The first cryptocurrency was launched in the aftermath of the 2008 global financial crisis (GFC). It ushered in a new perspective in the financial market and primarily served the purpose of transferring value with no other use case.

The BRC-20 token standard is an attempt by developers to introduce additional use cases to the Bitcoin blockchain. The ‘Bitcoin Request Comment: BRC’ Is an experimental token standard that allows the transfer and minting of fungible tokens on the Bitcoin blockchain through the protocol Bitcoin ordinal.

With the BRC-20 token standard, Bitcoin can now host fungible tokens on its blockchain, which was impossible earlier. This is similar to the ERC-20 token standard that allows tokens like Tether USD (USDT) and Binance USD (BUSD) to thrive on its blockchain.

The Origin of BRC-20 Token

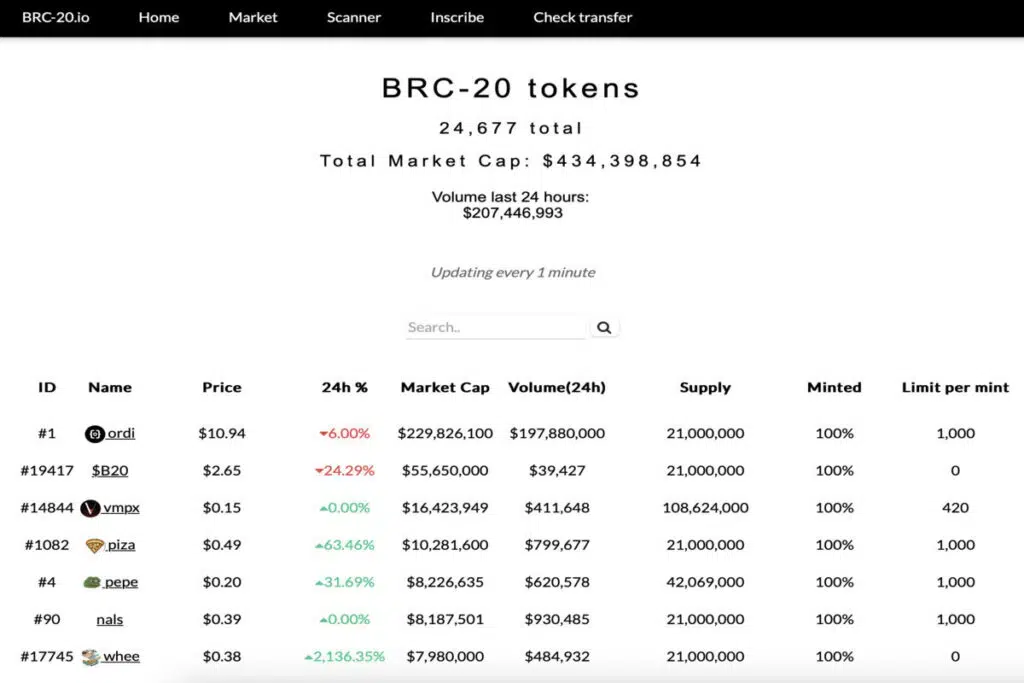

Like every other token standard has its creator, the BRC-20 token standard was created by a pseudonymous programmer, Domo. Ordi became the first token to launch on the Bitcoin network, and ever since there’s been a rise in the number of other tokens deployed, most of them being meme tokens like BISO, PEPE, PIZA, and ZBIT. At the time of writing, the BRC-20 tokens have a total market capitalization of over $424 million.

An experiment into "brc-20's" and fungibility on bitcoin with ordinals 1/x pic.twitter.com/9khKLbEPk6

