Bitcoin is the first decentralized and one of the most popular digital currencies. It offers peer-to-peer transfers without the involvement of intermediaries like banks, government, or brokers, using Blockchain technology. Blockchain is a distributed immutable ledger that allows maintaining a secure and decentralized record of transactions. It is a shared database that stores data in blocks chained together by cryptography.

Bitcoin mining is a process of minting new coins and validating ongoing transactions by solving complex cryptographic puzzles.

This article explains in detail what is bitcoin mining, how it works, what is bitcoin halving including how bitcoin mining evolved with time, and what economics and issues you need to know when you are exploring bitcoin mining.

What Is Bitcoin Mining?

Bitcoin mining is a process of minting new coins and validating ongoing transactions by solving complex cryptographic puzzles.

It is probably some heavy, expensive machinery in remote parts of the world and suit-face workers with hard hats digging deep underneath the earth’s surface to find natural resources like coal or diamond.

Well, bitcoin miners aren’t suit-faced humans working in remote parts, but it’s a network of powerful computers worldwide. These miners add individual blocks to a Bitcoin’s blockchain network, validating ongoing transactions by solving complex cryptographic puzzles, thereby getting the reward in return: A Bitcoin. Whoever solves the puzzle first wins the prize.

How Does Bitcoin Mining Works?

Bitcoin Mining is a guessing game.

Let’s dive into this quote through a scenario. Let’s say you and your friends have been tasked to guess a number between 1 and 1000. Let’s say the number you have to guess is 25; then, you don’t need to guess an exact number, but you have to be the first one to guess a number less than or equal to 25.

If you came up with a number 55, and one of your friends came up with 27, another 67, and yet another 80, they lost because they all came up with a number more than 25.

But if you have five friends left and one of them guessed 20, then they win, and the remaining others don’t get a chance to guess. The one who guessed 20 was first to guess a number less than or equal to 25.

Here, number 25 represents the target Hash created by the Bitcoin network for a block, and random guesses by you and your friends are guesses made by miners to solve this puzzle. The solution that our computer or miner tries to find for the puzzle given is called “Hash.” So, what is Hash?

The Hash

The Hash is a 64-digit hexadecimal number generated by sending the information in the block through the SHA256 hashing algorithm. In less than a second, this could be done by sending some content into a SHA256 hash generator.

SHA256 is an encryption method the Bitcoin network uses to create a block hash. However, decrypting that hash back is impossible, as it can take centuries to decode with modern technology.

Hash might look like this (this is the previous paragraph run through a hash generator). If you change one value in that content, like switching one “b” to an “a,” the hash changes:

A65f83a5db7371eeefa2287a0ede750ac623e49a8ba29f248eb785fe0a678559

Here is the same paragraph, but the first word is misspelled as “Ba” instead of “Bt”:

Fbfa43ff980d1492b3a9275a1eb945d89bd6b699ca19c3c470021b8f253654af

This is the number called block hash, which also acts as the following block’s header. Each block uses the previous Block’s Hash, forming a chain and creating the term “Blockchain.”

The process of guessing the correct number (Hash) is known as proof of work.

Proof of Work

When a node guesses the number first or solves the puzzle first, the entire network comes to a consensus about that node to validate a transaction because this particular node has done a certain amount of work to solve the puzzle.

That is why the consensus algorithm used in the Bitcoin network is called “Proof of Work .”It consumes much energy and computational power to reach the goal of less than or equal to the target hash. The work done in this process is viewed as validation proof, so it’s called proof-of-work.

The difficulty of mining increases as more miner joins the network.

Confirmation

Each block contains a hash of the previous block- so when the next Block’s Hash is created, it’s connected; that’s how forming a network is. Even a single change in character in a block changes the Hash, thus changing the Hash of all of the following blocks. This process secured the Blockchain.

The block closed and received reward is only confirmed five blocks later when it’s through many validations.

Are you new to Web3? Here’s a Comprehensive guide to know all about Blockchain forks by Droomdoom.

