Crypto investors and traders, new or not in the cryptocurrency arena, will be faced with certain terminologies they’ll have to get familiar with to understand how the markets operate; one of those terms you’re likely to encounter is Total Value Locked (TVL).

- Understanding More About Total Value Locked (TVL)

- How To Calculate A Total Value Locked (TVL) Of A DeFi Protocol

- Why is Total Value Locked Important

- Brief History Of Total Value Locked (TVL)

- Platform To Check For Total Value Locked

- Current Total Value Locked Data

- TVL Combined With Other Factors

- Conclusion

Total Value locked is used to measure the value of the cryptocurrency or assets locked or staked in a decentralized application (dApp); It’s a valuable signal investor use to measure the worth of these decentralized finance applications and DeFi protocols.

Read this article to learn more about decentralized finance applications (dApps)

Understanding More About Total Value Locked (TVL)

Total value locked is considered a healthy indicator for investors and traders willing to make the most from exploring the decentralized finance (DeFi) space. To expand more on TVL, it includes all the cryptocurrencies or tokens deposited into a DeFi protocol for different functions, whether it’s lending, staking, or liquidity pools.

To learn more about Liquid stacking in the DeFI arena and how it works, read this article: Are Liquid Staking Derivatives DeFi’s Next Big Thing?

TVL measures a DeFi protocol’s current worth and does not include protocol earnings or rewards expected from the several functions. However, this doesn’t imply that TVL is a constant value; it’s subject to changes based on the price or worth of the token in the DeFi project. If the token’s price rises, the TVL goes up, and if the token price falls, the TVL also falls. Since the TVL doesn’t account for outstanding loans or profit generated from deposits, the TVL is subject to change with users depositing or withdrawing from the DeFi protocol.

Usually, most DeFi protocols operate on a single network and, in other cases, operate on multiple networks. Regardless of the number of networks on the DeFi protocol, the TVL is calculated independently for each network.

How To Calculate A Total Value Locked (TVL) Of A DeFi Protocol

Calculating the TVL for any DeFi protocol or application requires several factors, but it’s straightforward.

The TVL formula is simple: Price of the crypto assets in USD x the total number of staked, locked, and tokens in the liquidity pool of the protocol. This is different from a token’s market capitalization: the token’s price in USD x circulating supply of the token.

Investors and traders can find these details about a token, like market capitalization, circulating supply, and fully diluted valuation, on CoinMarketCap and CoinGecko.

Here’s an Ideal scenario for how staking, lending, and liquidity pool work to give a TVL of a DeFi protocol:

Stacking Scenario:

To validate whether a transaction on the DeFi protocol is valid, the miner of the protocol is required to stake the native cryptocurrency of the protocol. A user, David, can help miners by staking the native token on their behalf, and they receive a reward for doing so. In this case, David staked $1,000 worth of the native token.

Lending Scenario:

This DeFi protocol also allows users to earn more money by lending out their native tokens. Another user, Stephanie, deposited another $1,000 worth of the native token into the protocol for this purpose.

Liquidity Pool

And finally, the liquidity pool, it’s simply a money pool where users deposit tokens to provide liquidity for trades on the decentralized exchanges in exchange for a reward. Now, a user, Sarah, deposits $1,000 worth of tokens into the liquidity pool for a reward.

Assuming David, Stephanie, and Sarah are the only users this DeFi protocol has, the total value locked in this case will be the summation of all, giving us $3,000. TVL doesn’t account for the possible amount or potential rewards to be made by users from either of the actions taken.

How To Calculate Total Value Locked (TVL) Ratio

To calculate the TVL ratio for any DeFi protocol, it’s simply the market capitalization divided by the TVL of the token. In a situation where the TVL ratio is less than 1, then the token is undervalued; if it’s above 1, then it’s overvalued; this is a common indicator used by investors.

Building on the earlier example, let’s say the market capitalization of the DeFi is worth $2,000 in dollar value. Then, the TVL ratio = ($2,000/$3,000) = 0.67. This means the token is undervalued, and investors might consider buying if it aligns with Luther’s bullish signals they’ve had initially.

In most cases, the TVL is lower than the market capitalization. In situations like this, other factors are considered to determine whether the token is worth investing in.

Why is Total Value Locked Important

Investors or traders going into the DeFi space need to pay attention to the TVL because it is a good indicator that influences their profitability over time. Here are some of the most important reasons why TVL is an important metric:

- The most apparent reason why total value locked is important is that it’s one factor that indicates how healthy a DeFi protocol is. A high TVL is a good metric in the eyes of seasoned DeFi investors.