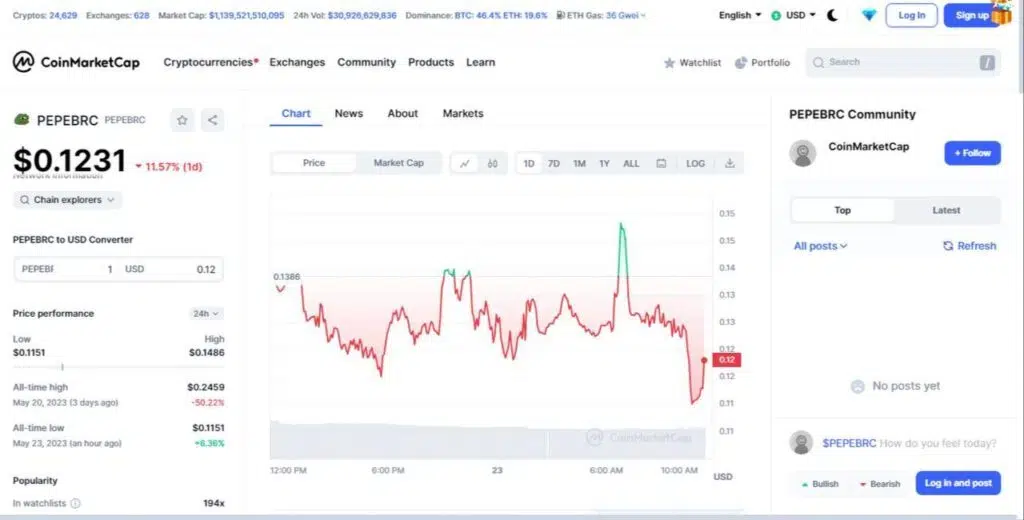

— domo (@domodata) March 9, 2023PEPE (ordinal) token is one of the meme coins that gained massive public interest as investors expect it to thrive as a similar version launched on the Ethereum blockchain did. Originally, Pepe is a popular internet meme frog that has maintained relevance over the years. After PEPE(Ordinal) went live on the Bitcoin network, its price peaked at $0.2459.

To be created, BRC-20 tokens take advantage of the Bitcoin Ordinal or Bitcoin NFTs made in January 2023 and Bitcoin Taproot that allows productizing of block spaces. Bitcoin Ordinal allows the inscription of information, including images and text on sats. Sats is the short form of Satoshis, smaller than Bitcoin; 1 Sat equals 0.00000001 BTC.

Marking individual satoshi with information and identifying it is possible because of the uniqueness of each satoshi, similar to how every $100 bill circulating has its unique serial codes. BRC-20 tokens build on the concept of marking satoshis with information but by minting these satoshis. Hence, they contain all the details about a token collection, such as its supply limit, token name, and symbol.

More Details on BRC-20 Token Standard

BRC-20 tokens function just like every other token on the blockchain. To mint BRC-20 tokens, JSON (JavaScript Object Notation) data which contains properties about a token, such as its supply and symbol, is inscribed into a sat. JSON houses executable codes deployed on the blockchain network, adding functionalities, including token transfer between addresses and minting more BRC-20 tokens.

BRC-20 tokens take advantage of the decentralization and security of the Bitcoin blockchain. Since the BRC-20 token standard is still early, it has its setbacks and limitations from its non-interactive interface that makes deploying, minting, and transferring tokens difficult due to the limited tools to support it. For example, there are limited wallets that support the storing and transferring of these tokens. As adoption grows with the crypto and Bitcoin community and tokens with more use cases are brought into the space, these limitations will be suppressed.

BRC-20 VS ERC-20 Token Standard

While Bitcoin’s BRC-20 draws cues from Ethereum’s ERC-20 standard in the naming and both tokens rely on their parent blockchain, there aren’t any other similarities between the standards. There are lots of differences between both standards.

- ERC-20 tokens are built using smart contract codes, making them compatible across all Ethereum Virtual Machines. BRC-20 tokens are built through the Bitcoin ordinal inscription using JSON and aren’t widely accepted.

- The minting process of a BRC-20 token makes token distribution decentralized with no central entity in control. Every ordinal wallet involved in the minting of a token has a cap on how many tokens it can mint; so to mint more tokens, there’s the need for involving several ordinal wallets. This is unlike the minting of an ECR-20 token involves a central entity minting all the tokens without involving multiple parties. This way, token distribution is centralized and controlled by one party, making it open to security vulnerabilities.

- Regarding the consensus mechanisms used to determine the validity of transactions, ERC-20 tokens rely on the proof of stake (PoS) through a stacking method. BRC-20 tokens instead rely on the proof of work (PoW), a form of validating transactions involving solving complex computational problems by validators.

- Another difference is the interaction between the protocol and network level. In the case of ERC-20 tokens, once transactions are approved on the network level, it’s automatically approved on the protocol level; here, both the network and protocol are synchronized. For BRC-20 tokens, it’s a different ball game. Here the network and protocol aren’t synchronized; so, if a person is to transfer a token, if it’s approved on the Bitcoin network, it’s checked for approval on the protocol level. An example will be a person trying to send $10 worth of BRC-20 tokens from an Ordinal wallet with a $5 balance; the transaction will be accepted on the Bitcoin network since every transaction is considered normal but denied on the protocol level because there isn’t a sufficient balance in the wallet.

- The most apparent of all differences is the network they rely on. ERC-20 token standards are to the Ethereum blockchain, as BRC-20 token standards are to the Bitcoin blockchain.