Evolution of Bitcoin Mining

In the early days of Bitcoin, there were few miners out there. Therefore, general computers with regular CPUs dominated Bitcoin mining. Satoshi, the inventor of Bitcoin, and his friend Hal Finney, along with a few people, were mining Bitcoin with their personal computers using their computer’s central processing unit (CPU) or computer’s brain. In 2009, that was enough for mining Bitcoin as mining difficulty was very low.

GPU Mining

As Bitcoin started to catch people’s eyes, they started looking for more powerful mining solutions,

Learn more ways to spot and avoid Crypto scams, compiled by DroomDroom.

Then GPU mining came to light. A GPU ( Graphical processing unit ), or graphic card, is a unique component added to computers to carry out more complex calculations. Initially, GPUs were intended to allow gamers to run computer games with intense graphics requirements. But, because of their architecture, they became popular in cryptography, and around 2011, people also started using them to mine Bitcoins. They were more effective and faster at mining with better hash rates than CPUs.

For reference, the mining power of one GPU equals that of around 30 CPUs.

But they consumed much power and, because of high demand, have skyrocketed in price.

FPGA Mining

Another evolution came later on with FPGA mining.

FPGA (Field Programmable Gate Array) is a piece of hardware that can be connected to a computer to run calculations. They are just like a GPU, but 3 to 100 times faster. But the downside is that they are more complex to configure, which is why, In 2013, a new type of miner was introduced, an ASIC miner.

ASIC Mining

Launched in 2012, ASIC stands for Application Specific Integrated Circuit.

As miners now prefer custom mining machines for Bitcoin mining, ASIC is hardware manufactured solely for mining Bitcoin. Unlike GPUs, CPUs, and FPGAs, they are equipped with specialized chips to mine Bitcoin more efficiently and can’t be used to do anything else. They are hardcoded with functions into the machines and are the mining standard. Some Early ASIC miners even appeared in the form of USB, but they became obsolete rather quickly.

But ASIC rigs could be expensive, ranging from $2,000 to $15000.

Cloud Mining

This is the latest way to mint Bitcoin, where miners can buy a cloud mining service or contract from an existing cloud mining provider specializing in cryptocurrency mining rigs. While this gives the miner the advantage of mining Bitcoins without sunk and maintenance costs of mining hardware setup, one must be careful in choosing a reputed cloud miner to avoid future scams or fraud.

New to Cryptocurrency? What are the inevitable cryptocurrency scams that you’re likely to fall for?

How Do You Start Bitcoin Mining

To Start Bitcoin mining, every miner needs basics, including

- Mining hardware ( like Ebang, Antiminer),

- Crypto Wallet, and

- Knowledge of how to install and configure mining software.

Let’s look at each one them individually now:

Powerful Hardware Resources

Before a miner starts minting bitcoins, they need a powerful mining hardware setup designed specifically for mining cryptos and tools to solve complex puzzles efficiently. For efficient and effective mining, mining would require graphical processing units with advanced graphic cards, FPGAs( field programmable gate array ), or advanced ASICs (Application-specific integrated circuits ).

Since 2013, after the introduction of ASICs, ASICs-based hardware has been the most advanced and capable of generating the most hashes per second. However, at the same time, it’s costly, which may range in thousands of dollars.

Installing Mining Software

Besides powerful Hardware essentials, miners need to know how to install and configure the mining software ( like CG miner, XMR miner ). Many of the software are free to download and work on Windows and Mac computers.

E-wallets

Then, a miner would also be required to create an e-wallet to store their rewards as Bitcoin. A Bitcoin wallet is a digital wallet that facilitates storing, accepting, and transferring Bitcoin or any other cryptocurrency.

Additionally, miners must possess advanced technical knowledge to operate hardware systems, improve the mining capacity, and monitor the progress.

Mining Pool or Solo Mining

Miners can choose between solo mining or opting for pool mining. With all the complexities of just starting up Bitcoin mining and going further, it takes work to do it, so mining pools were invented.

In mining pools, groups of miners are formed to face the increasing difficulty of mining together. Contrary to popular narrative, anyone with regular desktop computers or gaming systems can join the mining pools and mine. However, the returns are limited, as rewards are distributed among all the mining pool members according to how much work each miner has done.

