Many studies have discussed the irrational nature of human behavior regarding investing and financial markets. There is a field of study dedicated to this called behavioral finance, which explores the impact of psychology on the decision-making process of investors. The cryptocurrency FOMO (Fear Of Missing Out) trap is a common phenomenon.

Scammers prey on FOMO to trick victims into investing in fake cryptocurrency schemes. Therefore, it is essential to comprehend this bias, cultivate perspective, and implement a long-term patient strategy to avoid falling for scams.

Psychological Pitfalls of Retail Investors

The entry barrier into the cryptocurrency space, especially for retail investors, is lowering year over year as new crypto exchange platforms appear. As a result, the crypto market is expanding exponentially due to the influx of new investors with little investment experience. This new investor profile is entering a market with little regulation, information asymmetry, and high volatility. The resultant friction is an impetus for irrational behavior in cryptocurrency investment.

Despite entering the space with a belief in a rational frame of mind, in this 24/7 market and the age of social media, it is very easy for investors entering the space to make poor investment decisions driven by greed and hype.

The brain uses heuristics, which are shortcuts, to conserve processing power. The decision-making process is sped up by using “a rule of thumb” approach, which impairs reasoning. Our brains are incredibly adept at energy management. This explains why we occasionally struggle with processing information accurately.

Cognitive biases such as FOMO have an impact on our financial decisions. Information processing, prioritization, and behavior are all influenced to a large extent by an investor’s psychological profile. Unfortunately, scammers prey on FOMO as a psychological vulnerability to promote fraudulent projects and to dupe investors.

Therefore, it’s helpful to approach investing by consciously breaking away from “mental shortcuts.” Of course, this is easier said than done because even the most astute among us will misjudge the likelihood of events occurring or succumb to cryptocurrency FOMO. However, being aware of scams that rely on FOMO marketing to create a sense of urgency and undertaking due diligence on a project is an excellent starting point.

Understanding Cryptocurrency FOMO

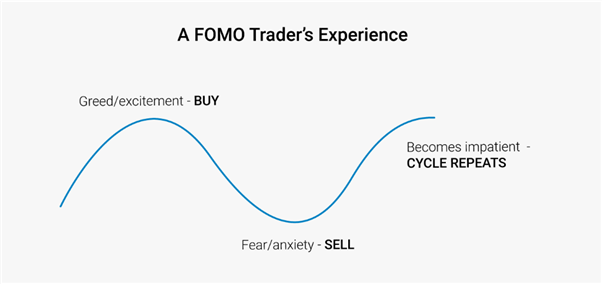

The fear of missing out is a common psychological reaction that includes the perception of missing out on something others are participating in or benefiting from. This often triggers feelings of anxiety, distraction, pressure, and compulsive behaviors. This can be especially prevalent when people feel left behind or lose out on an opportunity.

FOMO amplifies in a market fueled by hype, speculation, and extraordinary returns. As a result, people act hastily or take unwarranted risks to seize an opportunity or experience. Scammers in the cryptosphere take advantage of people’s cryptocurrency FOMO by advertising fake projects as the next big thing or a once-in-a-lifetime opportunity. They frequently promote projects in such a way that refusing to take part often seems almost illogical. These frauds can include phishing attacks, Ponzi schemes, fake initial coin offerings (ICOs), and social media scams.

Steps to Overcome FOMO and Avoid Scams

Spend Time Researching

To prevent becoming a victim of scammers attempting to lure people into their trap, it is imperative to thoroughly investigate the project’s foundation and authenticity. It’s crucial to take the time to double-check the project’s whitepaper, website, and team amid a sea of information and false impressions. Cryptocurrency scams frequently lack logical and consistent information about how they operate. Due diligence will reveal the red flags early.

Design and Follow a Strategy

Setting definite goals is another way to prevent rash decisions motivated by cryptocurrency FOMO. This can be the time in the market or an exit plan when a percentage return on investment is realized. Following a long-term approach reduces the possibility of falling into short-term pitfalls. A systematic investment plan (SIP) or cost averaging is an underrated strategy. This method involves allocating a predetermined sum of money to buy an asset regularly (daily, weekly, biweekly, or monthly) regardless of price movement.

Spreading out purchases evenly rather than making a large purchase will lower the risk of significant financial loss, which is beneficial not just to your wallet but also to your peace of mind. This allows you to buy assets at lower prices and average the purchase price, reducing risk. This effectively removes the burden of predicting market bottoms and tops.

Combat Confirmation Bias and Stay Grounded

The herd mentality and strong community nature of cryptocurrency make it easy to succumb to confirmation bias. Social media has become a fertile ground for the spread of misleading information. Like others in the financial world, the cryptocurrency market is cyclical, with bullish and bearish periods.

Fraudulent projects often assure guaranteed returns despite macroeconomic conditions. As a result, before making financial decisions involving cryptocurrency, individual investors must always seek numerous sources of accurate information. Search for both bullish and bearish narratives to help overcome confirmation bias.

Avoid Following the Crowd

It’s difficult to overlook the allure of social power. However, the famous adage by Warren Buffet, “Be fearful when others are greedy, and greedy only when others are fearful,” holds true. In other words, if one wishes to be successful, one must resist the impulse to follow the crowd and forge their path. Individuals who can do this have a better chance of succeeding in a market driven by emotion. A great tool for determining market sentiment is the Fear and Greed index.

Patience Is Key

The cryptocurrency market often gets false press for being a sector for quick returns. While it is true that the returns in the crypto space break the norm compared to traditional equity markets, the contrary is also true during bear markets. New investors often enter the market at inopportune times or when prices are high, only to sell low. A get-rich-quick mentality when entering the market will likely result in financial loss. Therefore it is wise to remember that “investing is a marathon, not a sprint,” a saying that stands the test of time.

Conclusion

While we have heard of investors making life-changing returns in the crypto market, countless others have fallen victim to scammers exploiting cryptocurrency FOMO for their illicit gains. Therefore, investing in one’s personal growth by becoming aware of common cognitive biases while exercising due diligence may yield the best long-term results than investing in the inflated promises of a cryptocurrency scam.