Features of BRC-20 Token Standard

One of the prominent benefits of the BRC-20 token is the introduction of more use cases on the Bitcoin network. However, there’s more to it. Some of the features and innovations ushered by the BRC-20 token include:

Introduction of Decentralized Finance (DeFi) Projects

Previously, the rigidity of the Bitcoin network made it challenging to build decentralized applications with several use cases, including decentralized finances platform and gaming dApps.

With this, the Bitcoin ecosystem system will experience much more growth than previously possible.

Tokenization

The BRC-20 token will bring about the tokenization of real-world assets such as real estate; all that’s required is inputting the property about the assets through the JSON codes and deploying them on the blockchain network.

For example, the creation of the tokenized real-world asset, Tether USDT. USDT is a stablecoin known for its stability; it is less volatile. A cryptocurrency stablecoin depends on omnichain and the EVM network to achieve a complex way to achieve decentralization. If a similar stablecoin asset is to launch using the BRC-20 token standard, the process would be much easier because BRC-20 uses a decentralized token issuance. Multiple ordinal wallets are involved in token creation, making it more decentralized.

Since transactions occur on the Bitcoin blockchain, which can get congested due to its low transaction per second (TPS) lighting network can be used to push transactions up to a million TPS.

Peer-to-Peer (P2P) Transaction

Just as Bitcoin has been a means to transfer value between different parties, BRC-20 tokens will have similar functions as a transfer of value, and their integration into DeFi products adds more usefulness to these tokens.

BRC-20 tokens will be just as efficient as the Bitcoin network as it utilizes Bitcoin decentralized, and security features make it more desirable. Transaction fees are charged in Bitcoin and carried out on BRC-20-enabled wallets.

Advantages of the BRC-20 Tokens

While the benefits of using the BRC-20 tokens aren’t undeniable yet, there are some immediate interests developers, and users can take from, including:

- Giving the Bitcoin blockchain additional use cases.

- Opening miners up to more earning potential with increased demand for block space.

- Launching BRC-20 tokens on the Bitcoin blockchain is straightforward without the complications of smart contract coding.

- BRC-20 tokens are decentralized and have tight security as they depend on the Bitcoin blockchain.

- Transactions of BRC-20 tokens can be much faster with the help of scaling solutions such as lightning networks.

Disadvantages of the BRC-20 Tokens

However great the BRC-20 tokens are, certain limitations are holding them back.

- Due to being in the early stage, interaction on BRC-20 tokens isn’t smooth with different steps and processes involved.

- Unlike other blockchain tokens like the ERC-20 tokens that utilize smart contracts to code rules and extra functionalities, BRC-20 tokens don’t have aren’t flexible and additional functions can’t be added, which limits their potential.

- As with many cryptocurrencies, BRC-20 tokens will be filled with unregistered tokens as it grows. Since BRC-20 tokens live on the Bitcoin network, adding extra workload makes it suffer issues of low scalability and transaction speed. This causes network fees to rise dramatically and can be solved using scaling solutions. Here’s an example of a high gas experienced on the Bitcoin network after BRC-20 tokens went live:

- The BRC-20 token standard lacks proper interoperability with other blockchains. There’s no convenient way to conduct cross-chain activities like token transfer.

I’m in El Salvador 🇸🇻 right now. Just witnessed a cash withdrawal via #btc

This individual now had to pay $20 in fees for getting $100 out in a country where the avg. salary is $300-350

I want you to think about this when enabling gambling on fkn jpegs or meme coins.

This is… pic.twitter.com/RTVLqG7DNn

— Marce Romero (@MarceMR19) May 8, 2023Conclusion

The BRC-20 token standard is still upcoming and in the experimental phase. More iterations will see the standards develop and accommodate more innovations as time passes. However, this is a significant innovation to Satoshi Nakamoto’s initial idea for a peer-to-peer solution in 2008.

This new standard indicates that the near future for the Bitcoin blockchain might be skewed toward more innovation, not just Bitcoin NFTs and tokens.

Frequently Asked Questions?

How Do I Buy BRC-20 Tokens?

BRC-20 tokens can be purchased from marketplaces that support BRC-20 tokens. Also, you’ll need a BRC-20 token-enabled wallet, such as an Ordinal or UniSat wallet.

Are BRC-20 Tokens Secured?

Yes, BRC-20 tokens are secured. They rely on the Bitcoin blockchain, one of the most secure and decentralized networks.

What are some BRC-20 Tokens?

There are a couple of BRC-20 tokens available on support exchanges, and some are ZBIT, DRAC, NOOT, ORDI, PEPE, and BISO.