Economics

Bitcoin mining is a business venture.

The three most significant factors that affect the cost of Bitcoin mining are electricity, network, and mining infrastructure.

Mining can result in substantial bills, given that electricity gives the power to run your mining systems 24/7. Mining systems produce much heat while mining, so these rigs need to be cooled, and the air conditioning is costly.

Mining alone can be hectic, so mining pools were introduced to reduce the complexity and difficulty miner faces during the mining. However, here, rewards are limited.

Network speeds do not affect significantly, but latency, i.e., time taken to communicate with the rest of the network, does.

So, for this venture to be profitable, the cost for these three inputs should be less than output ( bitcoin’s price ).

Rewards

What does one get for hustling and juggling so much through incurring the costs of such heavy infrastructure and energy usage?

In Bitcoin, the reward for successfully validating a block in Bitcoin’s network is free bitcoins and transaction fees ( a certain percentage of the transaction the miner inserted into the block).

Miner payment = block Reward + Transaction fees

However, since 2009 ( bitcoin launched ), the number of bitcoins each miner gets by validating each transaction is reduced by the Bitcoin halving phenomenon.

To know if you can do Bitcoin mining profitably, you can check it through the Profitability Calculator.

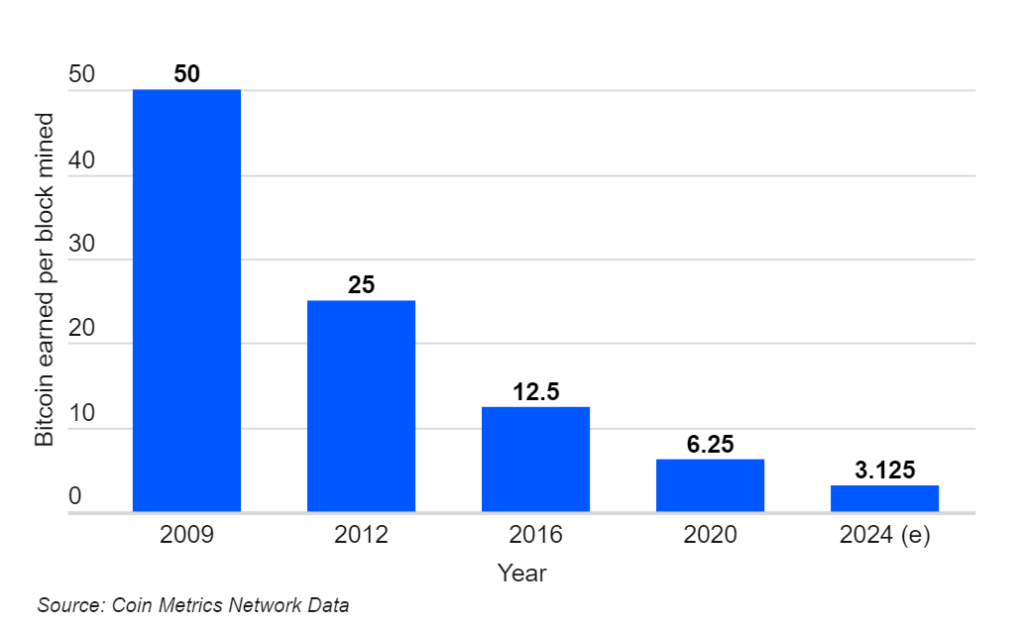

Bitcoin Halving

The reward for mining one block is halved every 210,000 blocks or about every four years. In 2009, when Bitcoin was launched, the reward for mining a block was 50 Bitcoins, then it was limited to 25 Bitcoins in 2012 and 12.5 in 2016. Bitcoin halving aims to cut down the Bitcoin’s inflation and circulation rate, stabilizing its value. The last Bitcoin halving event took place in May 2020.

When Bitcoin reaches its limit of 21 million, expected by 2140, miners will be constantly rewarded with fees for processing transactions that network users will pay. These fees are a way to ensure that miners validating the transactions still have the incentive to mine and keep the network going.

