Unlike cryptocurrency, CBDC is a financial method employed by the government to digitalize national currencies. The idea of Central Bank Digital Currencies (CBDC) emerged from blockchain, but they are not cryptocurrencies.

CBDCs are digital currencies that are backed by central bank and have a centralized regulatory authority. They can be used for various purposes, such as interbank transactions, retail payments, and financial inclusion projects. The aim is to combine the benefits of digital transactions with the stability associated with fiat currencies.

Research has shown that CBDCs offer potential benefits, such as curbing illicit activities and increasing transparency in the traditional banking system. However, potential users are also concerned about particular challenges or threats, including cyber insecurity and lack of users’ privacy.

Understanding Central Bank Digital Currencies

Fiat currencies are mainly operated by financial institutions to regulate monetary flow within the market system. They are used as legal tender in trading goods and services among consumers and sellers.

Over the years, fiat currencies have existed in coins and banknotes, but the trend has advanced since the pandemic era. Digital currency became rampant during this period, causing the government and central banks to develop an interest in a cashless policy. This also led to Central Bank Digital Currencies, a digital version of the already-established fiat currency. According to the Board of Governors of the Federal Reserve System, CBDC is the safest digital asset with no associated credit or liquidity risk.

Countries employ two effective methods or models of CBDC, which are Wholesale and General-purpose or retail CBDCs.

- Wholesale CBDC: This payment method is used explicitly for transactions between banks or other entities recognized by the central bank.

- Retail CBDC: Retail or general purpose CBDC is often between businesses and their customers or individuals. The amount of transactions is usually 100,000,000 or more.

CBDC Vs Cryptocurrency

As mentioned earlier, CBDCs are not the same as cryptocurrency. Bitcoin, for example, is built on a public blockchain network that provides unrestricted access to interested persons. Unlike CBDC, Bitcoin is not governed by any financial entity, making it a permissionless or public blockchain.

A public blockchain differs from a private blockchain in terms of governance, scalability, accessibility, and many more. You can read this article to learn more about the differences between private and public blockchain.

On the other hand, CBDC offers more stability and allow the government to easily track illegal activities, including internet scams. Here is an article explaining the common internet scams that crypto users are exposed to. Nevertheless, cryptocurrencies provide better protection of users’ privacy.

Why Was the Central Bank Digital Currency (CBDC) Introduced?

During the pandemic, the government realized the need for a transaction method between citizens without a financial intermediary. This will help the government to prepare for difficult economic periods by providing access to individuals that can’t reach traditional banks.

Research from the 2020 analysis report revealed that about 5% of U.S. citizens needed a bank account. It also showed that 13% of bank account owners were transitioning into expensive alternatives like payday loans and money orders. Thus, CBDC was introduced to provide users with payment alternatives with cheaper options and reduce cross-border transaction costs.

The government believes the central bank currency approach would curb the economic crisis that may result from cryptocurrency fluctuations. Nevertheless, blockchain technology will continually be on the wave, as it keeps creating more opportunities for tech innovations. You can read this recent article on the opportunities and challenges developers face with blockchain technology, which also explains its future.

Even though the CBDC idea was fully implemented in 2020, central agencies have always launched the concept of digital currencies far-dated to the 1980s. In 1989 and 1996, DigiCash and e-gold were launched, respectively. However, the introduction of Bitcoin in 2009 overshadowed the existing models. When the idea surfaced again during the Covid-19 era, central banks worldwide competed closely to generate genuine versions of the digital currency.

The Current State of CBDC

As of the time of writing, about 90% of the world’s central banks are exploring the Central Bank Digital Currencies. Places like South Africa and the United States are still exploring, while the European Union is at the developmental phase.

It was also reported that 60% of central banks are experimenting with decentralized technology, while 14% are implementing trial programs. Even though the Central Bank Digital Currencies have a great potential to improve cross-border payments, Statista analysts believe they may not be fully implemented until 2030.

