Artfi is painting a new canvas for art investment, quietly, yet profoundly. Forget bidding wars at Christie’s or Sotheby’s; Artfi is bringing revenue-sharing directly to the wallets of art enthusiasts through tokenized ownership, a feat previously unimaginable in the art world.

- RWA Revenue Models: A Primer

- Artfi’s First Step in Revenue Sharing

- How Artfi’s Revenue Streams Fuel the Revshare Economy

- 30% for Token Buyback and Burn

- 30% for Liquidity Provision on Artfi Sharemarket

- 40% for Operations and the Artfi Foundation

- The Deflationary Ecosystem: Artfi’s Commitment to Transparency

- The Beginning of a New Era

They’re calling it “revshare,” a first-of-its-kind revenue-sharing initiative in the decentralized art market. Revshare doesn’t just reward Artfi token holders with passive income; it gives them a front-row seat as stakeholders in a dynamic ecosystem of technology, transparency, and creativity.

How does Artfi achieve this innovative approach? And on a wider note, how do RWA platforms generate revenue to sustain their operations and reward their investors?

RWA Revenue Models: A Primer

RWA projects typically generate revenue through fees associated with tokenization, trading, and asset management. These fees can be structured as upfront issuance fees, ongoing management fees, or transaction fees on secondary market trades.

Additionally, some RWA projects leverage their platform’s utility to generate revenue, such as charging fees for custody services, data analytics, or other value-added services. Many platforms also act as market makers, earning from bid-ask spreads and incentivizing liquidity provision.

As the market for tokenized assets grows, with estimates projecting a total market capitalization of $2-4 trillion by 2030, the potential for revenue generation in this space is substantial.

Artfi’s First Step in Revenue Sharing

The story begins with “Unity 1,” a breathtaking artwork by global icon Salman Khan. This milestone piece sold for $300,000, with 10,000 fractional shares purchased at $30 each. These shares—represented by NFTs—are now live and trading on the OKX NFT marketplace.

But the magic doesn’t end there. The sale of Unity milestones Artfi’s first-ever token buyback funded entirely by the platform’s revenue, signaling the launch of its epochal revshare model.

How Artfi’s Revenue Streams Fuel the Revshare Economy

Artfi’s revshare model is fueled by sustainable and transparent revenue streams. The platform generates income across multiple verticals, including fractional ownership, marketplace commissions, and other initiatives that are part of the broader Artfi ecosystem.

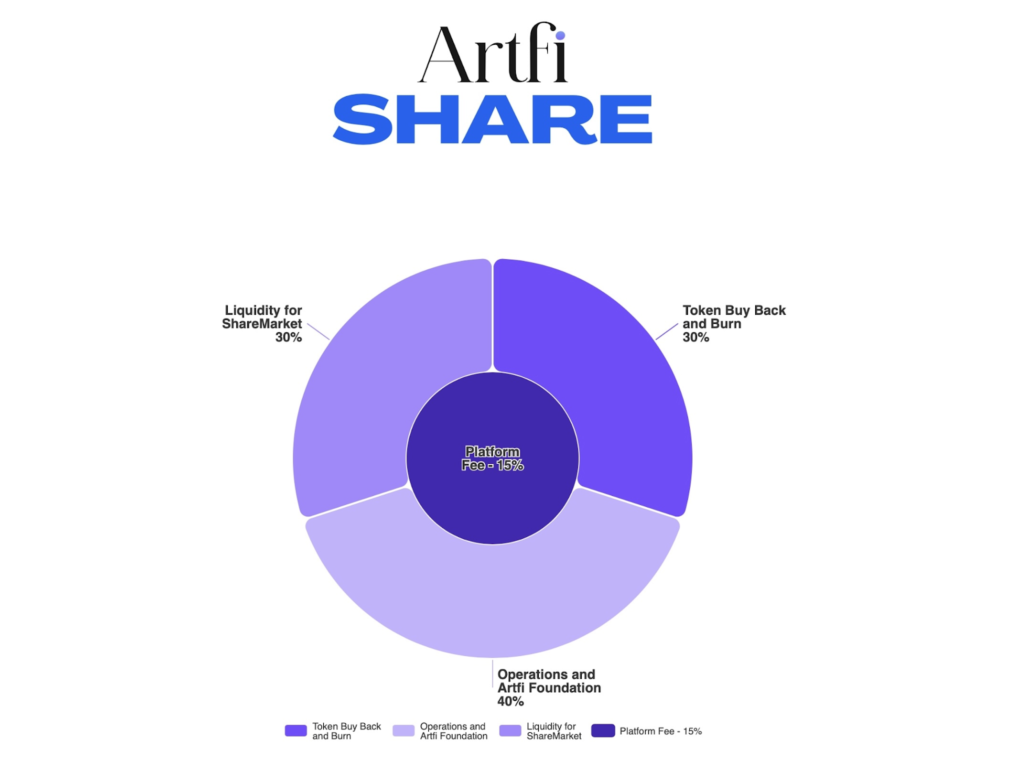

For instance, Artfi charges a 15% seller commission on every artwork consigned to its primary marketplace, Artfi Share. For the sale of Unity 1, this commission amounted to $45,000.

So, where does this money go? It’s split into three key areas for benefitting token holders, platform liquidity, and operations.

30% for Token Buyback and Burn

A deflationary mechanism lies at the core of Artfi’s approach. $13,500 from Unity 1’s sale was allocated to buy back and burn Artfi tokens to reduce supply and potentially increase token value over time.

30% for Liquidity Provision on Artfi Sharemarket

To support the secondary market for fractional art NFTs, Artfi Sharemarket, another $13,500 was also set aside to provide liquidity. It basically is for smooth trading experiences for investors and to create a dynamic marketplace for real-world art assets.

40% for Operations and the Artfi Foundation

$18,000 went toward strengthening the platform’s infrastructure and supporting the Artfi Foundation. Artfi’s strategy here is to reinvest for long-term stability and growth.

While Artfi Share is the first vertical to implement revenue sharing, the model is not limited to fractional ownership. Each vertical in the Artfi ecosystem contributes to the overall revenue pool for guaranteeing the benefits of revshare are shared across the entire platform.

The revshare economy spans all Artfi verticals so that revenue-sharing, token buybacks, and burns reflect total ecosystem revenue rather than just a single vertical.

The Deflationary Ecosystem: Artfi’s Commitment to Transparency

Every step of Artfi’s revenue-sharing process is verifiable on-chain to offer a level of transparency previously unheard of in the art market. By leveraging the Sui blockchain, Artfi ensures that every sale, buyback, and allocation is visible to its community.

For token holders, this deflationary model isn’t just about trust—it’s about tangible benefits. With every token burn, the circulating supply of $ARTFI decreases, creating a supply-demand dynamic that could drive value appreciation.

Lower supply, coupled with increased demand, could drive the token’s value up over time, creating a win-win scenario for token holders.

The revshare economy doesn’t just enrich token holders; it strengthens the entire art investment ecosystem.

The Beginning of a New Era

For centuries, art investments were illiquid assets—practically immune to everyday market forces and accessible only to the wealthy. Artfi changes the narrative by getting users to trade fractional art NFTs and providing liquidity and flexibility in a way traditional art investments never could.

Unity 1’s sale and Artfi’s first token buyback mark the dawn of a new era in art investment.

This, then, is more than just a step forward for Artfi. It’s a first in the blockchain art space, a financial experiment playing out on a global stage. For those holding Artfi tokens, revshare offers a slice of the pie, and a seat at the table, as decentralized art investment comes into its own.