- A high TVL is one way for the DeFi protocol to grow its user base, as potential users find this as an attraction to use the protocol services and join in with whatever is happening. Higher TVL equals greater trust.

- TVL provides insight on how activities or not a DeFi protocol will be. A high TVL means a lot of activities are happening on the protocol, such as lending and staking, which generally shows the protocol has a higher liquidity flow. This makes users’ actions, like swapping, much more convenient and faster.

- TVL is a good indicator for spotting potential scams within the DeFi space. If a DeFi protocol, despite its longevity in the market, has a low TVL, especially in a bullish market, this is a red flag that users and investors should be wary of as it is likely a scam in disguise.

3/ Why does it matter?

– Usually, the more the TVL, the more active the platform is

– This is indicative of the level of interest and engagement by DApp builders

– Which in turn encourages the development of new features, enhanced security, network effects, adoption, etc.

— Analog (we're hiring!) (@OneAnalog) February 15, 2023However, while TVL is an excellent signal for investors and traders, it shouldn’t be treated as a standalone metric for deciding to invest. Coupling TVL with other fundamental factors regarding the DeFi protocol and its token is the best way to avoid unwarranted risks and possible losses.

Brief History Of Total Value Locked (TVL)

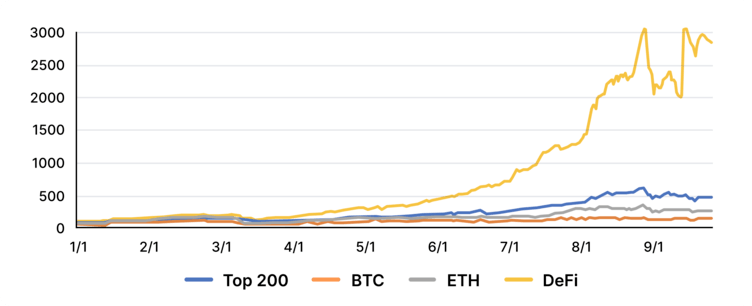

The DeFi industry has experienced significant growth since it all started. The most obvious was during the 2021 bull market after the 2020 pandemic struck. During the bull market, the DeFi industry saw an influx of users, investors, and DeFi protocols and applications.

A report from Coinbase showed how DeFi tokens outperformed other cryptocurrencies.

In 2020, DeFi platforms’ tokens did x2000, outperforming the top 200 cryptocurrencies in the market, including Bitcoin and Ethereum, CoinMarketCap reported. And from 2020 up to December 2022, the TVL of DeFi has grown by more than 6,900%, equivalent to 70 times what it was worth in 2020.

According to Nansen, by December 2022, the TVL of DeFi protocols saw a growth of 264% from 2021. At the same time, data from Cryptorank shows that as of April 2022, the growth of DeFi TVL was up 218% from 2021, with the Ethereum network leading the pack with a TVL of $153.79 billion, which represented the highest percentage of the total share, and Cronos having the least with a TVL of $5.36 billion.

At the time, the total value locked was recorded to be $280.73 billion, reflecting how much value has been generated across several DeFi protocols.

As of March 2023, BanklessTimes reported that the total value locked across the DeFi platform has fallen by 85 billion year-on-year.

Platform To Check For Total Value Locked

Different platforms are suitable for calculating the TVL across multiple blockchains and protocols. Two of the most prominent platforms used in this case are:

DeFi Lama

DeFi Lama is currently the largest multichain TVL stats dashboard and DeFi data aggregator. The platform is open source and transparent, contributing to its reliability. It’s a free-to-use platform and is fully sponsored by CoinGecko.

DefiLama considers a wide range of blockchains to drive its data, making it a rich source of information regarding TVL on different chains and protocols.

DeFi pulse

Although this DeFi Pulse used to be home to many regarding DeFi TVLs, particularly on the Ethereum blockchains, the platform has transitioned into the media side of the crypto niche, and users will not find TVL details needed aside from crypto articles and news pieces.

Although, while in operation, DeFi Pulse drew data from limited blockchains compared to DeFiLama. Aside from this, data from DeFi Pulse doesn’t include data on DeFi yield farming and instead focuses more on the Ethereum chain.