In October 2021, Nigeria was reported to be the first African country to introduce its digital currency, known as e-Naira. Below are the ongoing activities of central banks across other countries.

- China is piloting digital currency through the Digital Yuan (e-CNY) initiative. Further research revealed the circulation of e-CNY has reached 13.61 billion units by December 2022. This report confirms a growing adaptation rate of e-CNY in China.

- In October 2020, Bahamas launched the Sand Dollar initiative, which gathered up to $0.304 million units by the end of 2022.

- Sweden is creating a digital frontier through the e-Krona.

- The Saudi Arabian Monetary Authority (SAMA) plans to implement digital financial approaches in its Vision 2030.

- The central banks of the United Arab Emirates and Saudi Arabia initiated Aber’s project to test a jointly issued digital currency model.

- Jamaica launched JAM-DEX in June 2022, but it’s not blockchain-based like the Bahamas’ Sand Dollar.

Why is the Government Interested in CBDCs?

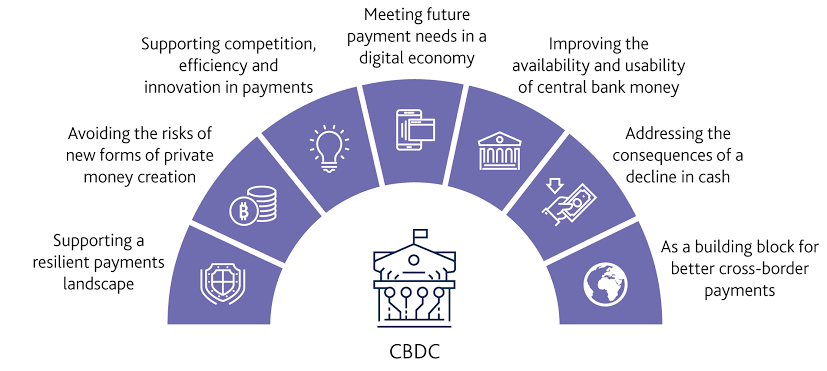

Several governments are interested in adopting CBDC due to the following reasons.

- It will help the government to make financial products more inclusive while improving the usage of fiat currencies.

- Governments can get involved and exert authority over the digital asset market. This will also help them to track transactions and offer more economic tools.

- Implementing digital currencies will help the government to connect central banks directly to citizens. This will be helpful when implementing monetary policies.

- Introducing CBDCs may encourage more people to participate in digital assets and currencies. It may also improve cryptocurrencies’ stability and increase their number of participants.

Possible Setbacks of the CBDC System

Recently, the United Nations announced its interest in linking digital IDs to individuals’ bank accounts through CBDC to promote Sustainable Development Goals. However, many people believe it’s rather a surveillance tool deployed by the government to expose users privacy.

Any central bank digital currency that is not open, permissionless, and private – like cash – is simply a surveillance tool. I am proud to have @SenTedCruz lead the Senate companion of my CBDC legislation. 👇

— Tom Emmer (@GOPMajorityWhip) March 30, 2022Below are possible setbacks of the CBDC and why some people fear it may lead to a financial crisis.

- Many people hesitate to adopt CBDC because they believe the government will fully monitor their financial activities.

- Central banks are at greater risk if there is no robust security measure to detect cyberattacks.

- Central banks will be solely responsible for influencing interest rates and inflation, affecting the country’s employment rate.

- There is no concrete evidence that CBDC will provide enough liquidity for central banks during the financial crisis.

Conclusion

CBDC may indeed become the saving grace for developed countries during global crises. However, there is an ongoing controversy about its credibility among the crypto community, considering the financial system will not run in line with the decentralized ethos of cryptocurrencies. Furthermore, the government’s input in implementing proper planning and measures will determine if the innovation CBDC system will be a success or not. However, if plans are well-executed, we can enjoy a more accessible, safer, and more secure payment method in the near future.