto bull market with the emergence of new trends like DeFi and NFTs shifting liquidity to Ethereum and other layer-1 altcoins.

Identifying Other Market Cycles through BTC Dominance Patterns

BTC dominance can be used to shed light on where we are in a crypto market cycle. It must be noted that these patterns are not ironclad indicators but must rather be used as a measure of strength in the market. Historical observations of the following patterns indicate a correlation but that does not guarantee the accurate performance of Bitcoin or any other crypto asset.

1. #BTC dominance is a measure that indicates what % of the total crypto market cap is comprised of Bitcoin.

It signals where capital is being allocated, and is a measure of consumer sentiment.

Dominance ⬆️ = Alts lose relative value to BTC

Dominance ⬇️ = Alts gain value to BTC pic.twitter.com/2yfOppWthP

— Miles Deutscher (@milesdeutscher) May 31, 2022When Bitcoin’s price and dominance are both in an uptrend, this is usually indicative of a Bitcoin bull run. Conversely, when both metrics are falling, this could signal overall weakness in the market and the potential of a bear trend. Finally, when the price of Bitcoin is declining alongside a rising dominance ratio, this usually indicates an altcoin bear market.

Incorporating Technical Analysis to Evaluate BTC Dominance

Like any other chart, investors can incorporate technical analysis into the BTC dominance chart to identify good trading opportunities. Investors can use trend lines to determine a potential reversal. For example, Bitcoin dominance has been in a trading range between 39% and 49% for the past two years.

It is useful to view these levels as potential reversals or resistance zones respectively. Again, it is important to manage risk here, since trend lines can be breached.

Closing Thoughts and Considerations

While Bitcoin dominance is a useful indicator, it is important to highlight a disclaimer for people using it as a tool to make investment decisions. Firstly, fixating on it as the only indicator is not the right approach and one that could lead to losses. The crypto sector remains a risk-on asset due to its nascency and volatility. Therefore, an appropriate mixture of different technical analysis tools in conjunction with a fundamental analysis of each project is a more strategic approach.

Furthermore, the reliability and long-term viability of Bitcoin dominance has come into serious question. Analysts view the rise of altcoins with substantial utility as a factor that will continue to chip away at BTC’s dominance. There have even been whispers of a potential Ethereum flippening. Since the dominance ratio also takes into account all new altcoins introduced into the market, there is a high possibility of Bitcoin dominance reaching new lows in the future. This could render the index ineffective.

However, on the flip side, with countries like El Salvador adopting Bitcoin as legal tender and the potential for others to follow suit, there is no certainty that Bitcoin’s market share will continue to decline. For now, BTC dominance remains a popular metric and, if used properly, can provide insights into trends and the overall health of the crypto market.