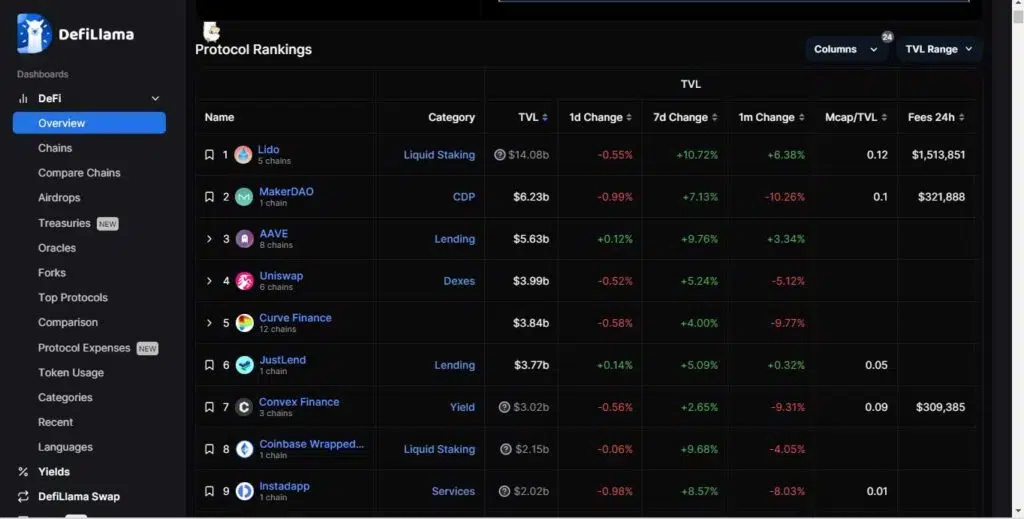

Current Total Value Locked Data

At the time of writing, the total value locked across all blockchains and protocols sits at $44.32 billion. Ethereum accounts for $26.13 billion of the total value locked, which is more than 50%, with other popular blockchains like Tron, BSC, Arbitrum, Polygon, and Optimism accounting for the next highest share, respectively, $5.6 billion, $3.36 billion, $2.17 billion, $974.24 million, and 791.95 million.

The Top Five five leading DeFi Protocols

The top DeFi protocols that accrue the largest total value locked are Lido, MakerDAO, AAVE, Uniswap, and Curve Finance.

Lido: is a type of liquidity staking protocol with a TVL of $13.89 billion, and it’s available on five chains: Ethereum, Solana, Polygon, Terra, Kusama, and Polkadot.

MakerDAO: is the next most popular DeFi with a TVL of 6.19 billion. It’s a collateralized Debt Position (CDP) protocol, and it’s available solely on Ethereum.

AAVE: is a lending DeFi protocol with a TVL of $5.54 billion on eight blockchains. AAVE provides lenders an opportunity to earn interest from their borrowers from their transactions: There are four versions of AAVE: AAVE V1, AAVE V2, AAVE V3, and Aave Arc.

UniSwap: is a decentralized exchange that supports different functions from Swap to earn to earning. It’s the leading decentralized crypto trading protocol with a TVL of $3.97 billion. It supports six blockchains: Ethereum, Polygon, Arbitrum, Optimism, BSC, and Celo. There’s Uniswap V1, V2, and V3.

Curve Finance: is sitting at the fifth spot on the DeFi protocols with the highest TVL. Curve Finance is a DeFi protocol that provides On-chain liquidity. The TVL sits at $3.83 billion, split between Curve DEX valued at $3.77 billion and crvUSD at $63.74 million. So far, it operates on 12 chains: Ethereum, Polygon, Arbitrum, Optimism, KAVA, Celo, Fantom, Gnosis, Avalanche, Moonbeam, Aurora, and Harmony.

Other leading protocols include JustLend, Convex Finance, Coin Base wrapped staked ETH, Instadapp, Compound Finance, Pancake Swap, Rocket Pool, Balancer, Frax Finance, and Liquidity.

TVL Combined With Other Factors

The current DeFi protocol total value locked data doesn’t account for certain details: staking, borrows, pool2, double counts, liquidity staking, and vesting. If these details are added, the TVL will experience a significant increase.

If the total value locked included the staked governance tokens in all DeFi protocols— the value will be $50.12 billion. The addition of the coins in the lending protocol will move it to $56.73 billion. If the rewards from the staked crypto assets are included, the TVL will be $77.14 billion. Vested tokens are included, and it becomes $77.68 billion, which reflects low impact. The addition of pool2, liquidity pool tokens containing one pair of governance tokens, will put the TVL at $78.1 billion. Finally, if the double count is accounted for, the TVL of the protocol will sit at $87.51 billion.

Conclusion

The total value locked is an important metric for investors looking to invest in DeFi protocols. Although it can be overwhelming when combining these different data, taking it a step at a time solves it.

Also, TVL shouldn’t be used as a single metric to base investment or trade judgments. Combine them with other fundamental details to make more informed decisions.