The world of decentralized finance (DeFi) has been nothing short of game-changing! It offers a new way to interact with financial products without relying on traditional banks or governments.

Central to this revolution is the concept of stablecoins—cryptocurrencies designed to maintain a consistent value. Among the myriad of stablecoins, Dai, created by MakerDAO, stands out as a cornerstone of the DeFi ecosystem.

But what exactly is MakerDAO?

MakerDAO is a decentralized autonomous organization (DAO) on the Ethereum blockchain that governs the creation of Dai, a decentralized stablecoin pegged to the US Dollar. Through the Maker Protocol, users generate Dai by depositing Ethereum-based assets as collateral in Maker Vaults, ensuring stability in the volatile crypto market.

Let’s dive in to read more about the workings of MakerDAO, explore the mechanisms that ensure Dai’s stability and examine the broader impact of these innovations on the DeFi ecosystem.

What Is MakerDAO and Dai?

MakerDAO is a decentralized autonomous organization (DAO) on the Ethereum blockchain, recognized as a pioneer in the DeFi space.

Established in 2014 by Rune Christensen, MakerDAO is the architect behind Dai, a decentralized stablecoin that has become an incredibly integral part to the DeFi movement, you know. Dai’s consistent value around $1 USD makes it a reliable medium of exchange, store of value, and unit of account in the digital economy.

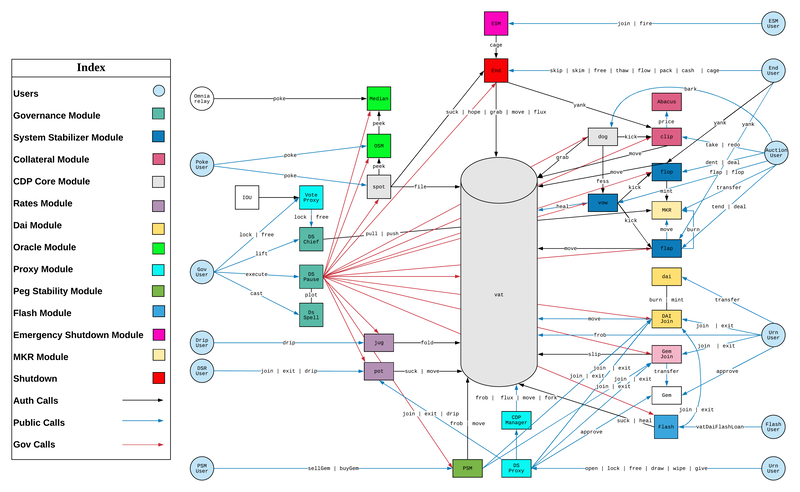

The Maker Protocol is the system governing the creation and management of Dai crypto. Users generate Dai by depositing Ethereum-based assets into smart contracts known as Maker Vaults. This decentralized approach ensures that Dai is not controlled by any central authority but is governed by the community of MKR token holders, who vote on key decisions affecting the protocol.

How MakerDAO Works

At the heart of MakerDAO’s governance are MKR tokens, which serve dual roles: governance and recapitalization. MKR holders vote on various proposals, from adding new collateral types to adjusting risk parameters. This decentralized governance ensures that those with a vested interest in the system’s health have a say in its direction.

If the system accrues a deficit—say the collateral backing Dai crypto falls below necessary levels—MKR tokens are minted and sold to recapitalize the system, diluting the supply.

Conversely, when there’s a surplus, MKR tokens are burned, reducing supply and potentially increasing their value. This mechanism aligns the incentives of MKR holders with the long-term stability of the Maker Protocol.

The Transition to Multi-Collateral Dai (MCD)

Initially, Dai was backed solely by Ethereum in what was known as Single-Collateral Dai (SCD) or Sai. However, this model had limitations, primarily its vulnerability to Ethereum’s price swings.

Recognizing this, the Maker community upgraded the system in November 2019 to support Multi-Collateral Dai (MCD). This transition allowed the protocol to accept a variety of Ethereum-based assets as collateral, significantly enhancing the stability and resilience of Dai.

With MCD, users can leverage multiple asset types—stablecoins, tokenized real estate, and other cryptocurrencies—to generate Dai. This diversification reduces systemic risk and expands the potential for broader participation in the Maker ecosystem.

Mechanisms for Maintaining Dai’s Stability

Maintaining Dai’s peg to the US Dollar is critical, and the Maker Protocol employs several mechanisms to achieve this—

- Stability Fee: This is an interest rate charged on the Dai crypto generated from Maker Vaults, paid in Dai when withdrawing collateral. Adjustments to the Stability Fee can influence Dai’s supply and demand, helping maintain its $1 peg.

- Dai Savings Rate (DSR): Dai holders can lock their Dai into a DSR contract to earn interest. The DSR is adjusted to manage Dai’s price—lowered when Dai is above $1 to reduce demand, or increased when below $1 to boost it.

- Liquidation Mechanism: If collateral value drops below a required threshold, the system automatically liquidates the collateral through an auction, ensuring Dai’s full backing and maintaining stability.

- Emergency Shutdown: In extreme cases, MKR holders can trigger an Emergency Shutdown, halting operations and allowing Dai crypto holders to redeem their Dai for a share of the system’s collateral, safeguarding their investments.

Dai in the Real World: Use Cases and Adoption

Dai’s stability has made it a preferred currency in various scenarios:

- Financial Inclusion: In regions with limited access to traditional banking, Dai offers a lifeline for participating in the global economy. Its stability is especially valuable in countries with high inflation, such as Venezuela and Argentina, where it helps preserve purchasing power.

- Digital Payments and E-commerce: Dai is increasingly used in online transactions, providing a stable alternative to more volatile cryptocurrencies. Its integration with payment processors has expanded its adoption across digital platforms.

- Gaming and Virtual Economies: Dai’s stability makes it ideal for in-game purchases and rewards in virtual economies, offering predictability and reliability.

- Charitable Donations and Aid: Dai’s transparency and traceability make it a powerful tool for distributing aid, ensuring funds reach those in need quickly and securely.

The Future of Dai: Expanding Horizons

As the DeFi ecosystem continues to evolve, so does Dai’s potential for broader adoption. With developments in Layer 2 solutions and cross-chain interoperability, Dai could become even more accessible across various blockchain networks.

Moreover, as central banks explore digital currencies, there could be opportunities for Dai to interact with these new forms of money, potentially enhancing financial inclusion and efficiency.

An extensive article by DroomDroom on the reviews of the top six DeFi lending platforms.

Conclusion

MakerDAO and Dai are not just innovations in DeFi; they are foundational elements shaping the future of digital finance.

Through decentralized governance and powerful risk management, MakerDAO has created a stable, reliable currency that has already proven its value in the DeFi ecosystem. Dai is poised to play an increasingly crucial role, offering a stable and decentralized alternative to traditional financial systems.

By understanding and engaging with the Maker Protocol and Dai, you’re not just witnessing the future of finance—you’re participating in it.