Issues

What is the probability of mining a Bitcoin block successfully through Pow?

It’s one in 57.6 trillion, with that scaling difficulty levels, a massive number of transactions being verified by users, and one block of transaction is verified roughly every 10 minutes. But remember, it’s a goal, not a rule.

Speed

With transactions logged in the Blockchain every 10 minutes, the Bitcoin network can currently process between 3 to 6 transactions per second. Whereas, in comparison, visa can process somewhere 65000 transactions per second. Upgrades and second-layer solutions have been addressed to the Bitcoin network for issues. However, there have yet to be any significant solutions./modern banking systems and other Blockchains dwarf the number of transactions the Bitcoin network can handle.

Scalability

The major problem at the core of Bitcoin protocol has been scaling. Though miners accept this as a core problem, there has yet to be much consensus about how to solve it.

Bitcoin has been introducing upgrades and accepting inputs from layers, but it still needs help with scalability.

Energy Usage

Energy usage has always been a topic of discussion worldwide, from Elon Musk to any average person expressing their opinions about what should and should not be done globally.

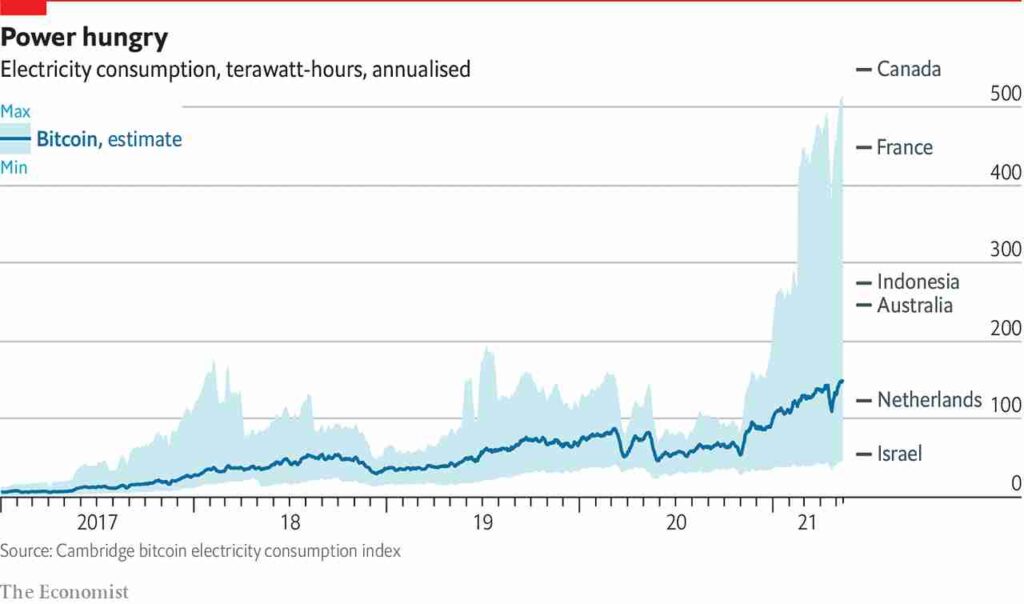

According to statistics, bitcoin mining alone consumes nearly 127 terawatt-hours (TWh) a year, more than many countries, including Norway. Bitcoin mining has always been an energy-intensive process. As the complexity and difficulty of Bitcoin mining rise, the computational power required to mine a Bitcoin also rises.

However, many Bitcoin enthusiasts claim that Bitcoin runs on renewable energy sources only. Nevertheless, it is still a matter of debate as it’s self-reported data from mining pools, and the information provided is scarce and lacks transparency.

Conclusion

Bitcoin has always been the most popular cryptocurrency. While it seems very exciting to mint your Bitcoin, it comes with many complications and upfront costs. Additionally, its extreme price volatility makes it an unviable medium of exchange.

Bitcoin remains a speculative currency due to a lack of intrinsic value that operates in a decentralized and autonomous manner.

Due to this, it’s invulnerable to regulations and law enforcement. Though, global leaders have addressed the impact and regulatory measures in G20 2023 meetings.